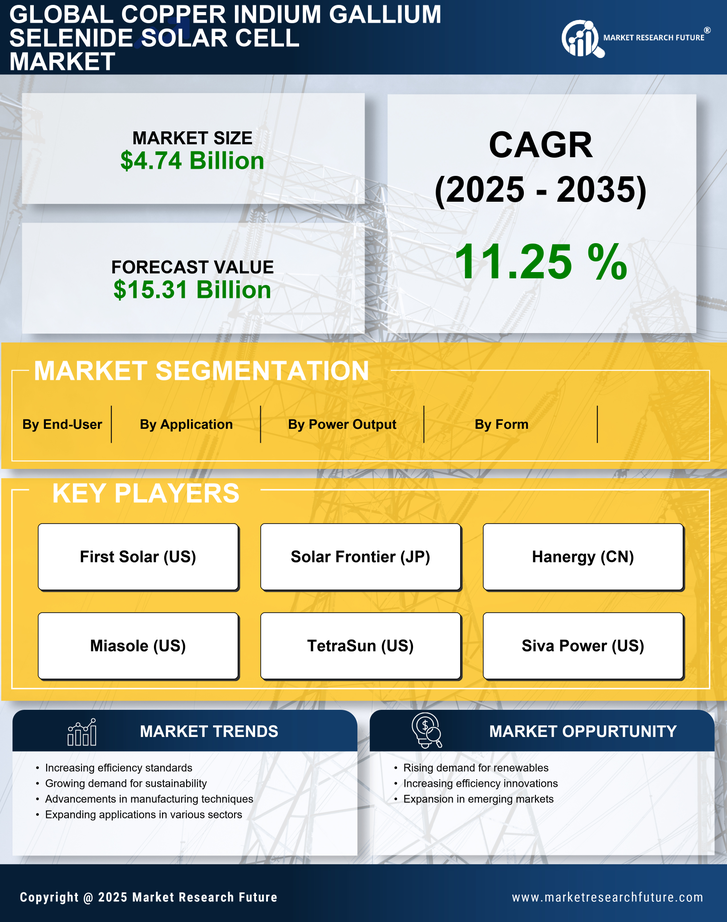

The Copper Indium Gallium Selenide (CIGS) Solar Cell Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for renewable energy solutions. Key players such as First Solar (US), Solar Frontier (JP), and Hanergy (CN) are strategically positioning themselves through innovation and regional expansion. First Solar (US) focuses on enhancing its manufacturing capabilities and has recently invested in new production facilities to increase output efficiency. Meanwhile, Solar Frontier (JP) emphasizes partnerships with local governments to promote solar energy adoption, thereby enhancing its market presence. Hanergy (CN) appears to be leveraging its technological prowess to develop next-generation solar cells, which could potentially reshape market dynamics.

The market structure is moderately fragmented, with several players vying for market share. Key business tactics include localizing manufacturing to reduce costs and optimize supply chains. This approach not only enhances operational efficiency but also allows companies to respond swiftly to regional market demands. The collective influence of these major players contributes to a competitive environment where innovation and strategic partnerships are paramount.

In August 2025, First Solar (US) announced a significant expansion of its manufacturing capacity in the United States, aiming to double its production of CIGS solar cells. This strategic move is likely to enhance its competitive edge by meeting the growing domestic demand for solar energy while also aligning with government initiatives to promote renewable energy sources. The expansion is expected to create numerous jobs and stimulate local economies, further solidifying First Solar's position in the market.

In July 2025, Solar Frontier (JP) entered into a partnership with a leading energy provider to develop a large-scale solar project in Southeast Asia. This collaboration is indicative of Solar Frontier's strategy to penetrate emerging markets, where solar energy adoption is rapidly increasing. By leveraging its technological expertise and local partnerships, the company aims to establish a strong foothold in this region, which could yield substantial long-term benefits.

In September 2025, Hanergy (CN) unveiled a new line of lightweight, flexible CIGS solar panels designed for urban applications. This innovation is particularly significant as it addresses the growing demand for versatile solar solutions in densely populated areas. By focusing on product differentiation, Hanergy is likely to attract a broader customer base, enhancing its competitive position in the market.

As of October 2025, the competitive trends in the CIGS solar cell market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence in manufacturing processes. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and expanding market reach. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices, which will be crucial for long-term success in this rapidly changing market.