Regulatory Compliance and Standards

The implementation of stringent regulations and standards regarding corrosion prevention is emerging as a significant driver for the Corrosion Protection Tapes Market. Various industries are mandated to adhere to specific guidelines aimed at minimizing corrosion-related failures, which in turn necessitates the use of effective protective solutions. Compliance with these regulations often requires the adoption of high-quality corrosion protection tapes that meet industry standards. As regulatory bodies continue to enforce these guidelines, the demand for compliant products is expected to rise. This trend is particularly evident in sectors such as oil and gas, where safety and reliability are paramount. Consequently, the corrosion protection tapes market is likely to experience growth as companies seek to align with regulatory requirements and enhance their operational integrity.

Increasing Infrastructure Development

The ongoing expansion of infrastructure projects across various sectors appears to be a primary driver for the Corrosion Protection Tapes Market. Governments and private entities are investing heavily in the construction of roads, bridges, and buildings, which necessitates effective corrosion protection solutions. The demand for corrosion protection tapes is likely to rise as these projects require materials that can withstand harsh environmental conditions. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, further fueling the need for corrosion protection solutions. This trend indicates a robust market potential for corrosion protection tapes, as they play a crucial role in extending the lifespan of infrastructure by preventing corrosion-related damage.

Rising Awareness of Corrosion Prevention

There is a growing awareness regarding the detrimental effects of corrosion on various materials, which significantly drives the Corrosion Protection Tapes Market. Industries such as oil and gas, marine, and automotive are increasingly recognizing the importance of implementing effective corrosion management strategies. This heightened awareness is leading to a surge in demand for corrosion protection tapes, as they offer a reliable solution for safeguarding assets against corrosion. Market data suggests that the oil and gas sector alone accounts for a substantial share of the corrosion protection market, with investments in corrosion prevention technologies expected to reach billions in the coming years. This trend underscores the critical role that corrosion protection tapes play in enhancing the durability and reliability of industrial applications.

Expanding Applications in Emerging Markets

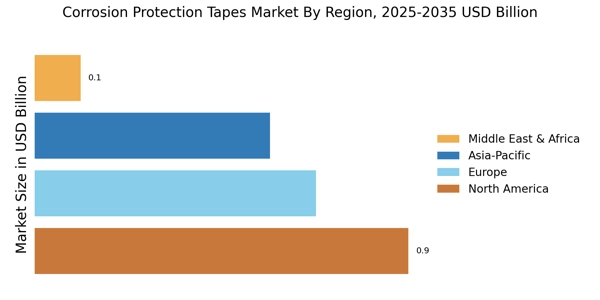

The expansion of applications for corrosion protection tapes in emerging markets is poised to drive growth in the Corrosion Protection Tapes Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is an increasing need for effective corrosion management solutions across various sectors, including construction, automotive, and manufacturing. The rising industrialization in these regions is likely to create new opportunities for corrosion protection tapes, as businesses seek to protect their assets from corrosion-related damage. Market data indicates that the Asia-Pacific region is expected to witness the highest growth rate in the corrosion protection market, driven by rapid urbanization and infrastructure development. This trend suggests a promising outlook for manufacturers of corrosion protection tapes as they tap into these emerging markets.

Technological Innovations in Tape Manufacturing

Technological advancements in the manufacturing processes of corrosion protection tapes are likely to enhance their performance and broaden their applications, thereby driving the Corrosion Protection Tapes Market. Innovations such as the development of advanced adhesive technologies and the incorporation of nanomaterials are improving the effectiveness of these tapes in preventing corrosion. As manufacturers continue to invest in research and development, the introduction of high-performance tapes that can withstand extreme conditions is anticipated. This evolution in product offerings may lead to increased adoption across various sectors, including construction, automotive, and aerospace. Market analysts project that the introduction of these innovative products could potentially increase market share for corrosion protection tapes by a notable margin in the next few years.