Growth of E-commerce

The rapid growth of e-commerce is a crucial factor influencing the Corrugated Box Printer Slotter Machine Market. As online shopping continues to expand, the demand for efficient and reliable packaging solutions is increasing. E-commerce businesses require durable and visually appealing packaging to ensure product safety during transit and to enhance customer satisfaction. This trend is driving manufacturers to invest in advanced slotter machines that can produce high-quality corrugated boxes at scale. Market analysis indicates that the e-commerce sector is expected to grow by over 15% annually, further propelling the demand for corrugated packaging solutions. This growth presents a significant opportunity for manufacturers in the industry.

Sustainability Initiatives

Sustainability is becoming a pivotal driver in the Corrugated Box Printer Slotter Machine Market. As environmental concerns rise, manufacturers are increasingly focusing on eco-friendly practices. This includes the use of recyclable materials and energy-efficient machines that reduce carbon footprints. The demand for sustainable packaging solutions is expected to rise, with studies indicating that over 70% of consumers prefer brands that prioritize sustainability. Consequently, companies are investing in machines that not only produce high-quality corrugated boxes but also align with these environmental goals. This trend is likely to shape the future of the industry, as businesses strive to meet regulatory requirements and consumer expectations for sustainable practices.

Rising Demand for Automation

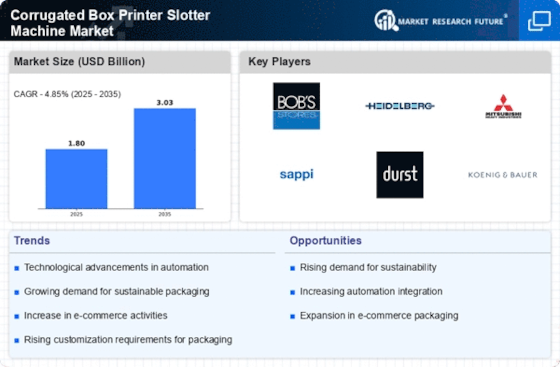

The rising demand for automation in manufacturing processes is significantly impacting the Corrugated Box Printer Slotter Machine Market. As companies strive to improve efficiency and reduce operational costs, the adoption of automated machines is becoming more prevalent. Automation not only enhances production speed but also minimizes human error, leading to higher quality outputs. The market for automated slotter machines is projected to expand, with estimates suggesting a growth rate of approximately 6% in the coming years. This trend reflects a broader shift towards Industry 4.0, where smart manufacturing practices are increasingly integrated into production lines, thereby transforming the landscape of the corrugated box industry.

Customization and Flexibility

The need for customization and flexibility in packaging solutions is a significant driver in the Corrugated Box Printer Slotter Machine Market. As businesses seek to differentiate their products, the demand for tailored packaging solutions is on the rise. This trend is particularly evident in sectors such as e-commerce and retail, where unique packaging can enhance brand identity and customer experience. The ability to produce small batches of customized boxes efficiently is becoming increasingly important. Market data suggests that companies offering flexible production capabilities are likely to capture a larger share of the market, as they can quickly adapt to changing consumer preferences and market trends.

Technological Advancements in Printing

The Corrugated Box Printer Slotter Machine Market is experiencing a surge in technological advancements that enhance printing quality and efficiency. Innovations such as digital printing technology allow for high-resolution graphics and faster production times. This shift towards automation and smart technology integration is likely to streamline operations, reduce labor costs, and minimize waste. As manufacturers adopt these advanced machines, they can meet the increasing demand for customized packaging solutions. The market for these machines is projected to grow, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This growth is indicative of the industry's response to evolving consumer preferences and the need for more efficient production processes.