Global Cosmetic Contact Lenses Market Overview

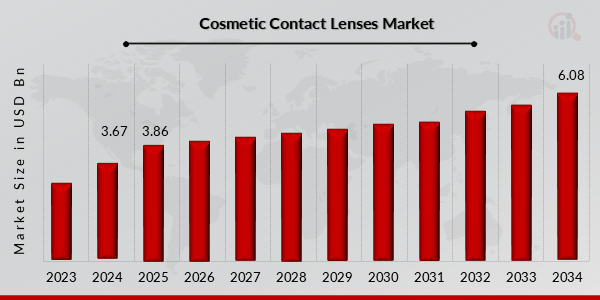

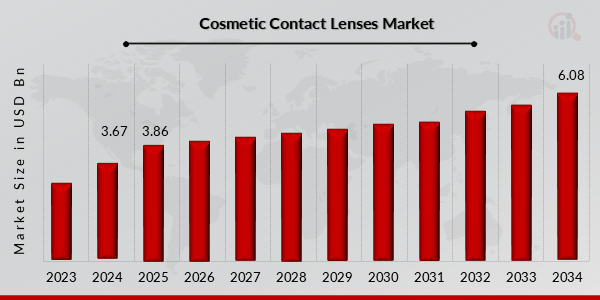

Cosmetic Contact Lenses Market Size was estimated at 3.67 (USD Billion) in 2024. The Cosmetic Contact Lenses Market Industry is expected to grow from 3.86 (USD Billion) in 2025 to 6.08 (USD Billion) by 2034. The Cosmetic Contact Lenses Market CAGR (growth rate) is expected to be around 5.19% during the forecast period (2025 - 2034).

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Cosmetic Contact Lenses Market Trends Highlighted

The Cosmetic Contact Lenses Market is driven by increasing consumer demand for innovative eye accessories that enhance aesthetic appeal and eye color. The trend of personalized beauty products is gaining momentum, with consumers seeking lenses that complement their unique style. Social media platforms play a significant role in influencing consumer choices, as influencers showcase different looks with colored lenses, encouraging others to try them. The rise in social awareness regarding eye health has also led to a demand for lenses that offer comfort and safety without compromising on appearance.

Opportunities in the market include developing advanced materials that improve lens comfort and breathability.

The introduction of smart lenses with integrated technology is also a potential growth area, appealing to tech-savvy consumers. Companies can explore collaborations with fashion brands to launch exclusive lens collections that cater to specific trends and events. The market can benefit from educational campaigns to inform consumers about lens care and hygiene, promoting safe usage while easing concerns about eye health. Recent trends include a growing popularity of eco-friendly and sustainable products as consumers become more aware of their environmental impact. Brands that focus on sustainable practices in sourcing and manufacturing could capture an emerging consumer segment.

Lenses that offer multifunctional benefits, such as UV protection, are also gaining traction. As the market evolves, personalization and customization are becoming key components, allowing consumers to choose lenses that reflect their individual identity and preferences. These shifts suggest a more diversified and innovative future for the cosmetic contact lens industry.

Cosmetic Contact Lenses Market Drivers

Growing Demand for Aesthetic Products

The Cosmetic Contact Lenses Market Industry is witnessing a surging demand for aesthetic products as consumers increasingly seek ways to enhance their physical appearance. Cosmetic contact lenses adapted for enhanced beauty and a unique appearance are growing in popularity which is particularly popular among younger people. These lenses provide correction of vision but, more importantly, allow the wearer to change the color of their eyes or a different shape, which is much safer than surgery.

Social media provides exposure to new looks by popular influencers and beauty enthusiasts alike, making cosmetic lenses appear a part of the beauty routines of many women and motivating them to make a purchase. The rate of market proliferation seems to be impressive owing to the emergence of new products as awareness becomes more accessible. Additionally, the market demand for necessary cosmetic lenses will be bolstered by marketing techniques such as cross-branding with well-known beauty brands.

The estimated expansion in self-consumption expenditure in beauty and personal care item spending rates also directly supports this element of the market and suggests a promising future for the Cosmetic Contact Lenses Market Industry.

Advancements in Lens Technology

Innovations in technology are a major driver for the Cosmetic Contact Lenses Market Industry. Advances in materials and lens design have resulted in products that are more comfortable, safer, and easier to wear. New manufacturing processes have improved lens durability and reduced the risk of eye infections. As technology continues to evolve, manufacturers are able to offer lenses with UV protection and moisture-locking properties that enhance user experience.

This trend attracts consumers who are concerned about eye health and comfort, fostering further growth in the market.

Increased Focus on Eye Health and Safety

There is a heightened awareness and emphasis on eye health and safety among consumers, driving the demand for high-quality cosmetic contact lenses. The Cosmetic Contact Lenses Market Industry benefits from this trend as manufacturers are increasingly focusing on creating products that prioritize user safety and comfort. This includes the development of lenses that reduce the risk of irritation and have better oxygen permeability, appealing to health-conscious consumers.

As people become more knowledgeable about their eye care options and the potential risks associated with inferior products, they are more likely to invest in reputable and quality lenses. This heightened focus on eye health contributes to robust market growth.

Cosmetic Contact Lenses Market Segment Insights

Cosmetic Contact Lenses Market Type Insights

The Cosmetic Contact Lenses Market is characterized by a diverse range of types, which contribute to its overall valuation and growth trajectory. In 2023, the market is valued at 3.32 USD Billion, reflecting a dynamic landscape where various segments cater to distinct consumer preferences. Among these types, Colored Lenses hold the majority market share, valued at 1.25 USD Billion in 2023 and projected to grow significantly to 2.0 USD Billion by 2032. This dominant segment appeals to consumers looking to enhance or change their eye color for aesthetic purposes, thereby driving substantial revenue within the market.

Special Effect Lenses also represent a significant portion of the market, with a valuation of 1.0 USD Billion in 2023, expected to rise to 1.6 USD Billion in 2032. These lenses cater to niche markets such as Halloween costumes or theatrical productions, where unique visual effects are desired, highlighting their importance in specialized environments. Theatrical Lenses generate a smaller, yet relevant, market contribution of 0.55 USD Billion in 2023, anticipated to reach 0.8 USD Billion by 2032. This segment focuses on use in performance settings, showcasing its significance in the entertainment industry as performers seek to create memorable characters.

Scleral Lenses, while the smallest segment at 0.52 USD Billion in 2023 have gained recognition for their comfort and appearance, with expected growth to 0.83 USD Billion by 2032. This growth underscores their rising popularity among those with irregular corneas or unique aesthetic needs. Overall, the Cosmetic Contact Lenses Market data demonstrates a vibrant and evolving industry where each type plays a crucial role in addressing diverse consumer desires, creating opportunities for market growth, and shaping market trends based on consumer preferences and technological advancements.

The market growth is driven by increasing fashion consciousness and the desire for self-expression among consumers, as well as innovations in lens technology improving comfort and wearing experience. Nevertheless, challenges such as regulatory compliance and the need consumers about lens safety present hurdles that the industry needs to navigate. With the overall market statistics reflecting a steady upward trajectory, the continued segmentation and innovation present significant opportunities for players within the Cosmetic Contact Lenses Market industry.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Cosmetic Contact Lenses Market Material Insights

The Cosmetic Contact Lenses Market is projected to be valued at 3.32 USD Billion in 2023, reflecting a robust growth trajectory within the Material segment. This segment includes various materials such as Hydrogel, Silicone Hydrogel, and Polymethyl Methacrylate. Hydrogel lenses are noted for their comfort and water retention capabilities, making them a favored choice among consumers, while Silicone Hydrogel is significantly growing due to its higher oxygen permeability, which enhances eye health during extended wear. Polymethyl Methacrylate, although less common today, remains significant due to its historical usage and cost-effectiveness.

Collectively, these materials drive substantial innovation in the Cosmetic Contact Lenses Market, responding to consumer demands for enhanced vision and comfort while also addressing industry trends focusing on eye health and aesthetics. The continuous advancement in material technology offers opportunities for market expansion, allowing for diverse product offerings and catering to the growing consumer interest in cosmetic contact lenses. Various market growth factors, including rising disposable income and increasing awareness about eye aesthetics, further support this evolving landscape within the Cosmetic Contact Lenses Market.

Cosmetic Contact Lenses Market Sales Channel Insights

The Cosmetic Contact Lenses Market, valued at 3.32 USD Billion in 2023, showcases a comprehensive segmentation based on Sales Channels, crucially impacting market dynamics and consumer accessibility. Among these channels, Online Retail has gained significant traction in recent years due to the convenience it offers, facilitating easy purchasing options. Optical Stores maintain their traditional allure, providing personalized service and professional fitting, which is vital for consumer confidence. Supermarkets and Hypermarkets dominate in terms of foot traffic and visibility, playing a key role in boosting impulse purchases of cosmetic contact lenses.

Specialty Stores also hold importance, catering to niche markets and offering unique designs that attract fashion-forward consumers. The interplay of these channels illustrates a diverse landscape where each channel contributes uniquely to the overall market growth. Current market trends highlight the increasing consumer preference for online shopping and the rising demand for fashion and personalized lenses, creating noteworthy opportunities while also navigating challenges such as regulatory compliance and market competition. Cosmetic Contact Lenses Market statistics accentuate evolving consumer behaviors, suggesting that understanding these sales channels is imperative for stakeholders aiming to enhance their market positioning.

Cosmetic Contact Lenses Market End User Insights

The Cosmetic Contact Lenses Market is poised for growth, with a significant focus on its End User segment, which includes Fashion Enthusiasts, Cosplayers, and Individuals with Eye Conditions. In 2023, the market was valued at 3.32 billion USD, a reflection of its expanding appeal among consumers seeking to enhance their appearance or address specific visual needs. Fashion Enthusiasts significantly contribute to the demand, driven by an ongoing trend in personal aesthetics and self-expression.

Cosplayers also play a major role, as they often seek unique and vibrant lens designs to complete their costumes, highlighting the importance of this segment in niche markets.

Meanwhile, Individuals with Eye Conditions benefit from cosmetic lenses that blend functionality with aesthetics, ensuring they can enjoy both sight correction and style. The combination of diverse consumer needs and preferences contributes to the overall market’s expansion, as evidenced by the anticipated Cosmetic Contact Lenses Market data and statistics, which reflect a steady uptick in revenue. The expected market growth is fueled by evolving fashion trends and increased awareness of cosmetic lenses, which pose both opportunities and challenges in terms of innovation and regulation within the Cosmetic Contact Lenses Market industry.

Cosmetic Contact Lenses Market Regional Insights

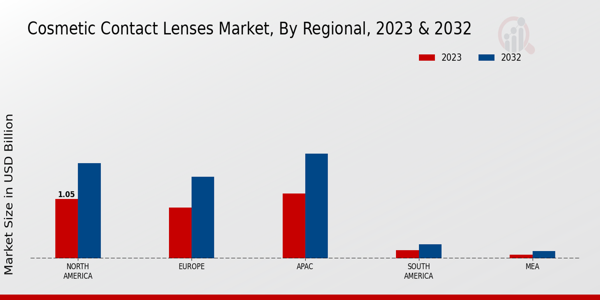

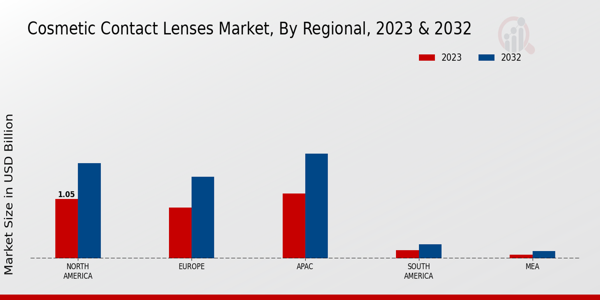

The Cosmetic Contact Lenses Market is projected to showcase considerable growth across various regions, underscored by expected market valuations that reflect its expanding footprint. In 2023, North America holds a significant market share with a valuation of 1.05 USD Billion, which is projected to rise to 1.68 USD Billion by 2032, indicating its dominant position as a major revenue generator. Europe follows closely, valued at 0.9 USD Billion in 2023 and anticipated to reach 1.44 USD Billion by 2032, reflecting the region's growing interest in cosmetic lenses.

The Asia-Pacific (APAC) region is also notable, demonstrating robust growth potential with a current valuation of 1.15 USD Billion and projected to grow to 1.85 USD Billion by 2032, indicating its increasing consumer demand for cosmetic contact lenses. South America, while smaller, shows growth with valuations of 0.15 USD Billion in 2023 and 0.25 USD Billion by 2032, indicating burgeoning interest in cosmetic eye enhancements. The Middle East and Africa (MEA), though the least dominant, is gaining traction with a valuation of 0.07 USD Billion, growing to 0.13 USD Billion by 2032.

The Cosmetic Contact Lenses Market statistics reveal a varied landscape, with each region presenting unique trends, growth drivers, and opportunities that influence the overall market dynamics.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Cosmetic Contact Lenses Market Key Players and Competitive Insights

The Cosmetic Contact Lenses Market has been experiencing significant growth, driven by the rising demand for aesthetic products that enhance visual appeal and correct vision. This market is characterized by a wide array of products, including colored and decorative lenses, which cater to consumers looking to change their eye color or style without compromising comfort and optical clarity. Competitive insights in this market reveal that various factors, such as technological advancements, consumer trends towards personalization and customization, along increasing awareness regarding eye health, contribute to the evolving landscape.

Manufacturers are focusing on innovative designs and sustainable practices to capture a larger market share, resulting in fierce competition between key players that foster continuous improvement in product quality and functionality.

Air Optix stands out in the Cosmetic Contact Lenses Market with its robust portfolio of products that combine comfort and aesthetics. Known for its advanced technology and superior breathability, Air Optix lenses are designed to maintain moisture and reduce dryness, which enhances user experience and satisfaction. The company's reputation for quality and innovation positions it favorably against competitors, allowing it to establish a strong presence in both the colored and specialty lens segments. With a focus on developing high-performance lenses, Air Optix appeals to a diverse consumer base, including those seeking convenience and style without compromising on eye health.

This strategic commitment to innovation and consumer-centric design aids in reinforcing Air Optix's competitive edge in the market.

Alcon has solidified its place in the Cosmetic Contact Lenses Market through its commitment to deliver high-quality products and unique selling propositions. The company is well-known for its research-driven approach and extensive product range, which includes a variety of cosmetic lenses that not only enhance aesthetics but also prioritize eye health. Alcon's lenses are characterized by their rich color offerings and user-friendly features, catering to the growing trend of individuals wanting to express themselves through their eye appearance.

With significant market presence and strong brand recognition, Alcon focuses on consumer education and engagement, ensuring that its products align with contemporary trends and preferences while maintaining a reputation for reliability and innovation. This emphasis on quality, research, and consumer satisfaction continues to strengthen Alcon's position in the competitive landscape of the cosmetic contact lens market.

Key Companies in the Cosmetic Contact Lenses Market Include

- Air Optix

- Alcon

- Bausch and Lomb

- EssilorLuxottica

- Hoya Corporation

- Acuvue

- Vision Direct

- Solotica

- Johnson and Johnson

- Fielmann AG

- Freshkon

- Colored Contacts

- Menicon

- CIBA Vision

- CooperVision

Cosmetic Contact Lenses Market Industry Developments

-

Q2 2024: Johnson & Johnson Vision Launches ACUVUE® DEFINE® Fresh Series Cosmetic Contact Lenses in the U.S. Johnson & Johnson Vision announced the U.S. launch of its ACUVUE® DEFINE® Fresh Series, a new line of cosmetic contact lenses designed to enhance natural eye beauty while providing vision correction. The product launch marks the company's expansion into the U.S. cosmetic lens segment.

-

Q2 2024: Alcon Expands AIR OPTIX® COLORS Range with New Monthly Disposable Cosmetic Lenses Alcon introduced new monthly disposable cosmetic contact lenses under its AIR OPTIX® COLORS brand, offering additional color options and improved comfort features. The launch targets growing consumer demand for colored lenses in North America and Europe.

-

Q1 2024: Menicon Announces Partnership with KOSÉ to Develop Beauty-Enhancing Contact Lenses Japanese contact lens manufacturer Menicon entered a strategic partnership with cosmetics giant KOSÉ to co-develop a new line of beauty-enhancing cosmetic contact lenses, aiming for a 2025 market debut in Asia.

-

Q2 2024: FDA Approves New Cosmetic Contact Lens by Bausch + Lomb for U.S. Market The FDA granted approval to Bausch + Lomb for its new line of colored cosmetic contact lenses, allowing the company to market the product in the United States for both vision correction and cosmetic use.

-

Q3 2024: CooperVision Opens New Manufacturing Facility in Malaysia to Boost Cosmetic Lens Production CooperVision inaugurated a new manufacturing facility in Malaysia dedicated to the production of cosmetic and colored contact lenses, aiming to meet rising demand in the Asia-Pacific region.

-

Q1 2025: EssilorLuxottica Acquires South Korean Cosmetic Contact Lens Brand OLENS EssilorLuxottica completed the acquisition of OLENS, a leading South Korean cosmetic contact lens brand, to strengthen its presence in the Asian beauty and vision care market.

-

Q2 2025: FreshKon Parent Company Wins Major Distribution Contract for Cosmetic Lenses in Middle East The parent company of FreshKon secured a multi-year distribution contract with a leading Middle Eastern retail chain, expanding the reach of its cosmetic contact lens products in the region.

-

Q2 2024: SEED Co. Launches UV-Blocking Cosmetic Contact Lenses in Japan SEED Co., a Japanese contact lens manufacturer, launched a new line of cosmetic contact lenses with advanced UV-blocking technology, targeting health-conscious consumers in Japan.

-

Q3 2024: Hoya Corporation Appoints New Head of Cosmetic Contact Lens Division Hoya Corporation announced the appointment of a new executive to lead its cosmetic contact lens division, signaling a renewed focus on innovation and international expansion.

-

Q1 2025: Carl Zeiss Meditec Unveils Smart Cosmetic Contact Lens Prototype at CES 2025 Carl Zeiss Meditec showcased a prototype of its smart cosmetic contact lens, featuring color-changing technology and integrated health sensors, at the Consumer Electronics Show (CES) 2025.

-

Q2 2025: Miacare Parent Company Files for IPO to Fund Cosmetic Contact Lens Expansion The parent company of Miacare filed for an initial public offering on the Singapore Exchange, with proceeds earmarked for expanding its cosmetic contact lens manufacturing capacity and R&D.

-

Q1 2024: Bausch + Lomb Launches LUMINA™ Cosmetic Contact Lenses in Europe Bausch + Lomb introduced its LUMINA™ line of cosmetic contact lenses in select European markets, offering a range of natural and vibrant color options for fashion-conscious consumers.

Cosmetic Contact Lenses Market Segmentation Insights

Cosmetic Contact Lenses Market Type Outlook

-

Theatrical Lenses

-

Scleral Lenses

Cosmetic Contact Lenses Market Material Outlook

-

Silicone Hydrogel

-

Polymethyl Methacrylate

Cosmetic Contact Lenses Market Sales Channel Outlook

Cosmetic Contact Lenses Market End User Outlook

Cosmetic Contact Lenses Market Regional Outlook

-

Asia Pacific

-

Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2024 |

3.67(USD Billion) |

| Market Size 2025 |

3.86(USD Billion) |

| Market Size 2034 |

6.08(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

5.19% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Air Optix, Alcon, Bausch and Lomb, EssilorLuxottica, Hoya Corporation, Acuvue, Vision Direct, Solotica, Johnson and Johnson, Fielmann AG, Freshkon, Colored Contacts, Menicon, CIBA Vision, CooperVision |

| Segments Covered |

Type, Material, Sales Channel, End User, Regional |

| Key Market Opportunities |

Growing demand for custom designs, Rising popularity among younger consumers, Increasing social media influence, Expansion in emerging markets, Advancements in lens technology |

| Key Market Dynamics |

Product innovation and variety, Rising fashion consciousness, Increasing disposable income, Growing online retail, Aging population with vision issues |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Cosmetic Contact Lenses Market is expected to reach a value of 5.23 USD Billion by 2032.

The expected CAGR for the Cosmetic Contact Lenses Market is 5.19% from 2024 to 2032.

North America is projected to have the highest market value at 1.68 USD Billion in 2032.

The market value of Colored Lenses in 2023 was 1.25 USD Billion.

Major players in the market include Air Optix, Alcon, Bausch and Lomb, and Johnson and Johnson.

The market size for Special Effect Lenses is expected to reach 1.6 USD Billion in 2032.

The market value for Theatrical Lenses in 2023 was 0.55 USD Billion.

The market for Scleral Lenses is expected to grow to 0.83 USD Billion by 2032.

The estimated market size for the APAC region is projected to be 1.85 USD Billion in 2032.

Growth opportunities in the market stem from increasing consumer demand for aesthetic and special effect lenses.