Emerging Markets Adoption

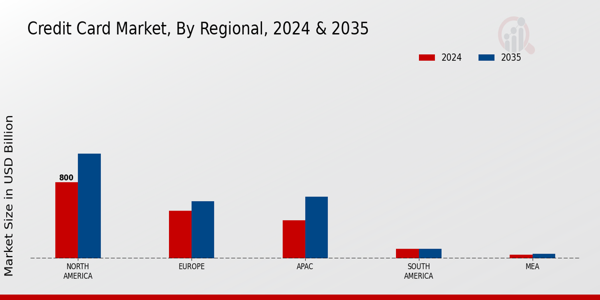

The Global Credit Card Market Industry is witnessing a surge in adoption within emerging markets, where financial literacy and access to banking services are improving. As these markets develop, an increasing number of consumers are gaining access to credit cards, driven by the desire for financial independence and the convenience of cashless transactions. This trend is particularly evident in regions such as Asia-Pacific and Latin America, where economic growth is fostering a burgeoning middle class. The expansion of credit card usage in these regions is expected to significantly contribute to the overall market growth, as more consumers embrace the benefits of credit.

Increasing Consumer Spending

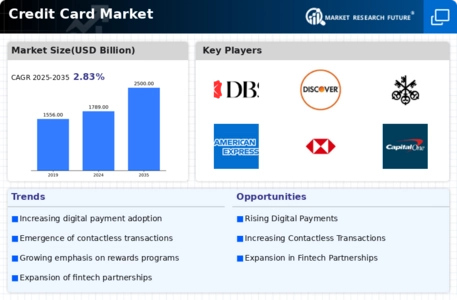

The Global Credit Card Market Industry is experiencing a notable surge in consumer spending, driven by rising disposable incomes and a growing preference for cashless transactions. As consumers increasingly opt for credit cards for everyday purchases, the market is projected to reach 1789.0 USD Billion in 2024. This trend is further supported by the convenience and rewards associated with credit card usage, which incentivizes consumers to utilize credit over cash. Additionally, the expansion of e-commerce platforms has facilitated this shift, as online shopping often necessitates the use of credit cards, thereby enhancing their adoption globally.

Rising Demand for Rewards Programs

The Global Credit Card Market Industry is significantly influenced by the increasing demand for rewards programs among consumers. Credit card issuers are responding to this demand by offering various incentives, such as cashback, travel points, and discounts on purchases. This competitive landscape encourages consumers to choose credit cards that align with their spending habits, thereby driving market growth. As more consumers seek to maximize their benefits, the adoption of credit cards is likely to rise, contributing to the overall market expansion. This trend may also lead to a diversification of credit card offerings, catering to specific consumer preferences and lifestyles.

Regulatory Support for Credit Accessibility

Regulatory frameworks across various countries are increasingly supportive of credit accessibility, which is a key driver of the Global Credit Card Market Industry. Governments are implementing policies that promote financial inclusion, allowing a broader segment of the population to access credit facilities. This regulatory support not only enhances consumer confidence but also encourages financial institutions to innovate and expand their credit card offerings. As a result, more individuals are likely to obtain credit cards, contributing to the anticipated growth of the market. This trend aligns with global efforts to foster economic development through improved access to financial services.

Technological Advancements in Payment Systems

Technological innovations play a pivotal role in shaping the Global Credit Card Market Industry. The integration of contactless payment systems and mobile wallets has revolutionized how consumers engage with credit cards. These advancements not only enhance transaction speed but also improve security through encryption and tokenization. As a result, consumers are more inclined to use credit cards for both in-store and online purchases. The market is expected to benefit from these technological trends, with projections indicating a growth trajectory that could see the industry valued at 2500 USD Billion by 2035, reflecting a compound annual growth rate of 3.09% from 2025 to 2035.