Research Methodology on CRM Software Market

Research Design

The research design used for this report is a longitudinal study. The report involves a detailed review of the past, present and future of the CRM software market, considering the product offerings, technological advancements, characteristics, usage of the software services and the competitive landscape. The data for this report is gathered through extensive primary and secondary research, covering various aspects of the CRM software market.

Primary Research

Primary research is conducted using a survey of the CRM software market providers to obtain in-depth knowledge of the market. The framework is based on a questionnaire that is sent out to the key service providers. The questionnaire contains questions on their competitive advantage, current market position and their plans to take their CRM software services to the next level. In addition, interviews are conducted with some of the participants to gain an understanding of their operations and strategies.

Secondary Research

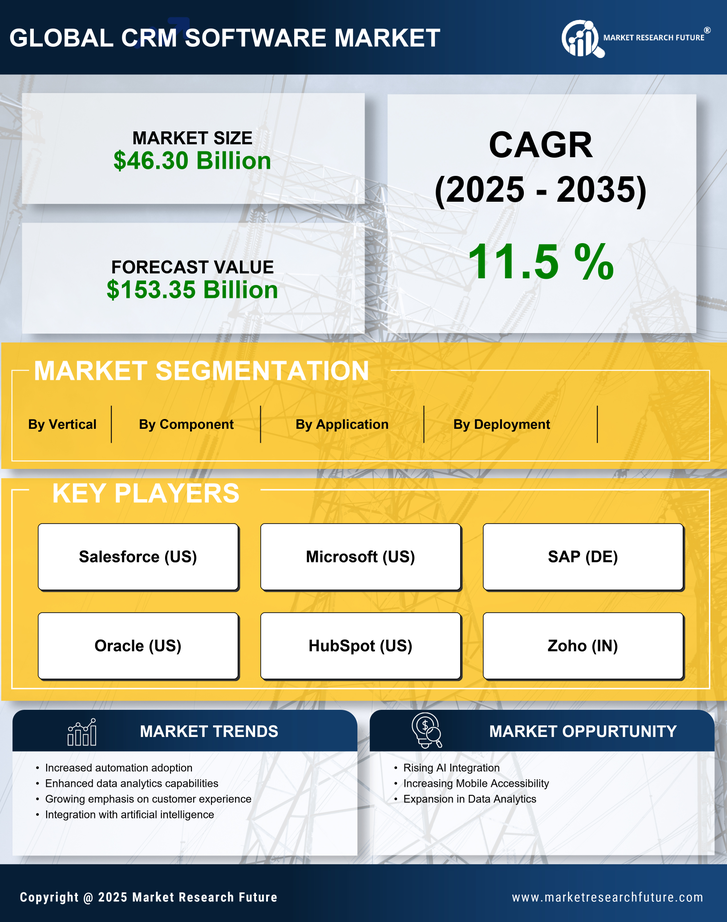

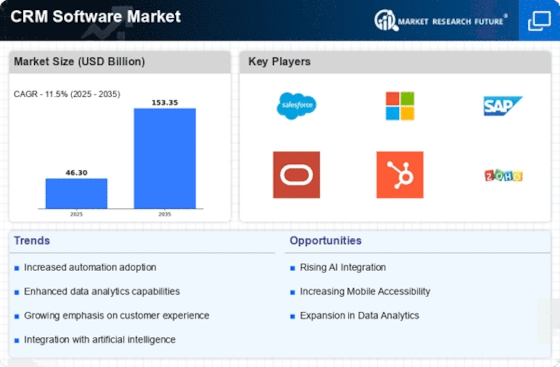

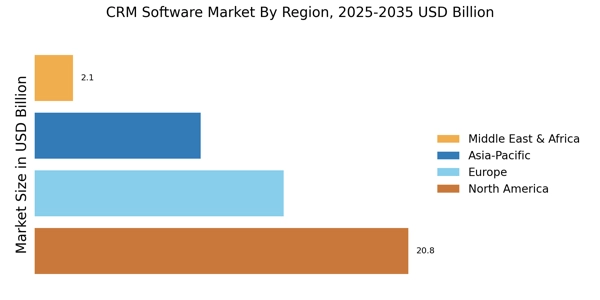

Secondary research is conducted using publicly available data such as market reports, websites, online articles, press releases, and industry associations. Statistical analysis is conducted to estimate the size of the market and to estimate the future growth of the CRM software market. The data is used to gain an understanding of the present landscape of the market and to forecast its future prospects.

Market Size Estimation

The market size is estimated using bottom-up and top-down approaches. The bottom-up approach is used to estimate the market size of the total CRM software market, while the top-down approach is used to validate the estimated market size. The revenue figures provided by the major key players in the market are taken into consideration to estimate the overall revenue for the CRM software market.

Data Analysis

The data collected from various sources is analysed using several research techniques such as correlation analysis, regression analysis, and trend analysis. The results of the analysis are used to obtain a better understanding of the CRM software market, its characteristics, and market trends. Additionally, the results are used to make inferences regarding the future of the market.

Data Validation

The collected data is validated through a triangulation method. The data is verified and validated through primary research and secondary sources to ensure accuracy and authenticity. The figures obtained from various sources are compared to validate the data and identify any discrepancies that may exist.