Market Trends

Key Emerging Trends in the Cryogenic Fuels Market

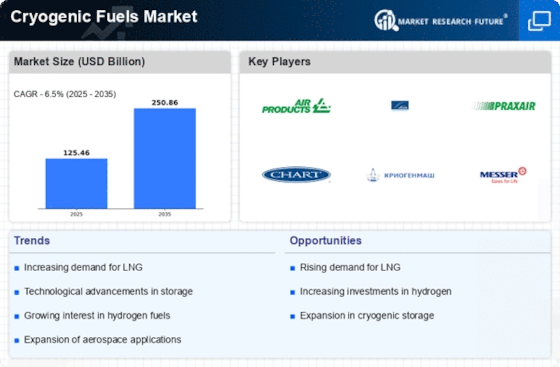

The cryogenic fuels market is expected to grow 6.50% from 2023 to 2032.In the competitive Cryogenic Fuels Market, companies use market share positioning methods to get an edge and identify key strengths. One common strategy is to differentiate themselves from competitors by offering unique cryogenic fuel solutions. This might involve developing new technologies, improving efficiency, or improving security. Companies hope to attract a certain market and build customer loyalty by delivering clear benefits.

Another strategy is cost initiative, where companies try to be the cheapest cryogenic fuel provider. This involves improving production methods, supply networks, and economies of scale to save costs. Companies may attract price-sensitive customers and increase market share by offering low prices. Quality and reliability must be maintained to ensure that cost-cutting initiatives don't compromise product value.

A common Cryogenic Fuels Market strategy is market division. Companies choose target audiences based on industry, geology, or application and create their products and marketing to match their needs. This allows companies to efficiently focus their resources and meet the needs of different client groups. For instance, a company may specialize in cryogenic fuels for clinical uses or airplanes.

Cryogenic Fuels Market share depends on key organizations and coordinated efforts. Companies often form alliances with key players like gear producers, distributors, and exploration firms. These partnerships can open new markets, inventions, and assets, bolstering the company's standing. Organizations can accelerate development and meet market demands by using diverse chemicals.

Effective Cryogenic Fuels Market market share positioning requires continuous innovation. Investing in new technologies, improving old products, and meeting administrative requirements. This proactive approach assures product relevance and positions companies as industry leaders, attracting customers who value cutting-edge solutions and compliance with the latest regulations.

Cryogenic Fuels Market share is affected by natural maintainability. Eco-friendly companies that offer controllable cryogenic fuels gain an edge as the worldwide focus on fossil fuel waste grows. This method supports cultural assumptions and presents firms as climate stewards, attracting earth-conscious customers and boosting brand awareness.

The Cryogenic Fuels Market is competitive, forcing companies to use diverse market share positioning methods. Organizations seek market dominance by separation, cost authority, market division, critical organizations, inventive work, or natural supportability. These systems depend on firms' ability to adapt to market trends, resolve customer difficulties, and prepare for cryogenic fuel improvements.

Leave a Comment