Rising Regulatory Frameworks

The carbon neutral-fuels market is experiencing a surge in regulatory frameworks aimed at reducing greenhouse gas emissions. The US government has implemented various policies that mandate lower emissions from transportation and industrial sectors. For instance, the Environmental Protection Agency (EPA) has set ambitious targets for reducing carbon emissions by 50% by 2030. This regulatory environment creates a favorable landscape for the carbon neutral-fuels market, as companies seek to comply with these regulations. Furthermore, states like California have established their own stringent standards, which further drive the demand for carbon neutral fuels. As a result, the market is likely to see increased investments in cleaner fuel technologies, which could potentially lead to a market growth rate of over 20% annually in the coming years.

Consumer Awareness and Education

Consumer awareness and education are emerging as vital drivers for the carbon neutral-fuels market. As the public becomes more informed about climate change and its impacts, there is a growing demand for sustainable fuel options. Educational campaigns and initiatives by environmental organizations are helping to raise awareness about the benefits of carbon neutral fuels. This increased consumer interest is prompting fuel providers to offer more transparent information regarding the environmental impact of their products. Consequently, the carbon neutral-fuels market is likely to see a shift in consumer preferences, with more individuals opting for fuels that align with their values. This trend could potentially lead to a market growth of around 12% annually as consumers actively seek out sustainable alternatives.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly influencing the carbon neutral-fuels market. Many companies are adopting ambitious sustainability goals, aiming for net-zero emissions by 2050. This shift is prompting businesses to explore carbon neutral fuels as viable alternatives to traditional fossil fuels. For instance, major corporations in the transportation and logistics sectors are investing in carbon neutral fuel technologies to meet their sustainability targets. This trend is not only driven by regulatory pressures but also by consumer expectations for environmentally responsible practices. As a result, the carbon neutral-fuels market is likely to benefit from a growing number of partnerships and collaborations between corporations and fuel producers, potentially leading to a market expansion of around 15% annually.

Technological Innovations in Fuel Production

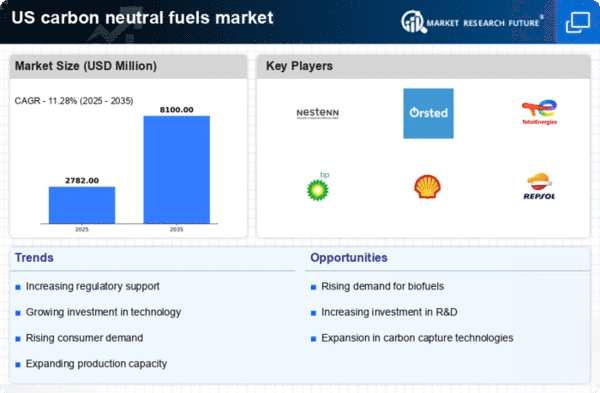

Technological innovations in fuel production are playing a pivotal role in shaping the carbon neutral-fuels market. Advances in processes such as gasification, fermentation, and carbon capture are enhancing the efficiency and viability of producing carbon neutral fuels. For example, new methods for converting agricultural waste into biofuels are being developed, which could significantly reduce production costs. Additionally, the integration of artificial intelligence and machine learning in optimizing production processes is becoming more common. These innovations not only improve the economic feasibility of carbon neutral fuels but also contribute to their scalability. As technology continues to evolve, the carbon neutral-fuels market is expected to witness a compound annual growth rate (CAGR) of approximately 18% over the next five years.

Investment in Renewable Energy Infrastructure

Investment in renewable energy infrastructure is a critical driver for the carbon neutral-fuels market. The US has seen a significant increase in funding for renewable energy projects, with investments reaching approximately $55 billion in 2025 alone. This influx of capital is directed towards developing facilities that produce carbon neutral fuels, such as biofuels and synthetic fuels. The establishment of these facilities not only enhances production capacity but also fosters innovation in fuel technologies. Moreover, the integration of renewable energy sources, such as wind and solar, into the fuel production process is becoming more prevalent. This trend indicates a shift towards a more sustainable energy landscape, which is essential for the growth of the carbon neutral-fuels market.