Growing Focus on Patient-Centric Care

The Vendor Neutral Archive Market is increasingly aligned with the growing focus on patient-centric care. Healthcare providers are recognizing the importance of having comprehensive access to patient data to deliver personalized treatment plans. Vendor Neutral Archive Market solutions enable clinicians to access a patient's complete imaging history, which is essential for informed decision-making. This shift towards patient-centric care is driving the adoption of Vendor Neutral Archive Market systems, as they facilitate better communication and collaboration among healthcare teams. The emphasis on improving patient outcomes is likely to propel the market forward, as organizations seek to leverage technology to enhance care delivery.

Regulatory Compliance and Data Security

In the Vendor Neutral Archive Market, regulatory compliance and data security are increasingly critical drivers. Healthcare organizations are mandated to adhere to stringent regulations regarding patient data protection, such as HIPAA in the United States. This regulatory landscape compels organizations to invest in secure and compliant Vendor Neutral Archive Market solutions. The market is witnessing a shift towards systems that not only store data but also ensure its integrity and confidentiality. As a result, vendors are focusing on developing solutions that incorporate robust security features, which is likely to enhance their competitive edge in the market. The emphasis on compliance is expected to sustain growth in the Vendor Neutral Archive Market.

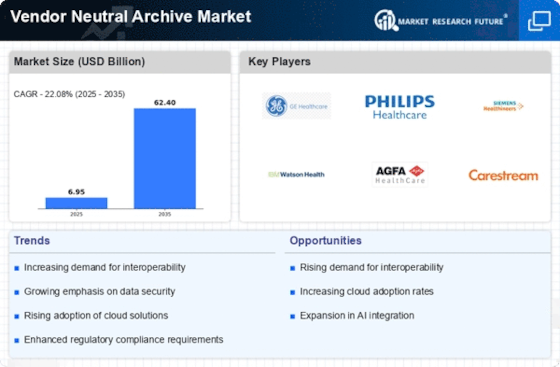

Rising Demand for Data Management Solutions

The Vendor Neutral Archive Market is experiencing a notable increase in demand for efficient data management solutions. As healthcare organizations generate vast amounts of imaging data, the need for effective storage and retrieval systems becomes paramount. The market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by the necessity for healthcare providers to streamline operations and enhance patient care through improved data accessibility. Furthermore, the integration of advanced analytics within Vendor Neutral Archive Market systems allows for better decision-making and resource allocation, thereby reinforcing the industry's relevance in contemporary healthcare settings.

Technological Advancements in Imaging Systems

Technological advancements in imaging systems are significantly influencing the Vendor Neutral Archive Market. Innovations in imaging modalities, such as MRI and CT scans, are generating higher volumes of data that require efficient management. The integration of these advanced imaging technologies with Vendor Neutral Archive Market solutions facilitates seamless data storage and retrieval, thereby enhancing clinical workflows. As imaging technology continues to evolve, the demand for sophisticated archiving solutions is likely to increase. This trend suggests that vendors who can adapt their offerings to accommodate new imaging technologies will be well-positioned to capture market share in the Vendor Neutral Archive Market.

Increased Investment in Healthcare IT Infrastructure

Investment in healthcare IT infrastructure is a pivotal driver for the Vendor Neutral Archive Market. As healthcare organizations strive to modernize their operations, there is a growing recognition of the need for robust IT systems that can support the management of imaging data. This trend is reflected in the increasing budgets allocated for IT solutions, with many organizations prioritizing the implementation of Vendor Neutral Archive Market systems. The market is expected to benefit from this influx of investment, as organizations seek to enhance their data management capabilities. Furthermore, the integration of Vendor Neutral Archive Market solutions with existing IT infrastructure is likely to create synergies that improve overall operational efficiency.