Research Methodology on Crystal Oscillators Market

Introduction

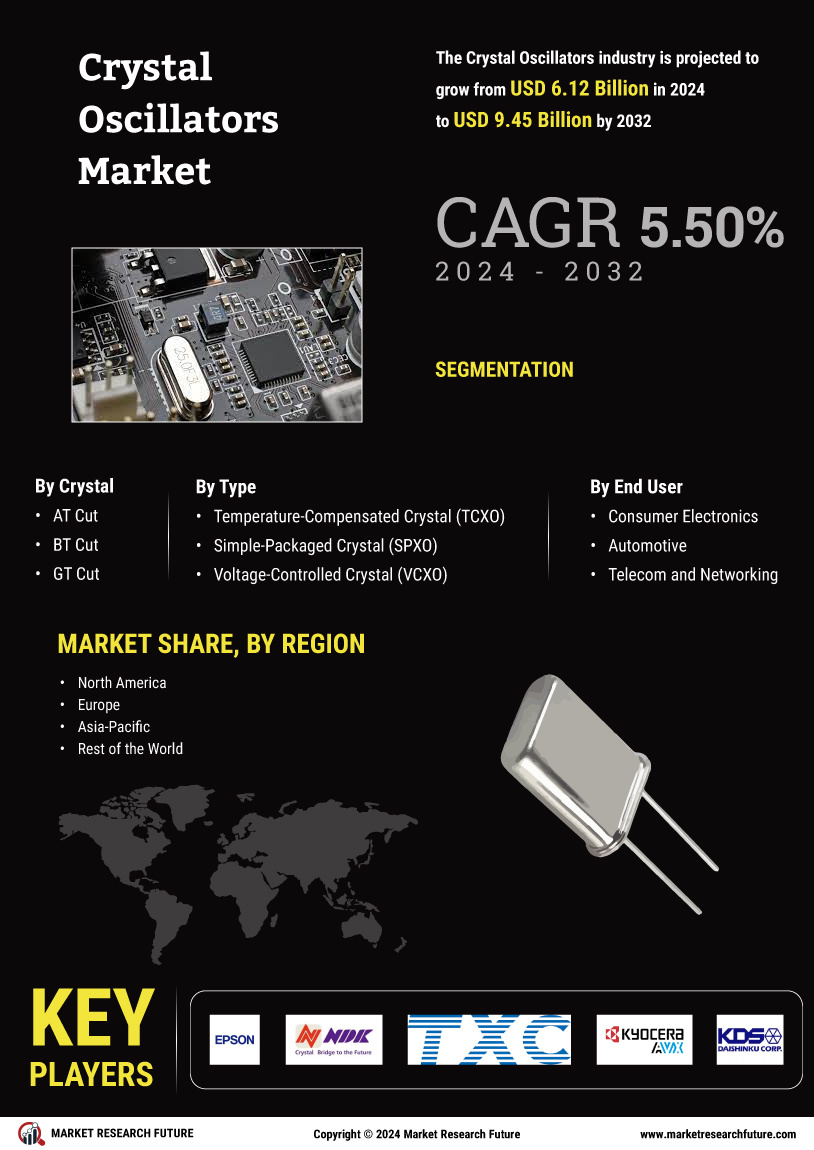

The Crystal Oscillator is an electronic device used to generate an oscillating signal with a stable frequency. It consists of an electronic frequency source and an amplifier. These devices have been used in various applications such as in telecommunication, radar, audio or video signal processing, televisions, cameras and other navigational systems. The application of crystal oscillators is increasing owing to rapid growth in the communication industry and advent of new technologies such as 3G,4G, and 5G. The global crystal oscillators market is estimated to grow at a considerable rate during the forecast period from 2023 to 2030.

Objective

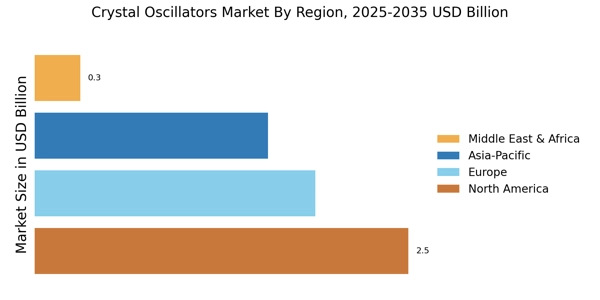

The purpose of the present study is to determine the market potential of Crystal Oscillators and identify potential opportunities for market growth. The study focuses on an in-depth examination of the market growth drivers, size, opportunities, trends and market share. It will also provide an analysis of the competitive environment, key players, and market segments.

Research Methodology

The research methodology employed in this study has been comprehensive and systematic. The data gathered in this study has been collected mainly through primary, secondary and tertiary sources. For primary data collection, the study employed questionnaires and surveys with key opinion leaders, industry experts, and industry experts. These interviews provided base of the study and helped to draw a comprehensive view of the market.

To collect secondary data, the study gleaned insights from published journals, government websites, World Bank reports and industry white papers. These sources were used to get an idea of the key trends and dynamics of the global crystal oscillator market. Furthermore, to provide a detailed analysis of the market, the study took into account the assessment of data compiled from technical sources, OEMs. Analysts also made use of a combination of bottom-up and top-down approaches to validate the market numbers and arrived at consensus view.

The study further provides a detailed analysis of key players operating in the market along with their market share, corporate affiliations and financial performance. The study further provides market attractiveness analysis based on region, sector, technology and product type. The study further contains Porter’s Five Force Analysis, market evolution map and market balance sheet integration to provide a clear picture of the market dynamics.

The information generated has been validated by industry experts through interviews and primary research. After validation, the data collected have been analyzed to arrive at a conclusion regarding the existing market trends, opportunities and market size.

Conclusion

This research study provides an in-depth market analysis of crystal oscillators based on technologies, market segments, key players and regional outlook. The study provides an insight into current market trends and future prospects of the crystal oscillators market. The report also includes Porter’s Five Force Analysis, market evolution map and market balance sheet integration to provide a clear picture of the market dynamics. With the help of this report, stakeholders can gain strategic insights and make informed decisions to drive their business forward.