Government Policies and Incentives

Government policies and incentives are playing a crucial role in shaping the Cylindrical LiFePO4 Battery Market. Many countries are implementing regulations and financial incentives to promote the adoption of clean energy technologies, including electric vehicles and energy storage systems. These initiatives often include tax credits, subsidies, and grants aimed at reducing the cost of battery technologies. In 2025, it is anticipated that such policies will contribute to a market growth rate of approximately 15% annually for the battery sector. This supportive regulatory environment not only encourages manufacturers to invest in research and development but also stimulates consumer demand for LiFePO4 batteries. As governments continue to prioritize sustainability, the impact of these policies on the Cylindrical LiFePO4 Battery Market is likely to be profound.

Growing Adoption of Electric Vehicles

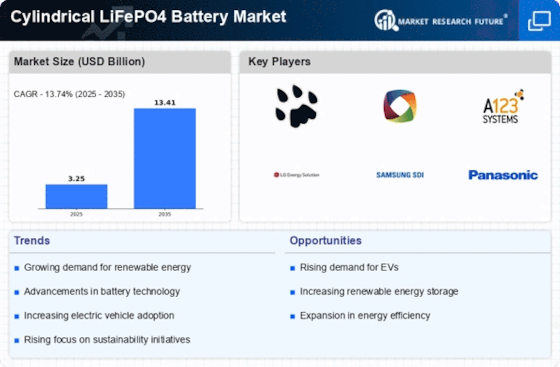

The increasing adoption of electric vehicles (EVs) is a primary driver for the Cylindrical LiFePO4 Battery Market. As consumers and manufacturers alike prioritize sustainability, the demand for efficient and reliable battery solutions has surged. In 2025, the EV market is projected to reach a valuation of over 800 billion USD, with LiFePO4 batteries being favored for their safety and longevity. This trend indicates a robust growth trajectory for the Cylindrical LiFePO4 Battery Market, as automakers seek to enhance vehicle performance while minimizing environmental impact. Furthermore, government incentives and regulations promoting electric mobility are likely to bolster this demand, creating a favorable landscape for battery manufacturers. The synergy between EV growth and battery technology advancements suggests a promising future for the Cylindrical LiFePO4 Battery Market.

Integration with Renewable Energy Systems

The integration of Cylindrical LiFePO4 batteries with renewable energy systems is emerging as a crucial driver for the market. As the world shifts towards sustainable energy solutions, the need for efficient energy storage systems becomes paramount. LiFePO4 batteries are particularly well-suited for solar and wind energy applications due to their stability and long cycle life. In 2025, the energy storage market is anticipated to reach approximately 200 billion USD, with a significant portion attributed to LiFePO4 technology. This integration not only enhances the reliability of renewable energy sources but also supports grid stability, making it an attractive option for energy providers. The synergy between renewable energy and battery technology is likely to foster growth in the Cylindrical LiFePO4 Battery Market, as stakeholders seek to optimize energy management solutions.

Rising Demand for Energy Storage Solutions

The rising demand for energy storage solutions is a pivotal factor driving the Cylindrical LiFePO4 Battery Market. As energy consumption patterns evolve, the need for efficient storage systems to manage peak loads and ensure energy availability is becoming increasingly critical. The market for energy storage is projected to grow significantly, with estimates suggesting a value of over 150 billion USD by 2025. LiFePO4 batteries, known for their safety and longevity, are gaining traction in various sectors, including residential, commercial, and industrial applications. This trend indicates a shift towards more sustainable energy practices, where energy storage plays a vital role in balancing supply and demand. Consequently, the growing emphasis on energy storage solutions is likely to enhance the prospects of the Cylindrical LiFePO4 Battery Market.

Technological Innovations in Battery Design

Technological innovations in battery design are significantly influencing the Cylindrical LiFePO4 Battery Market. Recent advancements have led to improved energy density, faster charging times, and enhanced thermal stability, making LiFePO4 batteries more appealing for various applications. For instance, the introduction of new manufacturing techniques has reduced production costs, allowing for competitive pricing in the market. In 2025, the market for advanced battery technologies is expected to exceed 50 billion USD, with LiFePO4 batteries capturing a substantial share due to their unique properties. These innovations not only enhance performance but also contribute to the overall sustainability of battery production, aligning with global efforts to reduce carbon footprints. As such, the ongoing research and development in battery technology are likely to propel the growth of the Cylindrical LiFePO4 Battery Market.