Research Methodology on Data Center Colocation Market

Introduction

This document describes the research methodology adopted for Market Research Future’s report Data Center Colocation Market (2023 – 2030). This report has been prepared by collecting and evaluating the market data from various primary and secondary sources along with a thorough study of the external as well as internal environment impacting the market. This research aims to provide an in-depth analysis of the Data Center Colocation market along with thorough profiling of key players and their standings in the market.

Research Objectives

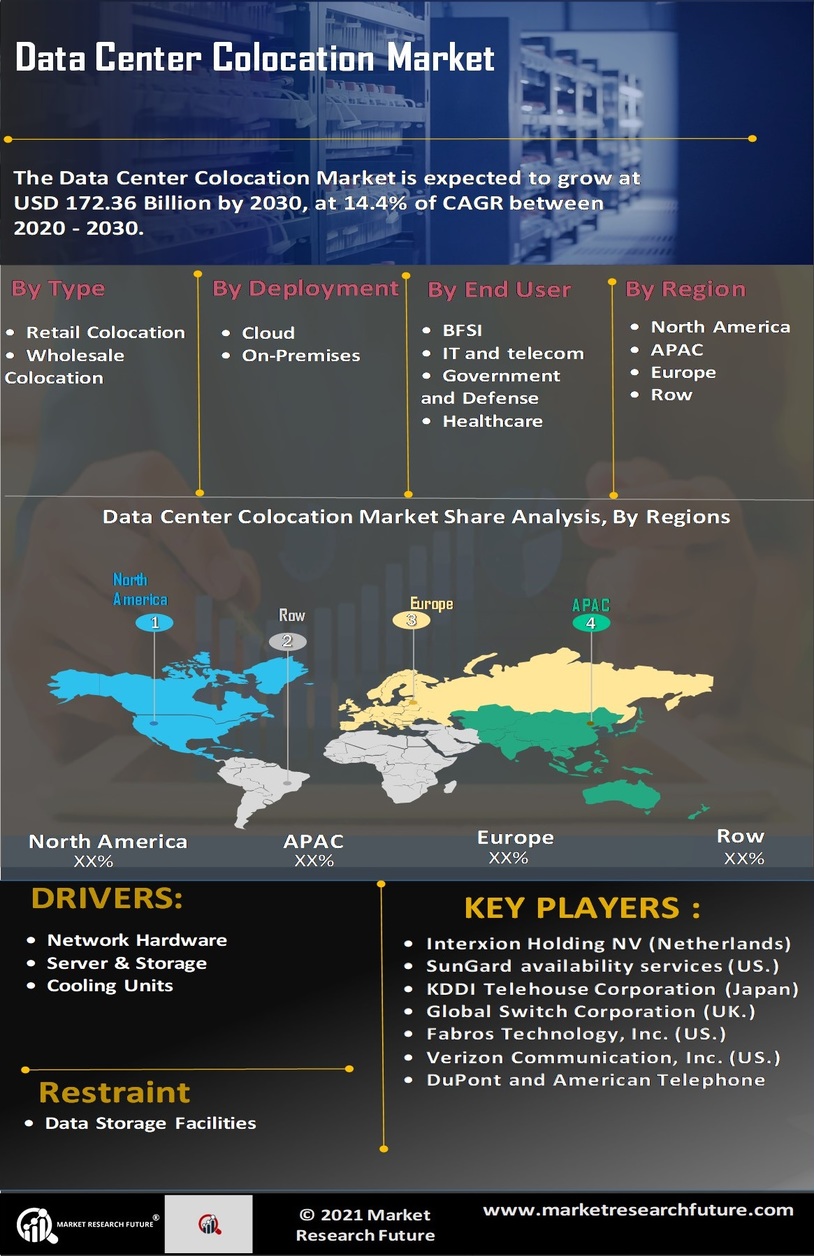

The objective of this report is to provide an in-depth analysis of the Data Center Colocation market with comprehensive segmentation based on service type, procurement type, size of the data centre, industry, and geography. The report covers a comprehensive market value chain; Porter’s Five Forces, SWOT analysis and market attractiveness analysis along with qualitative and quantitative drivers influencing the market. It also covers detailed profiles of top players in the market and the competitive landscape.

Research Process

The research study begins with an extensive study of primary as well as secondary sources undertaken through experts from the field and with the assistance of a wide range of research tools. The primary research involves extensive interviews with industry players and experts as well as brainstorming sessions with a team of professionals having expertise in the market. The research process is further strengthened with robust secondary research involving various business magazines, business journals, research papers, books and various periodicals.

Research Methodology

The research process is further strengthened with the assistance of analytical tools such as SWOT Analysis, Porter’s Five Forces Model, Market Attractiveness analysis and cluster analysis. The data collected from both primary as well as secondary sources are employed to analyse the global Data Center Colocation market. All the aforementioned factors along with the detailed syndicated report from research institutes, research papers and industry experts and associations provide the base for building the market assessment and estimating the prospects of the Data Center Colocation Market.

Data Collection Tools

The research process of this market includes a collection of data through both primary as well as secondary sources. To collect primary data, various survey tools and interviews with industry experts were conducted. For secondary data collection, various sources such as press releases, articles, corporate databases, research journals, business websites, and industry associations were referred to.

Geography Covered

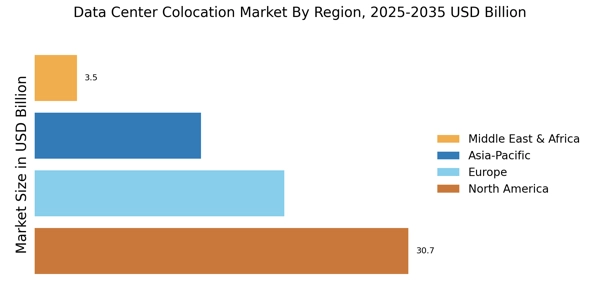

The regional analysis of the Data Center Colocation Market report covers North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, and the Rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia-Pacific), and Rest of the World (Brazil, Saudi Arabia, South Africa, UAE, and Rest of the World).

Conclusion

The research process conducted during this report has been thorough and the primary and secondary sources of data have provided a detailed and comprehensive understanding of the current market. This report is a great insight into the global Data Center Colocation Market, its drivers, restraints, and its current position in the market.