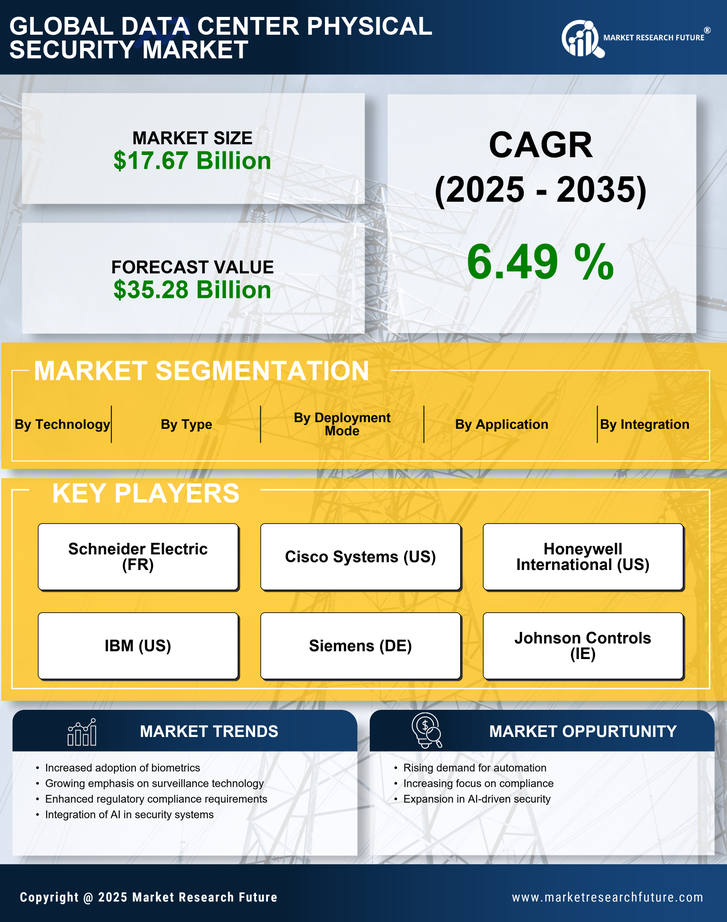

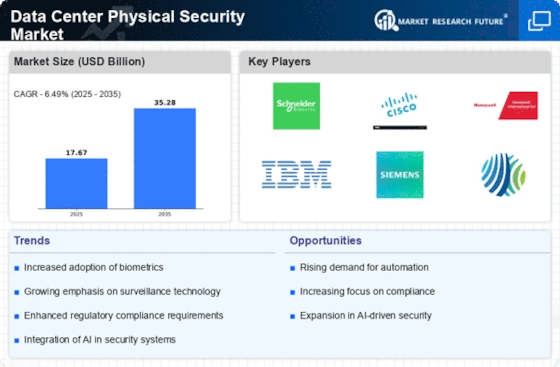

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats have heightened the need for robust physical security measures in the Data Center Physical Security Market. As organizations become more reliant on digital infrastructure, the potential for physical breaches that could lead to data theft or system compromise has escalated. In 2025, it is estimated that the global cost of cybercrime will reach trillions of dollars, prompting businesses to invest heavily in physical security solutions. This trend indicates a growing recognition that physical security is a critical component of an overall cybersecurity strategy, thereby driving demand for advanced security technologies and services in the Data Center Physical Security Market.

Increased Data Center Investments

The surge in data center investments is a pivotal driver for the Data Center Physical Security Market. With the proliferation of cloud computing, big data analytics, and the Internet of Things (IoT), organizations are expanding their data center capabilities to accommodate growing data storage and processing needs. According to industry reports, the data center market is projected to grow significantly, with investments reaching hundreds of billions of dollars by 2026. This expansion necessitates enhanced physical security measures to protect valuable assets and ensure operational continuity. Consequently, the Data Center Physical Security Market is likely to experience substantial growth as businesses prioritize security in their data center investments.

Regulatory Compliance Requirements

Regulatory compliance continues to be a significant driver in the Data Center Physical Security Market. Organizations are increasingly required to adhere to stringent regulations regarding data protection and privacy, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). These regulations necessitate the implementation of comprehensive physical security measures to safeguard sensitive information. As compliance failures can result in hefty fines and reputational damage, businesses are compelled to invest in physical security solutions that meet regulatory standards. This trend is expected to bolster the Data Center Physical Security Market as organizations seek to mitigate risks associated with non-compliance.

Emergence of Smart Security Solutions

The advent of smart security solutions is transforming the Data Center Physical Security Market. Technologies such as artificial intelligence, machine learning, and advanced surveillance systems are being integrated into physical security frameworks, enhancing threat detection and response capabilities. These innovations allow for real-time monitoring and analysis of security incidents, thereby improving overall security effectiveness. As organizations seek to leverage these technologies to bolster their security posture, the demand for smart security solutions is expected to rise. This trend indicates a shift towards more proactive and intelligent security measures within the Data Center Physical Security Market.

Growing Awareness of Physical Security Risks

There is a growing awareness among organizations regarding the risks associated with inadequate physical security in the Data Center Physical Security Market. High-profile security breaches and incidents have underscored the vulnerabilities that data centers face, prompting businesses to reassess their security strategies. This heightened awareness is leading to increased investments in physical security infrastructure, including access control systems, surveillance cameras, and perimeter security measures. As organizations recognize the potential financial and reputational repercussions of security failures, the Data Center Physical Security Market is likely to benefit from this shift in mindset, driving demand for comprehensive security solutions.