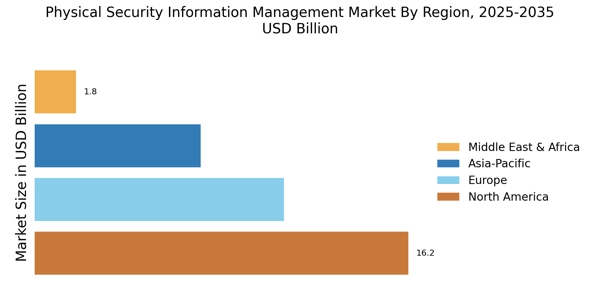

North America : Market Leader in Security Solutions

North America is the largest market for Physical Security Information Management Market (PSIM), accounting for approximately 45% of the global market share. The region's growth is driven by increasing security concerns, technological advancements, and stringent regulatory frameworks. The demand for integrated security solutions is rising, particularly in sectors like government, healthcare, and transportation, which are heavily investing in advanced security systems. The United States is the leading country in this market, followed by Canada. Major players such as Johnson Controls, Honeywell, and Tyco International are headquartered here, contributing to a competitive landscape characterized by innovation and strategic partnerships. The presence of these key players enhances the region's market dynamics, fostering continuous advancements in PSIM technologies.

Europe : Emerging Market with Regulations

Europe is witnessing significant growth in the Physical Security Information Management Market, holding approximately 30% of the global share. The region's expansion is fueled by increasing investments in security infrastructure, particularly in response to rising threats and regulatory requirements. The General Data Protection Regulation (GDPR) has also catalyzed the demand for compliant security solutions, driving organizations to adopt advanced PSIM systems for better data management and security. Leading countries in Europe include Germany, the UK, and France, where key players like Bosch Security Systems and Axis Communications are actively enhancing their market presence. The competitive landscape is marked by a focus on innovation and collaboration among technology providers, ensuring that European organizations remain at the forefront of security advancements. This dynamic environment is expected to continue fostering growth in the PSIM sector.

Asia-Pacific : Rapid Growth in Security Adoption

Asia-Pacific is rapidly emerging as a significant player in the Physical Security Information Management Market, accounting for about 20% of the global market share. The region's growth is driven by urbanization, increasing crime rates, and the need for advanced security solutions in various sectors, including retail, transportation, and critical infrastructure. Governments are also investing heavily in smart city initiatives, which further propels the demand for PSIM technologies. Countries like China, India, and Japan are leading the charge in adopting PSIM solutions. The competitive landscape features both global and local players, with companies like Genetec and Milestone Systems making substantial inroads. The presence of a diverse range of security providers fosters innovation and competition, ensuring that the region continues to evolve in response to emerging security challenges.

Middle East and Africa : Growing Demand Amid Challenges

The Middle East and Africa region is experiencing a growing demand for Physical Security Information Management Market solutions, holding approximately 5% of the global market share. This growth is driven by increasing security threats, geopolitical instability, and the need for enhanced surveillance systems in both public and private sectors. Governments are prioritizing security investments, particularly in critical infrastructure and urban areas, to address these challenges effectively. Leading countries in this region include the UAE, South Africa, and Saudi Arabia, where key players are establishing a foothold. The competitive landscape is characterized by a mix of local and international companies, with a focus on tailored solutions to meet specific regional needs. As security concerns continue to rise, the demand for PSIM technologies is expected to grow, fostering a more robust market environment.