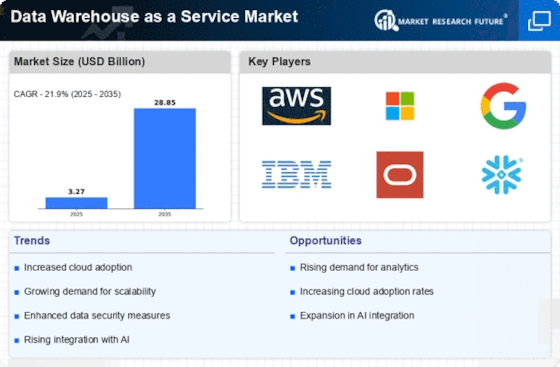

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the data warehouse as a service market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, data warehouse as a service industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global data warehouse as a service industry to benefit clients and increase the market sector. In recent years, the data warehouse as a service industry has offered some of the most significant advantages to medicine. Major players in the Data Warehouse as a Service Market, including Snowflake Inc. (US), MarkLogic Corporation (US), SAP SE (Germany), Google (US), Netavis Software GmbH (Austria), Amazon Web Services (US), Actian Corporation (US), IBM Corporation (US), Microsoft Corporation (US), Hortornworks (US), Micro Focus (UK), Oracle Corporation (US). An Amazon subsidiary called Amazon Web Services, Inc. (AWS) offers meters, pay-as-you-go on demand

cloud computing platforms and APIs to people, businesses, and governements. Clients frequently utilize this in addition to autoscaling. Via Amazon server farms, these cloud computing web services offer a range of services for networking, computing, storage, middleware, IoT, and other processing resources, as well as software tools. Clients are relieved of administering, scaling, and patching operating systems and hardware. For instance: Amazon Redshift Serverless, a new feature from Amazon Web Services (AWS), makes it incredibly simple to execute analytics in the cloud with great performance at any size. For users to get started, the appropriate computational resources are automatically provisioned. Based in Bozeman, Montana, Snowflake Inc. is a cloud computing and data cloud startup. After two years in stealth mode, it was officially unveiled in October 2014, having been formed in July 2012. The company provides “data-as-a-service” or cloud-based data analytics and storage, services. Using cloud-based technology and software, it enables corporate users to store and analyses data. To meet the demanding requirements of expanding businesses, Snowflake Services’ primary features include storage and compute isolation, on-the-fly scalable computation, data sharing, data cloning, and support for third party tools. It runs on Amazon, Microsoft Azure, and on the Google cloud. For Instance: To make on-premises data easier to access, Dell teamed with Snowflake Inc. The capabilities from Snowflake Data Cloud are now available for on-premises object storage thanks to a partnership between Snowflake Inc. and Dell Technologies.