Focus on Energy Efficiency

Energy efficiency has become a critical consideration in the Datacenter Chip Market, as organizations aim to reduce operational costs and environmental impact. The increasing energy consumption of datacenters has prompted a shift towards chips that offer better performance per watt. Recent studies indicate that energy-efficient chips can reduce operational costs by up to 30%, making them an attractive option for datacenter operators. This trend is further fueled by regulatory pressures and corporate sustainability goals, which emphasize the need for greener technologies. Manufacturers are responding by developing chips that incorporate advanced power management features and innovative architectures. The Datacenter Chip Market is thus evolving to prioritize energy efficiency, aligning with broader trends in sustainability and cost reduction.

Emergence of Edge Computing

The rise of edge computing is reshaping the Datacenter Chip Market, as organizations seek to process data closer to its source. This paradigm shift is driven by the need for real-time data processing and reduced latency, particularly in applications such as IoT and autonomous systems. As a result, there is an increasing demand for specialized chips that can efficiently handle edge computing tasks. Market analysis suggests that the edge computing market could grow significantly, potentially exceeding 100 billion dollars by 2025. This growth presents opportunities for chip manufacturers to innovate and create solutions tailored for edge environments. The Datacenter Chip Market must adapt to these changes, focusing on developing chips that are not only powerful but also energy-efficient, thereby addressing the unique challenges posed by edge computing.

Growing Need for Data Security

As cyber threats become more sophisticated, the demand for enhanced data security solutions is driving innovation in the Datacenter Chip Market. Organizations are increasingly recognizing the importance of securing sensitive information, leading to a rise in the development of chips with built-in security features. Market Research Future suggests that the cybersecurity market is projected to reach over 300 billion dollars by 2025, highlighting the urgency for secure computing solutions. This trend is prompting chip manufacturers to integrate advanced encryption and authentication capabilities directly into their products. The Datacenter Chip Market is thus witnessing a shift towards security-focused chip designs, which not only protect data but also enhance overall system integrity. This focus on security is likely to remain a priority as organizations continue to navigate the complexities of the digital landscape.

Increased Demand for Cloud Services

The Datacenter Chip Market is experiencing a surge in demand for cloud services, driven by the growing reliance on digital infrastructure. As businesses increasingly migrate to cloud-based solutions, the need for advanced datacenter chips becomes paramount. According to recent data, the cloud services market is projected to reach a valuation of over 800 billion dollars by 2025. This growth necessitates the deployment of high-performance chips that can handle vast amounts of data processing and storage. Consequently, manufacturers are focusing on developing chips that offer enhanced speed, efficiency, and scalability. The competitive landscape is evolving, with companies investing heavily in research and development to meet the specific needs of cloud service providers. This trend indicates a robust future for the Datacenter Chip Market as it aligns with the broader shift towards cloud computing.

Advancements in AI and Machine Learning

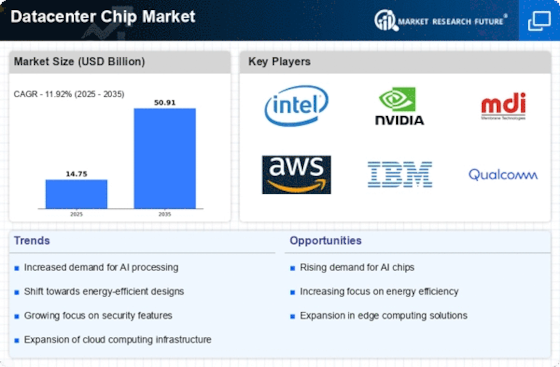

The integration of artificial intelligence and machine learning technologies is a key driver in the Datacenter Chip Market. As organizations leverage AI for data analytics, automation, and decision-making, the demand for chips that can support these complex computations is escalating. Recent estimates indicate that the AI chip market alone is expected to reach approximately 50 billion dollars by 2025. This trend compels chip manufacturers to innovate, creating specialized processors that can handle AI workloads efficiently. The Datacenter Chip Market is witnessing a shift towards chips that not only provide high processing power but also optimize energy consumption. This focus on AI capabilities is likely to shape the future of datacenter chips, as companies strive to enhance their competitive edge through advanced technology.

Leave a Comment