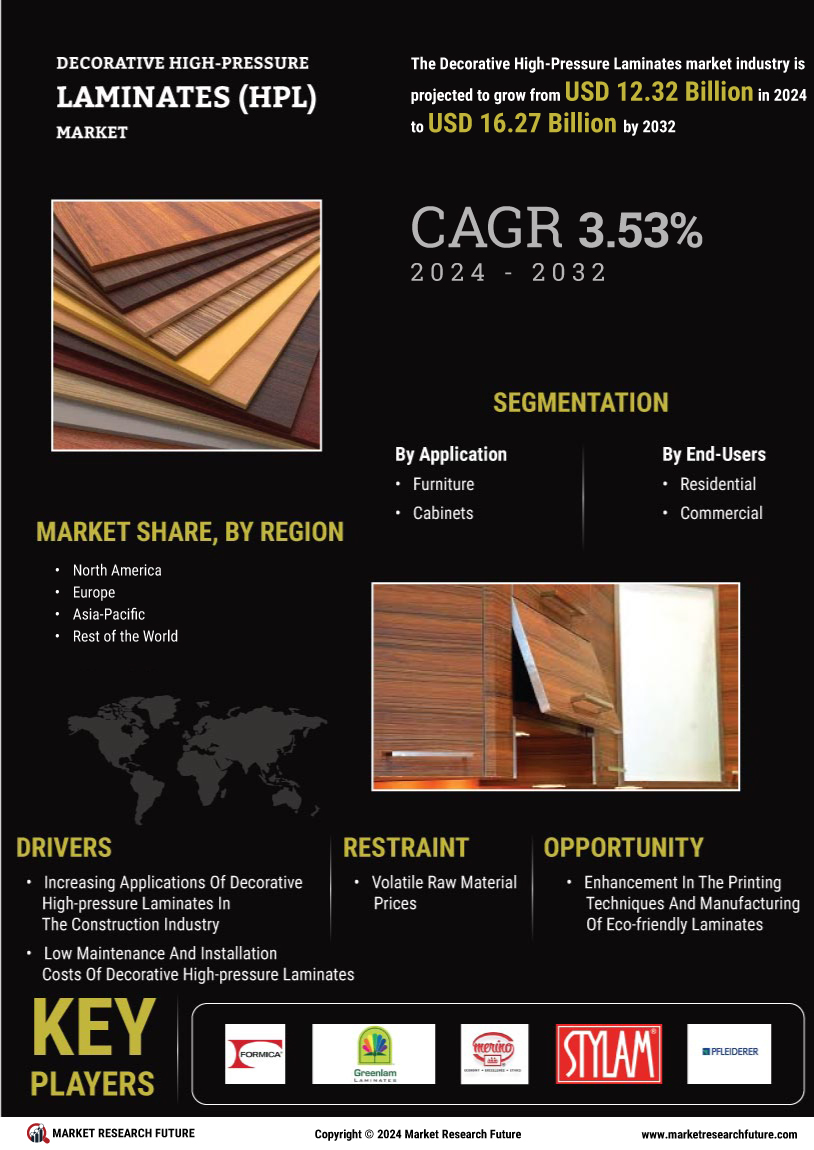

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Decorative High-Pressure Laminates Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Decorative High-Pressure Laminates industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Decorative High-Pressure Laminates industry to benefit clients and increase the market sector. In recent years, the Decorative High-Pressure Laminates industry has offered some of the most significant advantages to medicine. Major players in the Decorative High-Pressure Laminates Market, including Formica, Greenlam Industries Ltd , Merinolaminates , Stylam Industries limited , Pfleiderer, Wilsonart LLC , OMNOVA Solutions Inc , Abet, Laminati SpA, Panolam Industries , and Fundermax, are attempting to increase market demand by investing in research and development operations.

Custom furniture for homes and offices was planned by Formica, a producer and distributor of ornamental surface goods. High-pressure laminate (HPL), solid surface, compact laminate, and engineered stone are just a few of the company's decorative surfacing products that allow consumers to have modern patterns on their furniture based on their needs. Broadview Industries bought Formica, a Fletcher Building company, in December 2018. A sale-purchase agreement for the Fletcher Building was reached, uniting two of the top businesses in the ornamental surfacing market.

In accordance with the deal, Formica will sell its operations in North America, Asia, and Europe as well as its Homapal metal laminates division. Both businesses will earn sizable market shares because to the combined knowledge of Formica's presence, operational, and commercial capabilities, and Broadview's distinctive and creative product solutions.

Laminate flooring is made by Greenlam Industries Ltd. The business produces and markets laminates, decorative veneers, and related goods for use in homes, kitchens, offices, and other buildings. Through its wholesale and retail network, it engages in the production of laminates, compact laminates, decorative veneers, engineered wood floors, engineered door sets, and other related goods. Under the brands Greenlam, New Mika, Decowood, Mikasa Floors, and Mikasa Doors and Frames, the company sells its goods. Laminate and related products and Veneer and related items make up the company's operating segments.

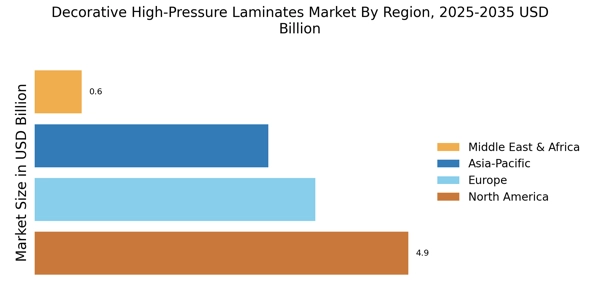

Geographically, the group operates in India and outside of India, with the majority of its income coming from within India.