Geopolitical Factors

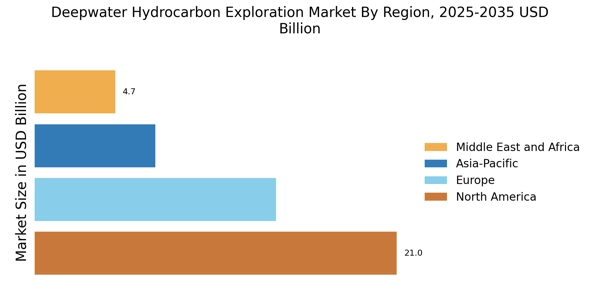

Geopolitical dynamics are increasingly influencing the Deepwater Hydrocarbon Exploration Market. Regions rich in hydrocarbon resources often experience political instability, which can impact exploration activities. For instance, tensions in the Middle East and parts of Africa can disrupt supply chains and create uncertainty for investors. Conversely, stable political environments can attract foreign investment, facilitating exploration efforts. The interplay of these geopolitical factors can lead to fluctuations in oil prices, which directly affect the viability of deepwater projects. As nations seek to secure their energy independence, the Deepwater Hydrocarbon Exploration Market may see a shift in focus towards regions with favorable political climates, thereby altering investment patterns and exploration strategies.

Rising Energy Demand

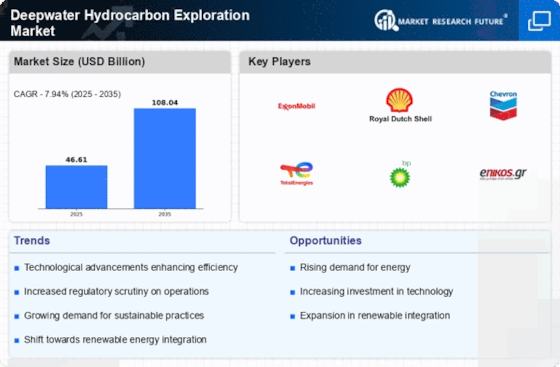

The increasing The Deepwater Hydrocarbon Exploration Industry. As economies expand and populations grow, the need for energy sources intensifies. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2040. This surge in demand compels energy companies to explore untapped resources, particularly in deepwater regions where significant hydrocarbon reserves are believed to exist. The Deepwater Hydrocarbon Exploration Market is thus positioned to benefit from this trend, as companies seek to secure long-term energy supplies to meet future needs. Furthermore, the transition towards cleaner energy sources does not diminish the necessity for hydrocarbons in the near term, as they remain integral to energy security and economic stability.

Environmental Regulations

The evolving landscape of environmental regulations is a significant driver for the Deepwater Hydrocarbon Exploration Market. As concerns about climate change and environmental degradation grow, regulatory frameworks are becoming more stringent. Companies operating in the deepwater sector must navigate these regulations to ensure compliance while pursuing exploration activities. This has led to increased investment in sustainable practices and technologies that minimize environmental impact. For example, the adoption of advanced spill prevention measures and waste management systems is becoming standard practice. While these regulations may pose challenges, they also present opportunities for innovation within the Deepwater Hydrocarbon Exploration Market, as companies strive to balance profitability with environmental stewardship.

Technological Innovations

Technological advancements play a crucial role in shaping the Deepwater Hydrocarbon Exploration Market. Innovations in drilling techniques, such as horizontal drilling and advanced seismic imaging, have significantly enhanced the ability to locate and extract hydrocarbons from deepwater reserves. For instance, the development of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) has improved operational efficiency and safety in deepwater environments. These technologies not only reduce exploration costs but also minimize environmental risks associated with deepwater drilling. As companies continue to invest in research and development, the Deepwater Hydrocarbon Exploration Market is likely to witness further enhancements in exploration capabilities, leading to increased production and profitability.

Investment in Renewable Energy Integration

The integration of renewable energy sources into traditional hydrocarbon exploration strategies is emerging as a key driver for the Deepwater Hydrocarbon Exploration Market. As the energy landscape evolves, companies are increasingly recognizing the need to diversify their portfolios. Investments in hybrid systems that combine deepwater hydrocarbon extraction with renewable technologies, such as offshore wind, are gaining traction. This approach not only enhances energy security but also aligns with global sustainability goals. The Deepwater Hydrocarbon Exploration Market is likely to see a rise in collaborative ventures between traditional oil and gas companies and renewable energy firms, fostering innovation and creating new revenue streams. This trend reflects a broader shift towards a more integrated energy future.

.png)