Cost Reduction Initiatives

Cost reduction initiatives are a prominent driver in the Big Data in Oil and Gas Exploration and Production Market. By employing big data analytics, companies can identify inefficiencies and optimize their supply chains. For example, predictive analytics can forecast demand and adjust production schedules accordingly, potentially reducing operational costs by up to 20%. This focus on cost efficiency is particularly relevant in a fluctuating market where profit margins can be tight. As organizations strive to maintain competitiveness, the integration of big data solutions is likely to become a standard practice.

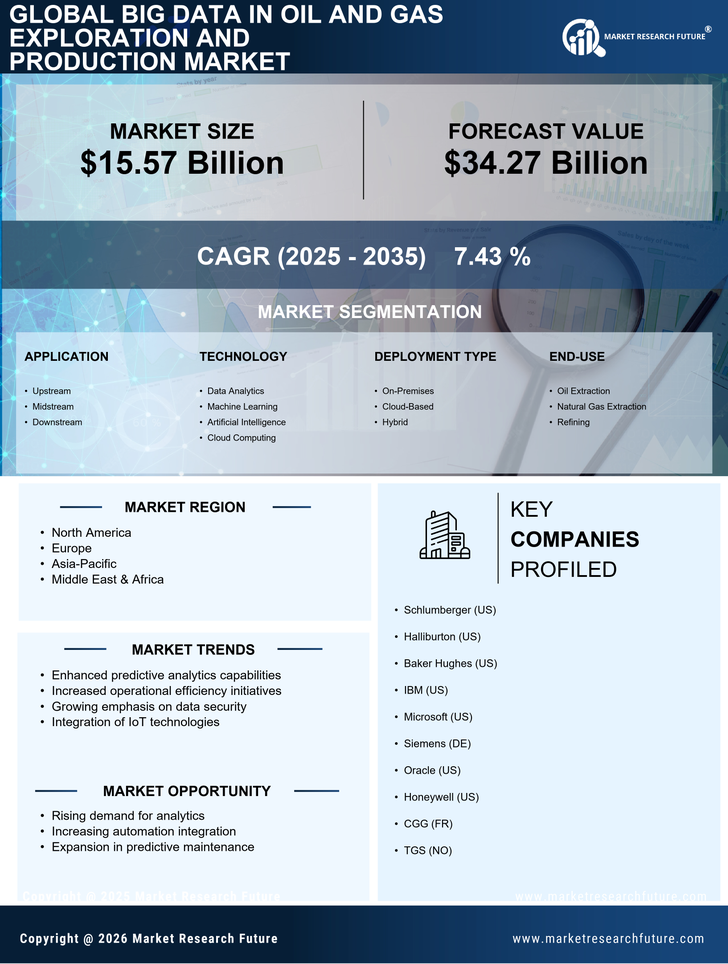

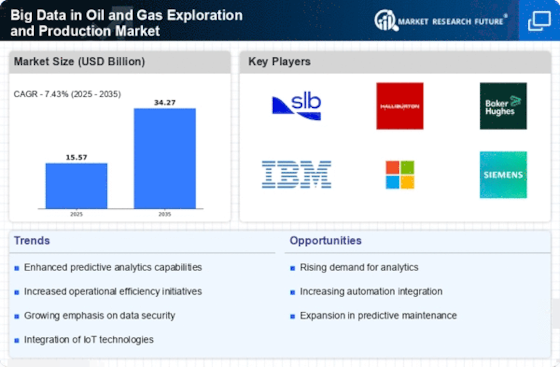

Increased Operational Efficiency

The Big Data in Oil and Gas Exploration and Production Market is witnessing a surge in operational efficiency due to advanced data analytics. Companies are leveraging big data to optimize drilling operations, reduce downtime, and enhance resource allocation. For instance, predictive maintenance powered by big data analytics can potentially decrease equipment failure rates by up to 30%. This efficiency not only leads to cost savings but also maximizes production output. As a result, organizations are increasingly investing in big data technologies to streamline their operations, which is expected to drive market growth significantly.

Enhanced Decision-Making Capabilities

In the Big Data in Oil and Gas Exploration and Production Market, enhanced decision-making capabilities are emerging as a crucial driver. The integration of big data analytics allows companies to analyze vast amounts of geological and operational data, leading to more informed decisions. For example, data-driven insights can improve exploration success rates by identifying optimal drilling locations. This capability is particularly vital in a market where the cost of exploration can reach millions of dollars. Consequently, the ability to make data-informed decisions is likely to propel the adoption of big data solutions in the industry.

Regulatory Compliance and Risk Management

The Big Data in Oil and Gas Exploration and Production Market is increasingly influenced by the need for regulatory compliance and effective risk management. Companies are utilizing big data analytics to monitor environmental impacts and ensure adherence to safety regulations. This proactive approach not only mitigates risks but also enhances corporate reputation. For instance, the ability to analyze real-time data can help in identifying potential hazards before they escalate. As regulatory frameworks become more stringent, the demand for big data solutions that facilitate compliance is expected to rise, thereby driving market growth.

Advancements in Technology and Infrastructure

The Big Data in Oil and Gas Exploration and Production Market is propelled by advancements in technology and infrastructure. Innovations such as cloud computing and IoT are enabling the collection and analysis of vast datasets in real-time. This technological evolution allows for more sophisticated data analytics, which can enhance exploration accuracy and production efficiency. For instance, the implementation of IoT sensors in drilling operations can provide continuous data streams, facilitating immediate decision-making. As technology continues to evolve, the reliance on big data analytics is expected to grow, further driving market expansion.