Increased Geopolitical Tensions

Increased geopolitical tensions are emerging as a critical driver for the Exploration And Drilling Security Market. As nations vie for control over valuable natural resources, the security of exploration sites becomes paramount. The potential for conflict and instability in resource-rich regions necessitates robust security measures to protect personnel and assets. Companies operating in these areas are compelled to invest in comprehensive security strategies, including risk assessments and crisis management plans. The market is likely to see a surge in demand for security services and technologies that can address these geopolitical challenges, with an anticipated growth rate of around 5% in the coming years. This trend highlights the need for a proactive approach to security in the exploration sector.

Collaboration with Security Providers

Collaboration with specialized security providers is becoming increasingly vital in the Exploration And Drilling Security Market. As exploration activities expand into more complex and high-risk environments, companies are recognizing the value of partnering with experts in security management. These collaborations enable organizations to leverage specialized knowledge and resources, enhancing their overall security posture. The market for security services is projected to grow by approximately 7% annually, driven by the demand for tailored security solutions that address specific operational challenges. This trend indicates a shift towards a more integrated approach to security, where exploration companies work closely with security providers to develop comprehensive strategies that ensure the safety of their operations.

Rising Demand for Resource Exploration

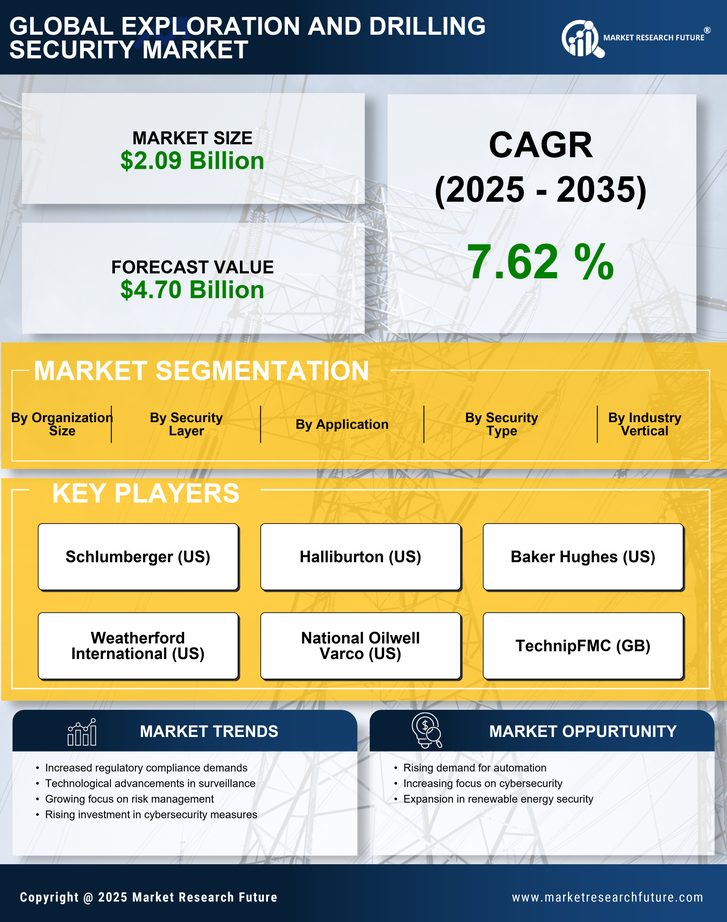

The Exploration And Drilling Security Market is experiencing a notable increase in demand for resource exploration, driven by the need for energy security and sustainable resource management. As countries seek to reduce dependency on imported energy, there is a heightened focus on domestic exploration activities. This trend is reflected in the significant investments made in drilling technologies and security measures to protect these operations. According to recent data, the exploration sector is projected to grow at a compound annual growth rate of approximately 5% over the next five years, indicating a robust market for security solutions tailored to exploration activities. The need for enhanced security protocols is paramount, as the risks associated with exploration, including theft and sabotage, continue to pose challenges to operators.

Regulatory Compliance and Safety Standards

The Exploration And Drilling Security Market is significantly influenced by the need for regulatory compliance and adherence to safety standards. Governments and regulatory bodies are imposing stricter guidelines to ensure the safety of exploration activities, which in turn drives the demand for comprehensive security solutions. Companies are increasingly investing in security measures that not only meet regulatory requirements but also enhance operational safety. The market for compliance-related security solutions is projected to grow by approximately 4% over the next few years, as organizations strive to mitigate risks associated with non-compliance. This trend underscores the importance of integrating security protocols into the overall operational framework of exploration and drilling activities.

Technological Advancements in Security Solutions

Technological advancements are reshaping the Exploration And Drilling Security Market, as innovative security solutions become increasingly essential for safeguarding exploration sites. The integration of advanced surveillance systems, drones, and artificial intelligence is enhancing the ability to monitor and respond to potential threats in real-time. These technologies not only improve security but also streamline operations, allowing for more efficient resource management. The market for security technology in the exploration sector is expected to witness a growth rate of around 6% annually, driven by the demand for more sophisticated security measures. As exploration activities expand into remote and challenging environments, the reliance on cutting-edge technology to ensure safety and security is likely to increase.