Increasing Prevalence of Diabetes

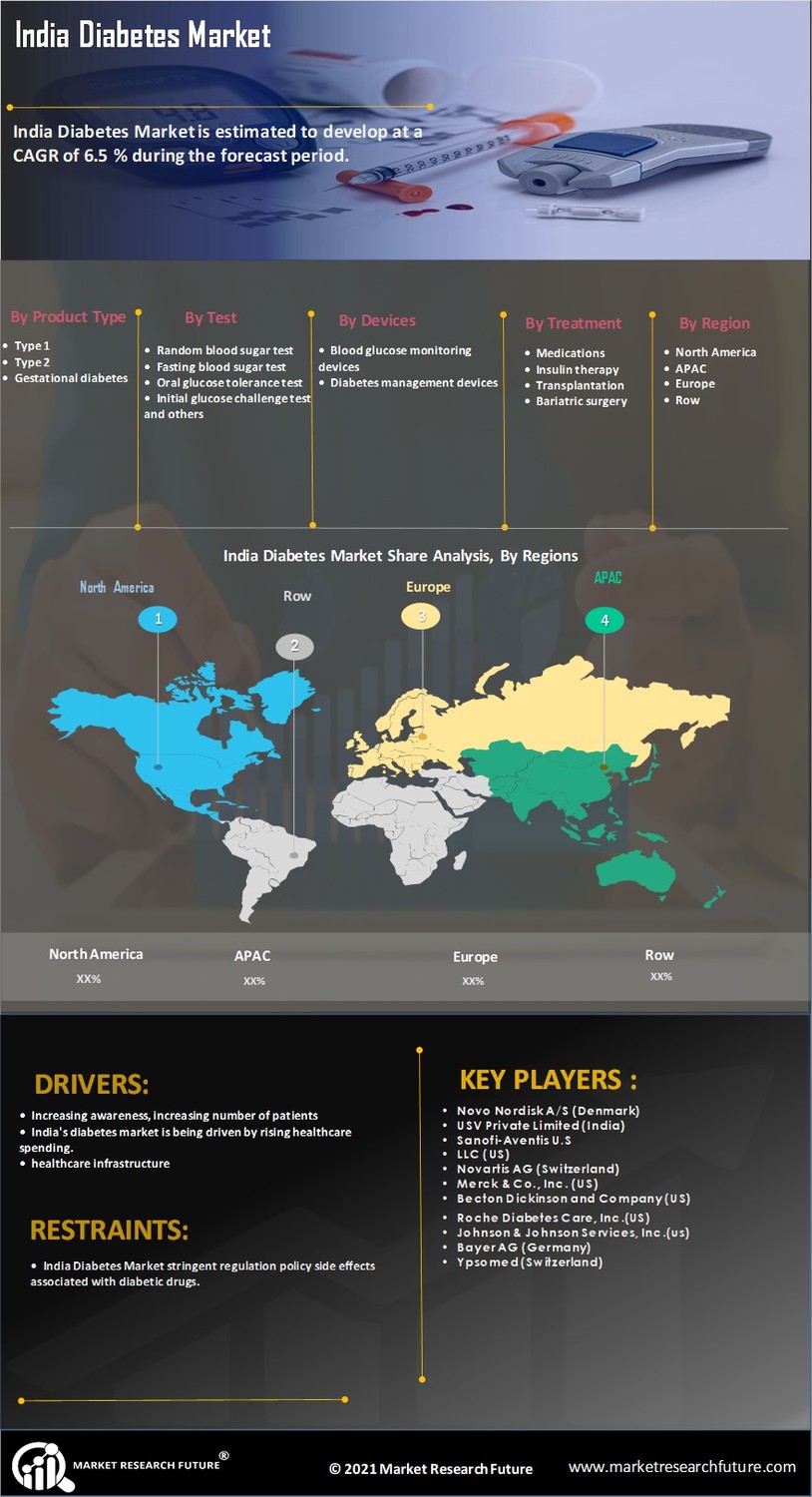

The rising incidence of diabetes is a primary driver in the Diabetes Market. According to recent estimates, approximately 537 million adults are living with diabetes, a figure projected to rise to 643 million by 2030. This alarming trend is attributed to factors such as sedentary lifestyles, unhealthy diets, and increasing obesity rates. As the number of diabetes cases escalates, the demand for effective management solutions, including medications, monitoring devices, and educational resources, intensifies. Consequently, healthcare providers and pharmaceutical companies are compelled to innovate and expand their offerings to cater to this growing patient population. The increasing prevalence of diabetes not only highlights the urgent need for comprehensive care but also presents lucrative opportunities for stakeholders within the Diabetes Market.

Government Initiatives and Support

Government initiatives aimed at combating diabetes are playing a crucial role in shaping the Diabetes Market. Various countries are implementing policies and programs to promote awareness, prevention, and management of diabetes. For instance, public health campaigns are being launched to educate citizens about the importance of healthy lifestyles and regular screenings. Additionally, funding for diabetes research and development is increasing, leading to the discovery of new treatments and technologies. In the United States, the National Institute of Diabetes and Digestive and Kidney Diseases allocates substantial resources to diabetes research, which fosters innovation within the industry. These government efforts not only enhance public awareness but also stimulate investment in the Diabetes Market, creating a more robust ecosystem for diabetes care.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the Diabetes Market. Patients are increasingly seeking tailored treatment options that consider their unique genetic, environmental, and lifestyle factors. This trend is prompting pharmaceutical companies and healthcare providers to develop individualized therapies and management plans. The market for personalized diabetes care is projected to grow substantially, as patients demand more effective and targeted solutions. Moreover, advancements in genomics and biotechnology are facilitating the development of precision medicine approaches, which are expected to enhance treatment efficacy and patient satisfaction. As the focus on personalized care intensifies, the Diabetes Market is likely to adapt and evolve, offering innovative solutions that cater to the diverse needs of patients.

Rising Awareness and Education on Diabetes

The increasing awareness and education surrounding diabetes are driving growth in the Diabetes Market. As more individuals become informed about the risks and complications associated with diabetes, there is a heightened demand for preventive measures and management solutions. Educational programs, workshops, and community initiatives are being implemented to empower patients and healthcare professionals alike. This surge in awareness is reflected in the growing market for diabetes education resources, which is expected to expand significantly in the coming years. Furthermore, the emphasis on self-management and lifestyle modifications is encouraging patients to actively participate in their care, leading to improved health outcomes. As awareness continues to rise, the Diabetes Market is poised for further growth, with an increasing number of stakeholders recognizing the importance of education in diabetes management.

Advancements in Diabetes Management Technologies

Technological innovations are reshaping the Diabetes Market, enhancing the management and treatment of diabetes. Continuous glucose monitoring systems, insulin pumps, and mobile health applications are becoming increasingly prevalent, providing patients with real-time data and improved control over their condition. The market for diabetes management devices is expected to reach USD 27 billion by 2026, driven by the demand for more efficient and user-friendly solutions. These advancements not only facilitate better patient outcomes but also empower individuals to take charge of their health. Furthermore, the integration of artificial intelligence and machine learning into diabetes management tools is anticipated to revolutionize personalized treatment plans, making them more effective and tailored to individual needs. As technology continues to evolve, the Diabetes Market is likely to witness significant growth and transformation.