Aging Population

The aging population is likely to be a key driver for the Digestive Enzyme Supplements Market. As individuals age, their digestive systems may become less efficient, leading to a higher incidence of digestive issues. Research indicates that older adults often experience decreased enzyme production, which can result in malabsorption and discomfort. This demographic shift suggests that there will be a growing need for digestive enzyme supplements among older consumers seeking to maintain their digestive health. The increasing number of elderly individuals globally could potentially expand the market, as they may actively seek out supplements to enhance their quality of life.

E-commerce Expansion

The expansion of e-commerce platforms is transforming the way consumers access digestive enzyme supplements, potentially driving market growth. Online shopping offers convenience and a wider selection of products, allowing consumers to easily compare options and read reviews. Data suggests that e-commerce sales in the dietary supplement sector are expected to grow significantly, with online channels accounting for a substantial portion of total sales. This shift towards digital purchasing may enhance the visibility of digestive enzyme supplements, making them more accessible to a diverse audience. As consumers increasingly turn to online platforms for their health needs, the Digestive Enzyme Supplements Market could benefit from this trend.

Rising Health Consciousness

There is a notable trend towards health consciousness among consumers, which appears to be influencing the Digestive Enzyme Supplements Market. Individuals are increasingly prioritizing their health and wellness, leading to a surge in demand for dietary supplements that promote digestive health. This trend is supported by data indicating that the dietary supplement market is projected to reach USD 230 billion by 2027, with digestive health products playing a significant role. As consumers become more informed about the benefits of digestive enzymes, the market for these supplements is likely to expand, reflecting a shift towards proactive health management.

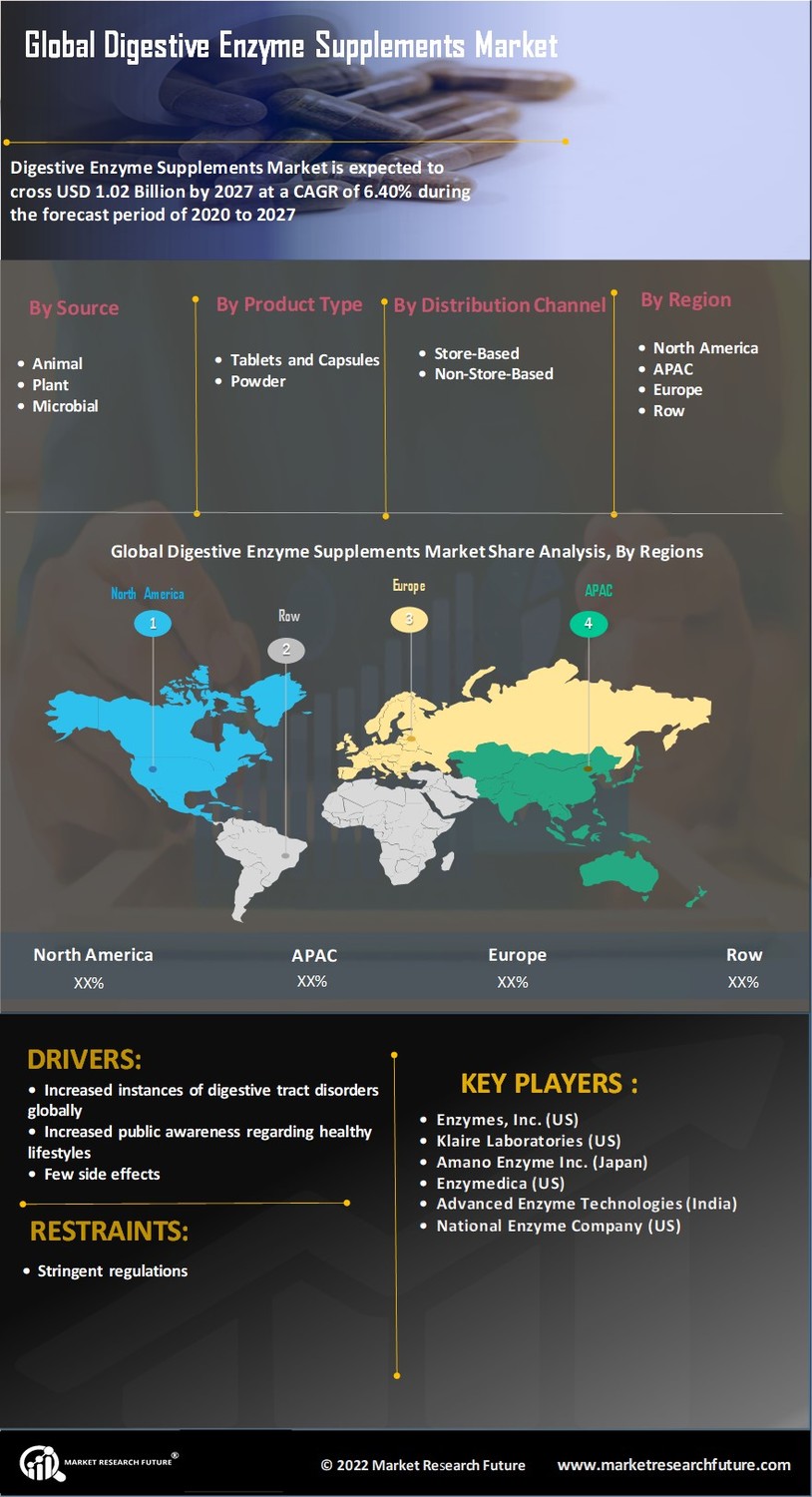

Increasing Digestive Disorders

The prevalence of digestive disorders appears to be on the rise, which may drive demand for digestive enzyme supplements. Conditions such as irritable bowel syndrome, lactose intolerance, and celiac disease are becoming more recognized, leading consumers to seek solutions for their digestive health. According to recent data, approximately 60 to 70 million individuals are affected by digestive diseases, indicating a substantial market for digestive enzyme supplements. This growing awareness of digestive health issues suggests that the Digestive Enzyme Supplements Market could experience significant growth as consumers increasingly turn to these products for relief and support.

Innovative Product Development

The Digestive Enzyme Supplements Market is witnessing a wave of innovative product development, which may serve as a catalyst for growth. Manufacturers are increasingly focusing on creating specialized formulations that cater to specific dietary needs, such as vegan or gluten-free options. This innovation is likely to attract a broader consumer base, including those with dietary restrictions or preferences. Furthermore, advancements in technology and research are enabling the development of more effective enzyme blends, which could enhance product efficacy. As a result, the market may see an influx of new products that appeal to health-conscious consumers seeking tailored digestive solutions.