Increased Focus on Brand Identity

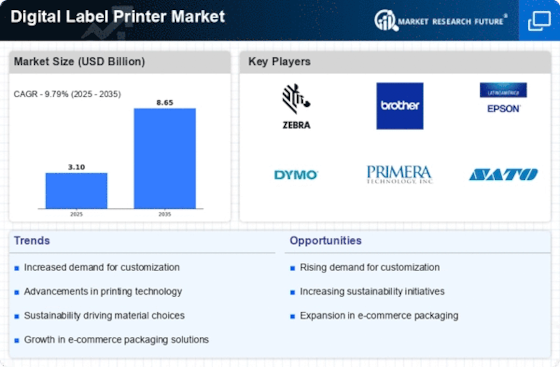

In the Digital Label Printer Market, there is an increasing focus on brand identity and packaging aesthetics. Companies recognize that labels serve as a critical touchpoint for consumers, influencing purchasing decisions. As a result, businesses are investing in high-quality, visually appealing labels that convey their brand message effectively. The demand for unique and customized labels is on the rise, as brands strive to differentiate themselves in a competitive marketplace. Market analysis indicates that the segment of premium labels is expected to grow at a rate of 6% over the next few years. This emphasis on brand identity not only enhances customer engagement but also drives innovation within the Digital Label Printer Market, as manufacturers develop new printing techniques and materials to meet evolving consumer preferences.

Rising Demand for Short-Run Production

The Digital Label Printer Market experiences a notable increase in demand for short-run production. This trend is driven by the need for businesses to produce smaller quantities of labels quickly and efficiently. Companies are increasingly adopting digital label printing technologies to meet the growing consumer preference for customized products. According to recent data, the market for short-run label production is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This shift towards short-run production not only enhances flexibility but also reduces waste, aligning with the sustainability goals of many organizations. As a result, the Digital Label Printer Market is likely to see a surge in investments aimed at improving digital printing capabilities to cater to this demand.

Technological Advancements in Printing

Technological advancements play a crucial role in shaping the Digital Label Printer Market. Innovations such as improved ink formulations, faster printing speeds, and enhanced print resolutions are transforming the landscape of label printing. The introduction of advanced digital printing technologies, including inkjet and laser printing, has enabled manufacturers to produce high-quality labels with intricate designs and vibrant colors. Furthermore, the integration of software solutions for design and production management streamlines the printing process, making it more efficient. Market data indicates that the adoption of these technologies is expected to increase, with a projected growth rate of 8% in the next few years. This evolution in technology not only enhances the quality of printed labels but also expands the capabilities of the Digital Label Printer Market to meet diverse customer needs.

Growth of E-commerce and Retail Sectors

The Digital Label Printer Market is significantly influenced by the growth of e-commerce and retail sectors. As online shopping continues to gain traction, the demand for efficient labeling solutions has surged. E-commerce businesses require labels that are not only functional but also visually appealing to enhance brand identity. The rise in direct-to-consumer sales has further fueled the need for customized labels that reflect the unique characteristics of products. Recent statistics suggest that the e-commerce sector is expected to grow by over 10% annually, driving the demand for digital label printing solutions. Consequently, the Digital Label Printer Market is poised to benefit from this trend, as retailers and e-commerce platforms seek innovative labeling solutions to improve customer experience and operational efficiency.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly important in the Digital Label Printer Market. As industries such as food and pharmaceuticals face stringent labeling regulations, the demand for accurate and compliant labels is on the rise. Companies are required to provide clear and precise information on product labels, including ingredients, usage instructions, and safety warnings. This necessity drives the adoption of digital label printing technologies that ensure high accuracy and quick turnaround times. Recent data suggests that the market for compliant labeling solutions is expected to grow by approximately 5% annually. As businesses prioritize compliance with regulations, the Digital Label Printer Market is likely to see a surge in demand for innovative labeling solutions that meet these requirements.