Top Industry Leaders in the Disaster Recovery Service Market

Competitive Landscape of Disaster Recovery as a Service (DRaaS) Market: Navigating a Booming Arena

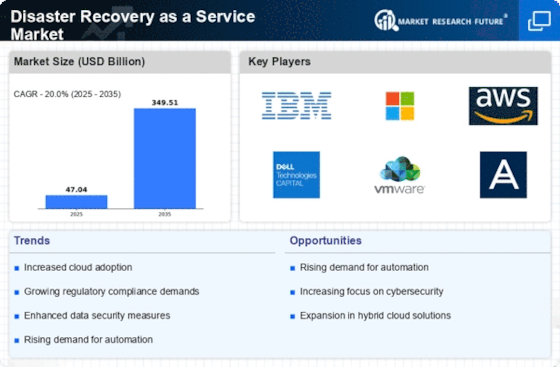

The Disaster Recovery as a Service market is experiencing explosive growth, fueled by the ever-increasing dependence on digital infrastructure and the rising frequency of cyberattacks and natural disasters. This dynamic landscape presents a plethora of opportunities for both established players and emerging contenders.

Key Players:

-

HP Enterprises Company

-

Microsoft Corporation

-

Treo Information Technology

-

VMware Inc.

-

Sungard Availability Services

-

Amazon Web Services

-

Cable & Wireless Communications

-

IBM Corporation

-

Cisco Systems

-

NTT Communications

-

InterVision

-

TierPoint, LLC

-

Infrascale

-

Acronis International GmbH

-

KDDI Corp.

-

Insight Partners

-

SpaceX

-

The LEMOINE Company

Strategies Adopted:

-

Cloud-First Approach: Leveraging the scalability, cost-effectiveness, and agility of cloud platforms is the dominant strategy, enabling rapid recovery and flexible DRaaS models.

-

Partnerships and Acquisitions: Collaborations with technology providers and MSPs expand reach and expertise, while acquisitions bolster service portfolios and market share.

-

Verticalization: Tailoring DRaaS solutions to specific industries, such as healthcare, finance, or retail, caters to unique compliance needs and data sensitivity.

-

Automation and AI: Integrating automation and AI into DRaaS platforms streamlines recovery processes, reduces human error, and enhances predictive capabilities.

-

Security Focus: Highlighting robust security features and compliance certifications is crucial for building trust and attracting risk-averse clients.

Factors for Market Share Analysis:

-

Service Portfolio Breadth: Offering a comprehensive range of DRaaS functionalities, from data backup and replication to failover and recovery orchestration, attracts a wider customer base.

-

Cloud Platform Agility: Demonstrating expertise in leveraging specific cloud platforms for DRaaS solutions caters to existing cloud investments and preferences.

-

Pricing and Flexibility: Offering tiered pricing models and flexible deployment options caters to diverse budgets and operational needs.

-

Customer Support: Providing robust 24/7 support and rapid recovery times is paramount for building customer loyalty and trust.

-

Track Record and Industry Recognition: A proven track record of successful DRaaS implementations and industry accolades bolster credibility and attract new clients.

New and Emerging Companies:

-

DRaaS Startups: Startups like Acronis and Druva are disrupting the market with innovative DRaaS solutions utilizing cutting-edge technologies like blockchain and machine learning.

-

Cybersecurity Specialists: Cybersecurity companies like Palo Alto Networks and Crowdstrike are venturing into DRaaS, offering integrated solutions for disaster recovery and cyberattack mitigation.

-

Regional Players: DRaaS providers like NTT DATA and Rackspace are expanding their reach in specific regions, catering to local compliance requirements and language preferences.

Current Company Investment Trends:

-

R&D in Automation and AI: Companies are investing heavily in AI-powered automation tools to optimize disaster recovery processes and minimize human intervention.

-

Security Enhancements: Continuous investments in data encryption, threat detection, and compliance certifications are crucial to addressing evolving cybersecurity threats.

-

Cloud-Native Development: Building DRaaS solutions specifically for cloud platforms ensures seamless integration, scalability, and cost optimization.

-

Partner Ecosystem Expansion: Building partnerships with technology providers and MSPs broadens reach, enhances expertise, and accelerates market penetration.

-

Go-to-Market Strategies: Investing in targeted marketing campaigns, attending industry events, and showcasing customer success stories are key to attracting new clients in a competitive landscape.

Latest Company Updates:

-

Oct 27, 2023: Acronis launches cyber protection bundle with enhanced DRaaS: Includes disaster recovery for workloads on AWS, Azure, and GCP.

-

Nov 16, 2023: Barracuda strengthens DRaaS offering with ransomware recovery guarantee: Guarantees 12-hour restore times for ransomware attacks.

-

Jan 18, 2024: Datto acquires IT Managed Services Provider (MSP) Infrascale: Expands Datto's global reach and DRaaS capabilities.