Surge in Gaming Demand

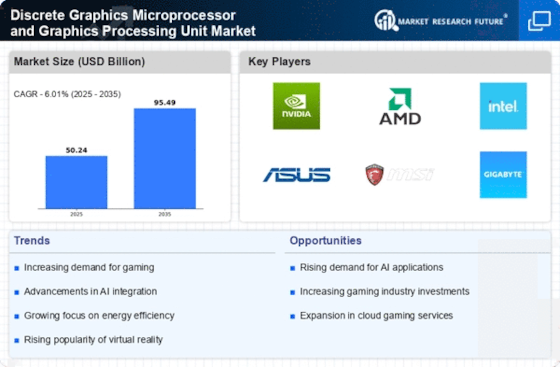

The Discrete Graphics Microprocessor and Graphics Processing Unit Market experiences a notable surge in demand driven by the gaming sector. As gaming technology advances, consumers increasingly seek high-performance graphics solutions to enhance their gaming experiences. The market for gaming hardware is projected to reach substantial figures, with estimates suggesting a growth rate of approximately 10% annually. This trend indicates a robust appetite for discrete graphics solutions that can deliver superior rendering capabilities and immersive experiences. Furthermore, the rise of competitive gaming and eSports has intensified the need for high-quality graphics processors, thereby propelling the demand for discrete graphics microprocessors and GPUs. As a result, manufacturers are compelled to innovate and develop cutting-edge technologies to meet the evolving expectations of gamers, solidifying the market's growth trajectory.

Shift Towards Cloud Gaming Solutions

The shift towards cloud gaming solutions is transforming the Discrete Graphics Microprocessor and Graphics Processing Unit Market. As consumers increasingly favor streaming games over traditional console or PC gaming, the demand for powerful graphics processing capabilities in cloud infrastructure is on the rise. This trend is supported by market data indicating that the cloud gaming market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20%. Consequently, cloud service providers are investing in high-performance discrete graphics microprocessors to ensure seamless gaming experiences for users. This shift not only influences hardware development but also encourages collaboration between cloud service providers and graphics manufacturers to optimize performance. As cloud gaming continues to gain traction, the discrete graphics market is likely to evolve, adapting to the changing landscape of gaming consumption.

Advancements in AI and Machine Learning

The integration of artificial intelligence and machine learning technologies significantly influences the Discrete Graphics Microprocessor and Graphics Processing Unit Market. These advancements necessitate powerful graphics processing capabilities to handle complex computations and data analysis. As industries increasingly adopt AI-driven solutions, the demand for high-performance GPUs is expected to rise. Market data indicates that the AI hardware market is projected to grow at a compound annual growth rate of over 25%, which directly correlates with the need for advanced graphics processors. Consequently, manufacturers are focusing on developing discrete graphics microprocessors that can efficiently support AI workloads, thereby enhancing their market position. This trend not only drives innovation but also encourages collaboration between hardware and software developers to create optimized solutions for AI applications, further propelling the growth of the discrete graphics market.

Emergence of Virtual and Augmented Reality

The rise of virtual reality (VR) and augmented reality (AR) technologies is reshaping the Discrete Graphics Microprocessor and Graphics Processing Unit Market. These immersive technologies require high-performance graphics processing to deliver seamless experiences. As VR and AR applications expand across various sectors, including gaming, education, and healthcare, the demand for advanced graphics solutions is likely to increase. Market analysis suggests that the VR and AR market could reach billions in revenue, thereby creating substantial opportunities for discrete graphics microprocessor manufacturers. The need for real-time rendering and high frame rates in VR applications further emphasizes the importance of powerful GPUs. As a result, companies are investing in research and development to create specialized graphics processors tailored for VR and AR, which could significantly enhance user experiences and drive market growth.

Growing Demand for High-Resolution Displays

The increasing prevalence of high-resolution displays, such as 4K and 8K screens, is a key driver for the Discrete Graphics Microprocessor and Graphics Processing Unit Market. As consumers and professionals alike seek enhanced visual experiences, the need for powerful graphics processors capable of supporting these resolutions becomes paramount. Market data indicates that the 4K display market is expected to witness substantial growth, with projections suggesting a compound annual growth rate of around 15%. This trend compels manufacturers to innovate and produce discrete graphics microprocessors that can efficiently handle the demands of high-resolution content. Additionally, the rise of content creation, including video editing and graphic design, further fuels the need for advanced GPUs that can deliver exceptional performance. Consequently, the market for discrete graphics solutions is likely to expand as consumers increasingly invest in high-quality display technologies.