Disposable Hygiene Products Market Summary

As per Market Research Future analysis, The Global Disposable Hygiene Products Market was estimated at 203.3 USD Billion in 2024. The market is projected to grow from 218.76 USD Billion in 2025 to 455.17 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Disposable Hygiene Products Market is experiencing robust growth driven by sustainability and technological advancements.

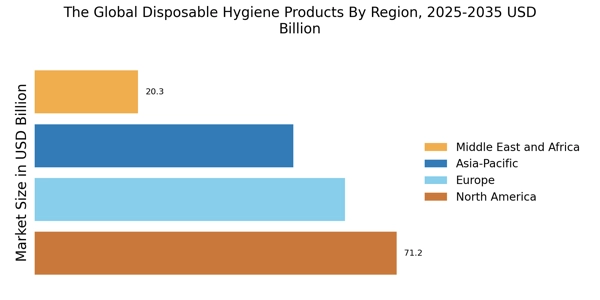

- North America remains the largest market for disposable hygiene products, primarily due to high consumer demand and established retail channels.

- The Asia-Pacific region is identified as the fastest-growing market, fueled by increasing urbanization and rising disposable incomes.

- Diapers continue to dominate the market as the largest segment, while wipes are emerging as the fastest-growing category due to changing consumer preferences.

- Key market drivers include rising health awareness and innovations in product design, which are significantly influencing purchasing decisions.

Market Size & Forecast

| 2024 Market Size | 203.3 (USD Billion) |

| 2035 Market Size | 455.17 (USD Billion) |

| CAGR (2025 - 2035) | 7.6% |

Major Players

Procter & Gamble (US), Kimberly-Clark (US), Unicharm (JP), Essity (SE), Johnson & Johnson (US), Hengan International (CN), SCA Hygiene Products (SE), Ontex Group (BE), Pampers (US)