Growing Awareness of Health and Hygiene

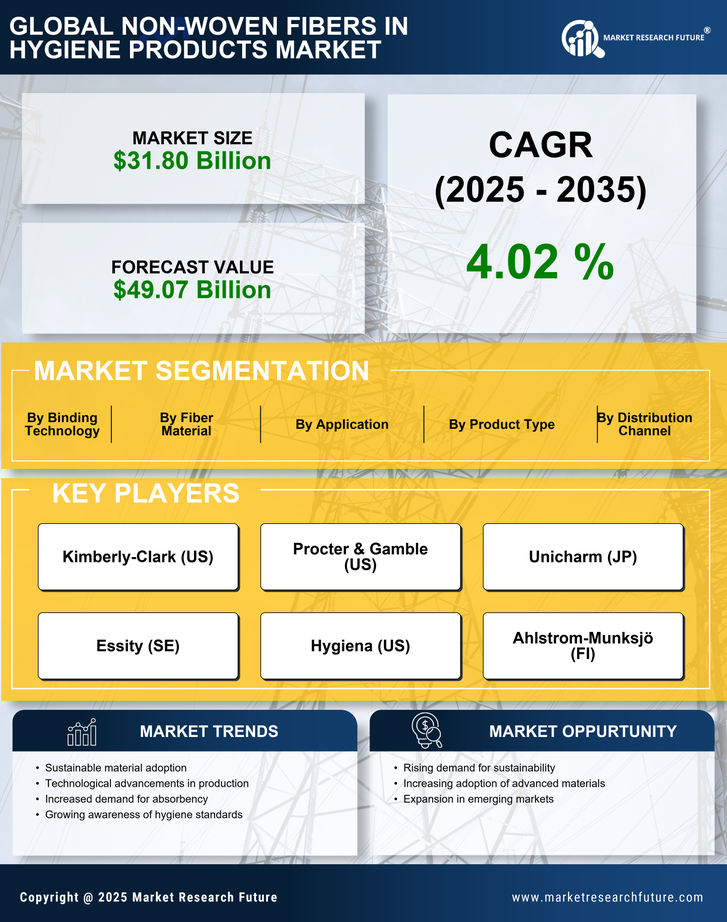

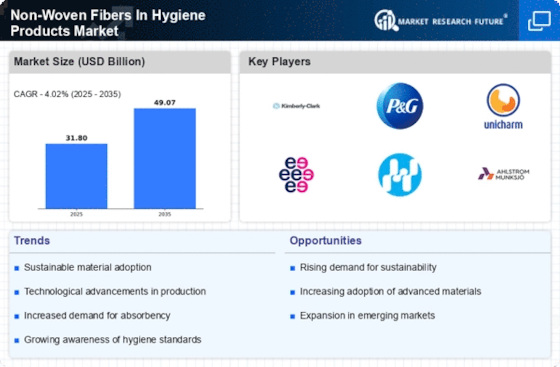

The heightened awareness of health and hygiene practices is a critical driver for the Non-Woven Fibers In Hygiene Products Market. Consumers are increasingly prioritizing hygiene in their daily lives, leading to a surge in demand for products that ensure cleanliness and safety. This trend is particularly evident in the personal care sector, where non-woven fibers are utilized in items such as wipes and masks. Market analysis suggests that the hygiene products segment is expected to grow at a rate of 4.5% annually, reflecting the ongoing commitment to health and wellness among consumers. This growing awareness is likely to sustain the demand for non-woven fiber applications.

Innovations in Non-Woven Fiber Technology

Technological advancements in non-woven fiber production are significantly influencing the Non-Woven Fibers In Hygiene Products Market. Innovations such as the development of biodegradable non-woven materials and enhanced manufacturing processes are paving the way for more sustainable and efficient products. For instance, the introduction of spunbond and meltblown technologies has improved the performance characteristics of non-woven fabrics, making them more suitable for hygiene applications. As manufacturers continue to invest in research and development, the market is likely to see a surge in innovative products that cater to evolving consumer needs, potentially increasing market share.

Expansion of E-commerce and Retail Channels

The expansion of e-commerce and retail channels is transforming the landscape of the Non-Woven Fibers In Hygiene Products Market. With the rise of online shopping, consumers have greater access to a variety of hygiene products, including those made from non-woven fibers. This trend is particularly beneficial for niche products that may not be widely available in traditional retail outlets. Market data indicates that e-commerce sales in the hygiene sector are projected to grow by over 20% in the coming years. This shift not only enhances product visibility but also encourages manufacturers to innovate and diversify their offerings to meet the demands of a broader consumer base.

Rising Demand for Disposable Hygiene Products

The increasing consumer preference for disposable hygiene products is a notable driver in the Non-Woven Fibers In Hygiene Products Market. As awareness regarding hygiene and sanitation rises, particularly in personal care and medical sectors, the demand for products such as diapers, feminine hygiene products, and adult incontinence products is expected to grow. Market data indicates that the disposable hygiene products segment is projected to witness a compound annual growth rate (CAGR) of approximately 5% over the next few years. This trend is likely to bolster the utilization of non-woven fibers, which offer superior absorbency and comfort, thereby enhancing the overall consumer experience.

Environmental Regulations and Sustainability Initiatives

The implementation of stringent environmental regulations and sustainability initiatives is shaping the Non-Woven Fibers In Hygiene Products Market. Governments and organizations are increasingly advocating for eco-friendly materials, prompting manufacturers to explore sustainable alternatives to traditional non-woven fibers. This shift is likely to drive innovation in the development of recyclable and biodegradable non-woven products. As a result, companies that align their production processes with sustainability goals may gain a competitive edge in the market. The emphasis on environmental responsibility is expected to influence consumer purchasing decisions, further propelling the demand for sustainable hygiene products.