Growth of E-commerce and Online Retail

The rapid growth of e-commerce and online retail is a significant driver of the Distribution Planning Software Market. As more consumers turn to online shopping, businesses are compelled to adapt their distribution strategies to meet the demands of this evolving landscape. Efficient distribution planning is crucial for managing the complexities associated with online orders, including inventory management, order fulfillment, and last-mile delivery. Recent statistics indicate that e-commerce sales have been steadily increasing, prompting retailers to invest in distribution planning software to enhance their logistics capabilities. This investment not only improves operational efficiency but also enables companies to provide better service to their customers, thereby fostering growth in the distribution planning software sector.

Increased Focus on Customer Satisfaction

In the Distribution Planning Software Market, there is a growing emphasis on enhancing customer satisfaction through improved distribution strategies. Companies are recognizing that efficient distribution planning directly impacts their ability to meet customer demands and expectations. With the rise of e-commerce, consumers are increasingly expecting faster and more reliable delivery options. As a response, businesses are turning to distribution planning software to optimize their logistics operations. This software enables firms to streamline their processes, reduce lead times, and enhance service levels. Data suggests that companies that prioritize customer satisfaction through effective distribution planning can see a significant increase in customer loyalty and retention rates, further driving the demand for advanced software solutions.

Regulatory Compliance and Risk Management

The Distribution Planning Software Market is also being shaped by the need for regulatory compliance and effective risk management. As businesses operate in increasingly complex regulatory environments, the ability to ensure compliance with various laws and standards becomes paramount. Distribution planning software can assist organizations in navigating these challenges by providing tools for tracking and managing compliance-related data. Furthermore, the software can help identify potential risks in the supply chain, allowing companies to proactively address issues before they escalate. This focus on compliance and risk management is likely to drive the adoption of distribution planning software, as organizations seek to mitigate risks and ensure operational continuity.

Rising Demand for Supply Chain Optimization

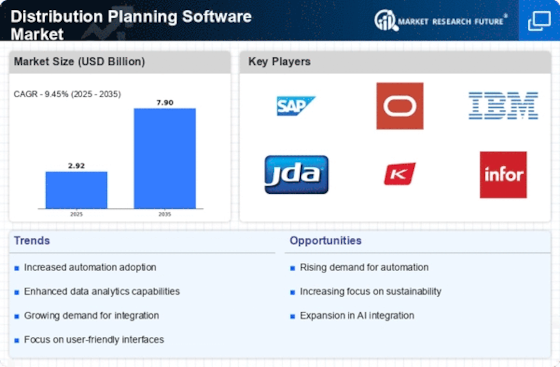

The Distribution Planning Software Market is experiencing a notable surge in demand for supply chain optimization solutions. Companies are increasingly recognizing the need to enhance their operational efficiency and reduce costs. According to recent data, organizations that implement advanced distribution planning software can achieve up to a 20% reduction in logistics costs. This trend is driven by the growing complexity of supply chains, necessitating sophisticated tools to manage inventory levels, transportation, and warehousing. As businesses strive to meet customer expectations for faster delivery times, the adoption of distribution planning software becomes essential. This software enables firms to analyze data in real-time, facilitating informed decision-making and improving overall supply chain performance.

Technological Advancements in Software Solutions

Technological advancements are significantly influencing the Distribution Planning Software Market. The integration of machine learning and predictive analytics into distribution planning tools is transforming how companies approach logistics. These technologies allow for more accurate demand forecasting and inventory management, which are critical for maintaining competitive advantage. Recent studies indicate that organizations utilizing advanced analytics can improve their forecasting accuracy by as much as 30%. As a result, businesses are increasingly investing in sophisticated distribution planning software to leverage these technological benefits. The ability to analyze vast amounts of data and derive actionable insights is becoming a key differentiator in the market, prompting more companies to adopt these innovative solutions.