Rising Demand for Orthopedic Procedures

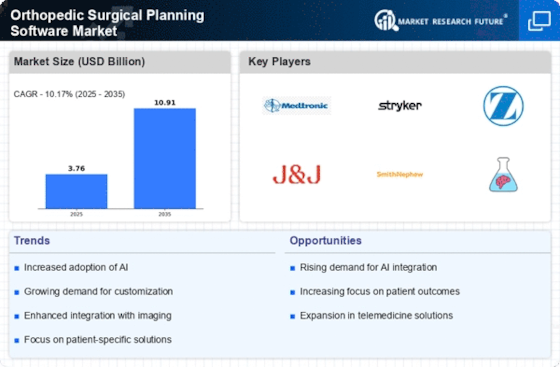

The Orthopedic Surgical Planning Software Market is experiencing a notable surge in demand for orthopedic procedures, driven by an aging population and increasing prevalence of musculoskeletal disorders. As the global population ages, the incidence of conditions such as arthritis and osteoporosis rises, necessitating more surgical interventions. According to recent data, the number of orthopedic surgeries is projected to increase significantly, with estimates suggesting a growth rate of approximately 5% annually. This trend underscores the need for advanced surgical planning software that enhances precision and outcomes in orthopedic surgeries. Consequently, the Orthopedic Surgical Planning Software Market is poised for expansion as healthcare providers seek innovative solutions to improve surgical efficiency and patient care.

Increasing Focus on Patient-Centric Care

The Orthopedic Surgical Planning Software Market is witnessing a shift towards patient-centric care, emphasizing personalized treatment plans and improved patient outcomes. Healthcare providers are increasingly recognizing the importance of tailoring surgical approaches to individual patient needs, which necessitates the use of advanced planning software. This trend is supported by data indicating that patient satisfaction scores are closely linked to the effectiveness of personalized surgical interventions. As a result, orthopedic surgical planning software that allows for customization and adaptability is becoming essential. The growing emphasis on patient engagement and shared decision-making is likely to drive the demand for innovative solutions within the Orthopedic Surgical Planning Software Market, as providers seek to enhance the overall patient experience.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are contributing to the growth of the Orthopedic Surgical Planning Software Market. Governments and healthcare organizations are increasingly recognizing the value of advanced surgical planning tools in improving surgical outcomes and reducing healthcare costs. As a result, there is a trend towards establishing reimbursement frameworks that support the adoption of orthopedic surgical planning software. Recent policy changes have indicated a willingness to invest in technologies that enhance surgical precision and efficiency. This regulatory environment is likely to encourage healthcare providers to integrate advanced software solutions into their practices, thereby driving growth in the Orthopedic Surgical Planning Software Market.

Growing Investment in Healthcare Infrastructure

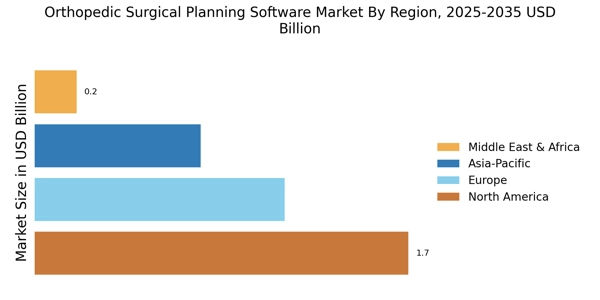

Investment in healthcare infrastructure is a significant driver of the Orthopedic Surgical Planning Software Market. As countries continue to enhance their healthcare systems, there is a corresponding increase in the adoption of advanced medical technologies, including surgical planning software. Data suggests that healthcare expenditure is on the rise, with many nations prioritizing the development of state-of-the-art facilities and technologies. This trend is particularly evident in emerging markets, where investments in healthcare infrastructure are expected to accelerate. The expansion of surgical facilities and the integration of advanced planning tools are likely to create new opportunities within the Orthopedic Surgical Planning Software Market, as healthcare providers seek to improve surgical capabilities and patient outcomes.

Technological Advancements in Surgical Planning

Technological advancements play a pivotal role in shaping the Orthopedic Surgical Planning Software Market. Innovations such as 3D imaging, augmented reality, and machine learning are revolutionizing surgical planning processes. These technologies enable surgeons to visualize complex anatomical structures in detail, facilitating more accurate preoperative assessments. The integration of advanced software solutions is expected to enhance surgical outcomes and reduce complications. Market data indicates that the adoption of such technologies is on the rise, with a projected increase in the use of 3D modeling software by orthopedic surgeons. This trend highlights the growing reliance on sophisticated surgical planning tools within the Orthopedic Surgical Planning Software Market, as practitioners strive for improved precision and efficiency.