Regulatory Frameworks and Incentives

Regulatory frameworks and incentives play a crucial role in shaping the Distribution Voltage Regulator Market. Governments worldwide are implementing policies aimed at enhancing energy efficiency and promoting the use of advanced electrical infrastructure. These regulations often include financial incentives for utilities to upgrade their voltage regulation systems. As a result, the market is likely to witness increased investments in distribution voltage regulators, driven by both compliance requirements and the desire to improve service reliability. Recent legislative measures indicate that utilities could receive up to 15% in tax credits for implementing energy-efficient technologies, thereby stimulating market growth and encouraging the adoption of modern voltage regulation solutions.

Integration of Smart Grid Technologies

The integration of smart grid technologies is a pivotal driver for the Distribution Voltage Regulator Market. Smart grids enhance the efficiency and reliability of electricity distribution, allowing for real-time monitoring and management of voltage levels. This integration facilitates the deployment of advanced voltage regulation solutions that can adapt to changing load conditions. As utilities invest in smart grid infrastructure, the demand for sophisticated voltage regulators is expected to rise. Market analysis indicates that the adoption of smart grid technologies could lead to a 20% increase in the deployment of distribution voltage regulators by 2030, reflecting a significant shift towards more intelligent energy management systems.

Increasing Demand for Reliable Power Supply

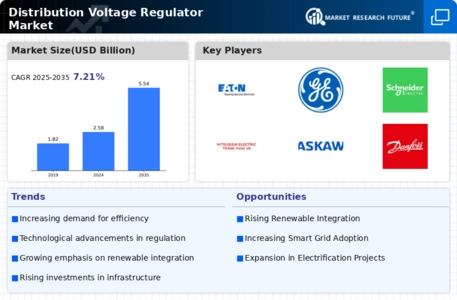

The Distribution Voltage Regulator Market is experiencing a surge in demand for reliable power supply solutions. As urbanization and industrialization continue to expand, the need for stable voltage levels becomes paramount. Fluctuations in voltage can lead to equipment damage and operational inefficiencies, prompting utilities and industries to invest in voltage regulation technologies. According to recent data, the market for distribution voltage regulators is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is driven by the increasing reliance on electronic devices and the necessity for uninterrupted power supply, which underscores the critical role of distribution voltage regulators in maintaining system integrity.

Rising Adoption of Renewable Energy Sources

The rising adoption of renewable energy sources is significantly influencing the Distribution Voltage Regulator Market. As more countries commit to reducing carbon emissions, the integration of solar, wind, and other renewable energy sources into the grid is becoming increasingly common. However, these sources often produce variable power output, necessitating effective voltage regulation to ensure grid stability. The market is projected to see a substantial increase in demand for distribution voltage regulators that can accommodate the fluctuations associated with renewable energy. It is estimated that by 2027, the share of renewable energy in the global energy mix will reach 30%, further driving the need for advanced voltage regulation solutions.

Technological Innovations in Voltage Regulation

Technological innovations in voltage regulation are propelling the Distribution Voltage Regulator Market forward. Advances in materials science, control algorithms, and digital technologies are leading to the development of more efficient and reliable voltage regulators. These innovations not only enhance performance but also reduce operational costs for utilities. The introduction of digital voltage regulators, which offer improved monitoring and control capabilities, is expected to capture a significant market share in the coming years. Market forecasts suggest that the segment of digital voltage regulators could grow by over 25% by 2028, reflecting the industry's shift towards more sophisticated and responsive voltage management solutions.