Increased Regulatory Requirements

The Document Verification Market is significantly influenced by the tightening of regulatory requirements across multiple sectors. Governments and regulatory bodies are implementing stringent measures to combat fraud and ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations. For instance, financial institutions are mandated to verify customer identities rigorously, leading to a heightened demand for document verification solutions. The global regulatory landscape is evolving, with an increasing number of jurisdictions adopting similar standards, thereby creating a uniform need for effective verification processes. This trend is expected to drive the Document Verification Market forward, as organizations invest in technologies that facilitate compliance and reduce the risk of penalties associated with non-compliance.

Growing Awareness of Cybersecurity Threats

The Document Verification Market is increasingly shaped by the growing awareness of cybersecurity threats. As data breaches and identity theft incidents become more prevalent, organizations are recognizing the critical importance of securing sensitive information. This heightened awareness is prompting businesses to invest in comprehensive document verification solutions that not only authenticate identities but also protect against potential cyber threats. The market for cybersecurity solutions is expected to reach USD 300 billion by 2025, indicating a strong correlation with the demand for document verification technologies. Consequently, the Document Verification Market is likely to benefit from this trend, as organizations prioritize the implementation of robust verification processes to safeguard their operations and customer data.

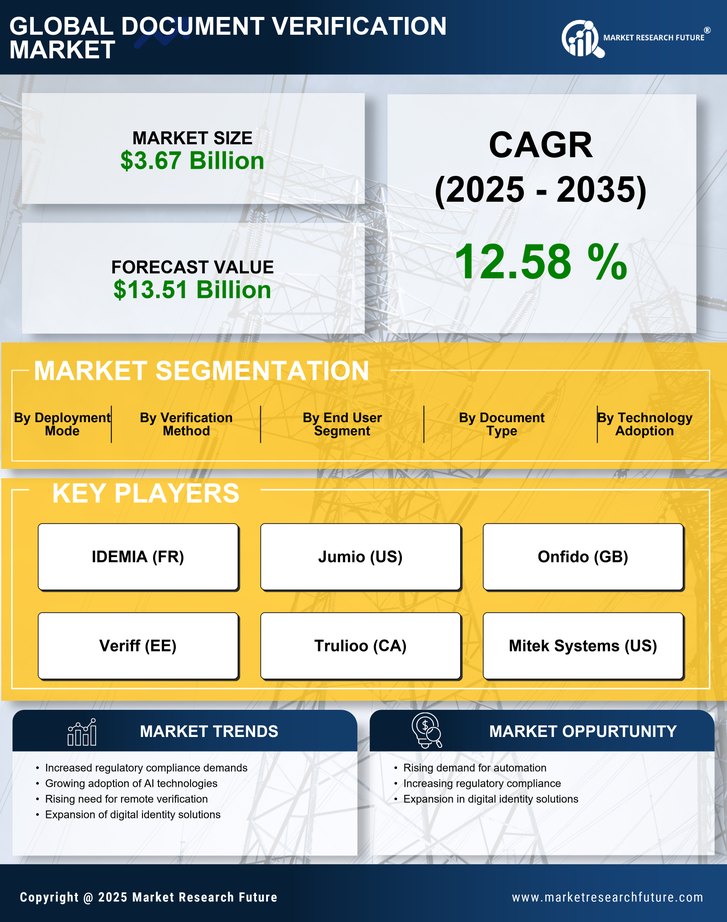

Rising Demand for Digital Identity Verification

The Document Verification Market is experiencing a notable surge in demand for digital identity verification solutions. As organizations increasingly transition to online platforms, the necessity for robust identity verification processes has become paramount. According to recent estimates, the market for digital identity verification is projected to reach USD 15 billion by 2026, reflecting a compound annual growth rate of approximately 15%. This growth is driven by the need to mitigate identity fraud and enhance customer trust. Businesses across various sectors, including finance, healthcare, and e-commerce, are adopting advanced document verification technologies to ensure compliance with regulatory standards and to protect sensitive information. Consequently, the Document Verification Market is poised for substantial expansion as organizations prioritize secure and efficient identity verification methods.

Shift Towards Remote Work and Digital Transactions

The Document Verification Market is experiencing a paradigm shift due to the increasing prevalence of remote work and digital transactions. As more businesses adopt flexible work arrangements, the need for secure and efficient document verification processes has become critical. Remote onboarding and digital transactions necessitate reliable identity verification to prevent fraud and ensure compliance with regulatory standards. Market Research Future indicates that the remote work trend is expected to persist, with over 30% of the workforce projected to work remotely by 2026. This shift is driving organizations to seek innovative document verification solutions that can accommodate the demands of a digital-first environment. As a result, the Document Verification Market is likely to see sustained growth as businesses adapt to these evolving operational landscapes.

Technological Advancements in Verification Solutions

The Document Verification Market is witnessing rapid technological advancements that enhance the efficiency and accuracy of verification processes. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into document verification systems, enabling real-time analysis and improved fraud detection capabilities. These technologies allow for the automation of verification tasks, significantly reducing processing times and operational costs. As organizations seek to streamline their verification processes, the adoption of these advanced solutions is likely to increase. Market analysts project that the integration of AI and ML in document verification could lead to a 30% reduction in verification times, thereby driving growth in the Document Verification Market as businesses strive for operational efficiency.