Dough Conditioners Size

Dough Conditioners Market Growth Projections and Opportunities

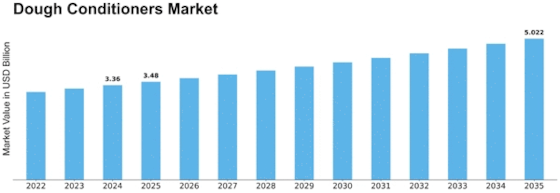

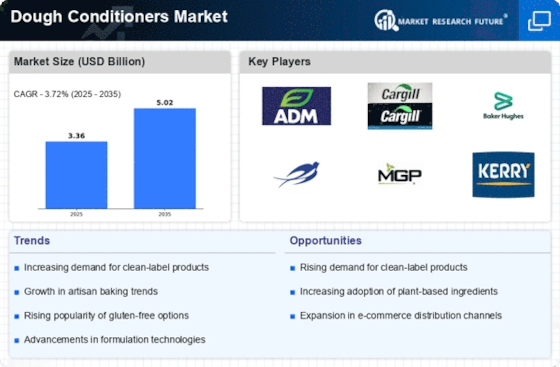

Dough conditioners market forecast for the period between 2022 and 2030 indicates a growth CAGR of 5.11%, with a value of $5.50 billion by the end of this period. The dough conditioners market is influenced by various factors that aid in its growth and adaptation process. One of the key drivers is increasing demand for processed and convenience food products, which is evident through the current preference of busy consumer lifestyles for easy-to-prepare and ready-to-serve foodstuffs. Dough conditioners are vital components during their production processes as they enhance dough quality, texture improvements, and shelf life maintenance. Hence, there is rising demand from these segments to produce a broad range of bakery items as well as processed food products.

Consumer's preferences towards healthy and cleaner labeling are also shaping the dough Conditioners market today. Also, people’s knowledge about nutrition has increased therefore causing them to turn to natural ingredients in their meals. Becoming popular are dough conditions made with basic elements such as enzymes or Vitamin C. Dieters prefer it too because it helps maintain weight without reducing nutritional values.

The continual innovation together with product development taking place within the baking industry significantly affects how the dough conditioners market operates. The manufacturers of breads and other processed foods have tried very much to be unique in terms of tastes, flavors or even forms (shapes). Dough conditioners provide an excellent platform that encompasses versatility directing to creation numerous improved quality baked goods at once.In addition, such constant innovation keeps pace with changing customers’ preferences leading to high demand for dough conditions.

In addition, global trends concerning sustainable practices have an impact on market factors.As consumers become more aware about their environment they need products that are in harmony with them.Dough conditioner producers have formulated formulations whose driving force is not only improving dough properties but also supporting ecology.Those include using organic ingredients that came from responsible sources ad well as recyclable packing materials.

The dough conditioners market is being affected by the rise in gluten-free and allergen-friendly products. With more customers looking for non-wheat based options, these dough conditioners are crucial since they cater for both gluten-free and allergen-free production requirements. Manufactures have however developed different conditioners that suit consumers with nutritional demands or intolerances.

Moreover, the retail landscape and distribution channels contribute to the dynamics of the dough conditioners market. The presence and visibility of dough conditioners in supermarkets, specialty stores as well as online platforms affects consumer accessibility too. Collaborative supply agreements with large distributors as well as efficient marketing strategies play a part in ensuring widespread availability of dough conditioner to meet up customer demand.

Leave a Comment