Increasing Demand for Energy Resources

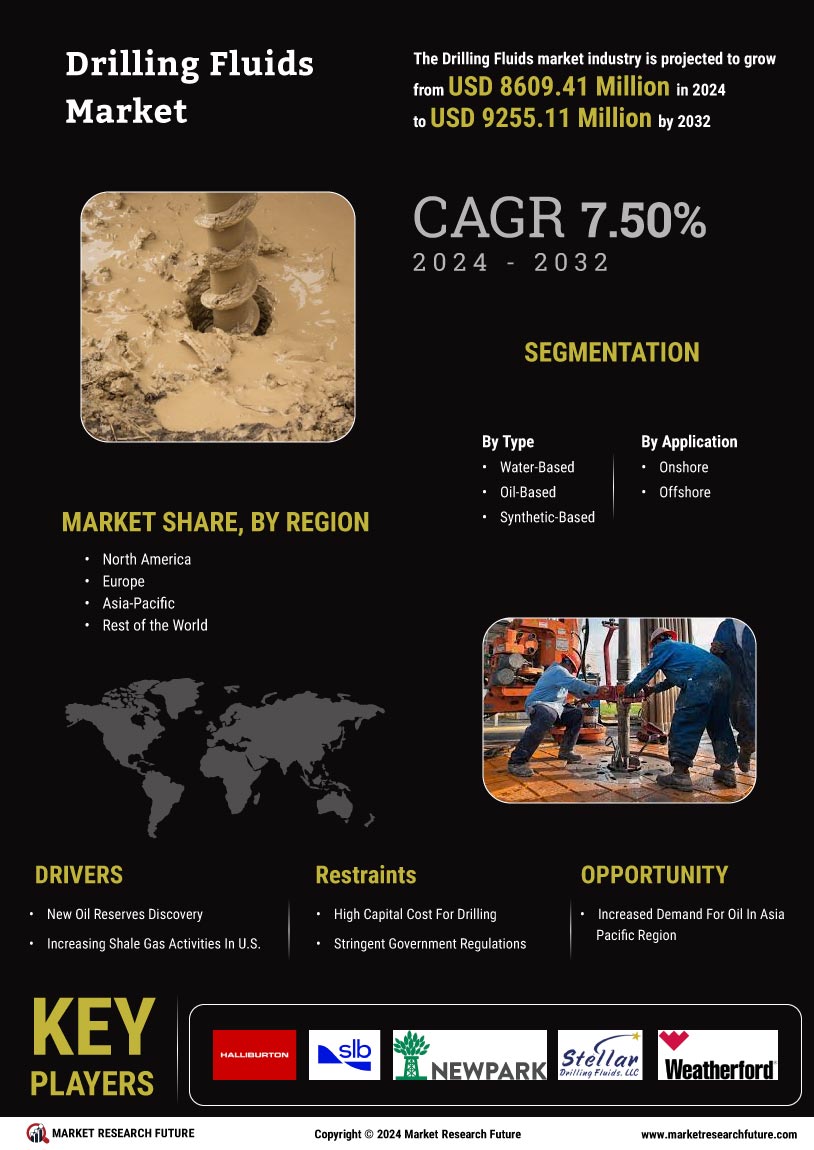

The Drilling Fluids Market experiences heightened demand driven by the need for energy resources. As countries strive to meet their energy requirements, the exploration and production of oil and gas become paramount. This demand is projected to propel the market to a valuation of 10.2 USD Billion in 2024. The continuous search for new reserves, particularly in offshore drilling, necessitates advanced drilling fluids that enhance efficiency and safety. Consequently, the industry is likely to witness innovations in fluid formulations to cater to these evolving needs, thereby fostering growth in the sector.

Growing Demand for Water-Based Drilling Fluids

The Global Drilling Fluids Market is experiencing a notable shift towards water-based drilling fluids due to their environmental advantages. Water-based fluids are increasingly preferred over oil-based alternatives, as they are less harmful to the environment and easier to manage. This trend is particularly evident in regions with stringent environmental regulations. The growing acceptance of water-based fluids is likely to drive market growth, as they offer effective solutions for various drilling applications. Companies are focusing on enhancing the performance of these fluids to meet the diverse needs of the industry, thereby contributing to the overall expansion of the market.

Regulatory Compliance and Environmental Concerns

The Drilling Fluids Industry is significantly influenced by regulatory compliance and growing environmental concerns. Governments worldwide are implementing stricter regulations regarding drilling practices and fluid disposal to mitigate environmental impacts. This trend compels companies to adopt sustainable practices and invest in environmentally friendly drilling fluids. As a result, the market is likely to evolve, with an increasing focus on biodegradable and non-toxic fluid formulations. This shift not only aligns with regulatory requirements but also caters to the rising consumer demand for sustainable energy solutions, thereby driving market growth.

Rising Exploration Activities in Emerging Markets

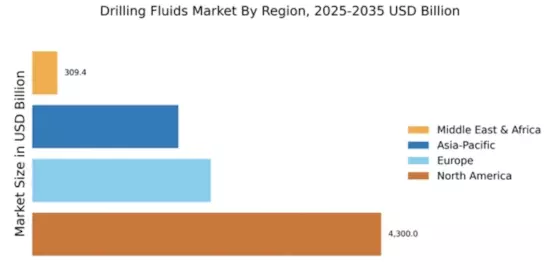

Emerging markets are witnessing a surge in exploration activities, which is a key driver for the Drilling Fluids Industry. Countries in regions such as Africa and South America are increasingly investing in oil and gas exploration to boost their economies. This trend is expected to contribute to the market's growth, with projections indicating a rise to 15 USD Billion by 2035. The influx of investments in these regions necessitates the use of advanced drilling fluids that can optimize drilling performance and reduce costs, thereby creating opportunities for industry players to expand their operations.

Technological Advancements in Drilling Techniques

Technological innovations play a crucial role in shaping the Drilling Fluids Market. The introduction of advanced drilling techniques, such as horizontal drilling and hydraulic fracturing, requires specialized drilling fluids that can withstand extreme conditions. These advancements not only improve extraction rates but also minimize environmental impacts. As a result, the market is expected to grow steadily, with a projected CAGR of 3.61% from 2025 to 2035. Companies are increasingly investing in research and development to create more efficient and eco-friendly drilling fluids, which is likely to enhance their competitive edge in the market.