Sustainability Initiatives

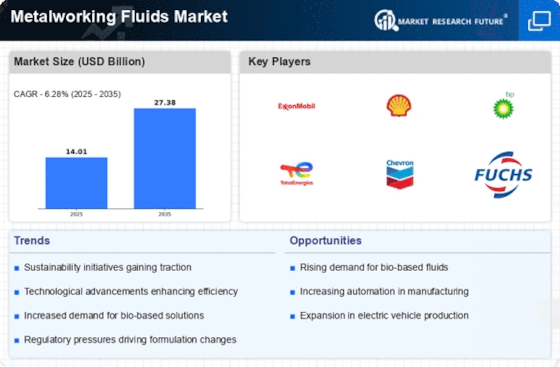

The Metalworking Fluids Market is increasingly influenced by sustainability initiatives. Manufacturers are under pressure to develop eco-friendly metalworking fluids that minimize environmental impact. This shift is driven by regulatory requirements and consumer demand for greener products. As a result, companies are investing in research and development to create biodegradable and non-toxic formulations. The market for sustainable metalworking fluids is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend not only aligns with global environmental goals but also enhances brand reputation, making sustainability a key driver in the Metalworking Fluids Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Metalworking Fluids Market. Innovations in fluid formulations and application techniques are enhancing the performance and efficiency of metalworking fluids. For instance, the introduction of high-performance synthetic fluids has improved lubrication and cooling properties, leading to better machining outcomes. Additionally, automation in fluid application processes is reducing waste and optimizing usage. The market is witnessing a shift towards smart fluids that can adapt to varying machining conditions, potentially increasing productivity. As these technologies evolve, they are likely to drive growth in the Metalworking Fluids Market, with a projected increase in demand for advanced solutions.

Diversification of Applications

The diversification of applications for metalworking fluids is a significant driver in the Metalworking Fluids Market. These fluids are no longer limited to traditional machining processes; they are now utilized in various sectors, including automotive, aerospace, and electronics. The expansion into new applications is fueled by the need for precision and efficiency in manufacturing. For example, the aerospace sector requires specialized fluids that can withstand extreme conditions, thereby increasing the demand for tailored solutions. This diversification is expected to contribute to a market growth rate of approximately 4% annually, as industries seek versatile metalworking fluids that meet specific operational requirements.

Rising Demand from Automotive Sector

The automotive sector is a major contributor to the Metalworking Fluids Market, driving demand for high-quality metalworking fluids. As automotive manufacturing becomes more complex, the need for efficient machining processes increases. Metalworking fluids are essential for ensuring precision and quality in the production of automotive components. The market is witnessing a surge in demand for fluids that enhance tool life and reduce production costs. With the automotive industry projected to grow steadily, the Metalworking Fluids Market is likely to benefit from this trend, with estimates indicating a potential increase in market size by several billion dollars over the next few years.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Metalworking Fluids Market. Governments and industry bodies are implementing stringent regulations regarding the use of hazardous substances in metalworking fluids. This has prompted manufacturers to reformulate their products to meet safety and environmental standards. Compliance not only ensures legal operation but also enhances market competitiveness. Companies that prioritize safety and adhere to regulations are likely to gain a competitive edge. The ongoing evolution of safety standards is expected to shape product development in the Metalworking Fluids Market, leading to increased investment in safer, more effective formulations.