Emerging Markets and Industrialization

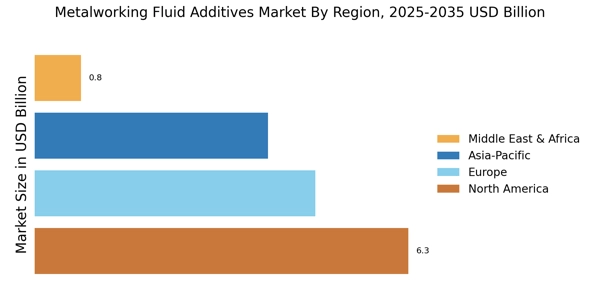

The Metalworking Fluid Additives Market is poised for growth due to the industrialization of emerging markets. Countries experiencing rapid industrial growth are increasingly investing in manufacturing capabilities, which in turn drives the demand for metalworking fluids and their additives. As these markets develop, there is a growing need for high-quality metalworking fluid additives that can support advanced manufacturing processes. The expansion of manufacturing facilities in regions such as Asia-Pacific is expected to contribute significantly to market growth, with projections indicating a potential increase in demand for metalworking fluid additives by 7% annually in these areas. This trend underscores the importance of adapting to the needs of emerging markets to capitalize on new opportunities in the metalworking fluid additives sector.

Growth in Automotive and Aerospace Sectors

The Metalworking Fluid Additives Market is significantly influenced by the growth of the automotive and aerospace sectors. These industries require high-performance metalworking fluids to meet stringent manufacturing standards and enhance product quality. The automotive sector alone is expected to witness a compound annual growth rate of 4.5% through 2025, which directly correlates with the demand for specialized additives. Aerospace manufacturing, known for its precision requirements, also relies heavily on advanced metalworking fluid additives to ensure optimal performance and safety. As these sectors expand, the need for effective metalworking fluid additives that can withstand extreme conditions and provide superior performance is anticipated to rise, further propelling market growth.

Increasing Focus on Worker Safety and Health

The Metalworking Fluid Additives Market is increasingly shaped by a heightened focus on worker safety and health. As regulations surrounding workplace safety become more stringent, manufacturers are compelled to adopt metalworking fluid additives that minimize health risks associated with exposure to hazardous substances. The introduction of safer, non-toxic additives is becoming a priority, as companies aim to comply with regulations while ensuring a safe working environment. This trend is likely to drive the demand for innovative formulations that not only enhance performance but also prioritize worker safety. Consequently, the market for metalworking fluid additives is expected to expand as companies seek to balance operational efficiency with health and safety considerations.

Rising Demand for Efficient Metalworking Processes

The Metalworking Fluid Additives Market is experiencing a surge in demand driven by the need for more efficient metalworking processes. Industries are increasingly seeking additives that enhance the performance of metalworking fluids, thereby improving machining efficiency and reducing operational costs. According to recent data, the market for metalworking fluids is projected to reach USD 12 billion by 2026, with additives playing a crucial role in this growth. The integration of advanced additives can lead to better lubrication, cooling, and corrosion protection, which are essential for high-speed machining operations. As manufacturers strive for higher productivity and lower waste, the demand for innovative metalworking fluid additives is likely to continue its upward trajectory.

Technological Innovations in Additive Formulations

The Metalworking Fluid Additives Market is benefiting from ongoing technological innovations in additive formulations. Manufacturers are increasingly investing in research and development to create new additives that offer enhanced performance characteristics, such as improved thermal stability and reduced toxicity. Recent advancements have led to the introduction of bio-based additives, which are gaining traction due to their environmental benefits. The market for bio-based metalworking fluids is projected to grow at a rate of 6% annually, reflecting a shift towards sustainable practices. These innovations not only improve the efficiency of metalworking processes but also align with the industry's growing emphasis on sustainability, thereby driving the demand for advanced metalworking fluid additives.