Sustainability Initiatives

Sustainability is becoming a central theme in the Metalworking Equipment Market, as companies seek to reduce their environmental impact. The push for greener manufacturing processes is prompting investments in energy-efficient machinery and waste reduction technologies. In 2025, the market for sustainable metalworking equipment is projected to reach 30 billion USD, driven by regulatory pressures and consumer demand for eco-friendly products. Manufacturers are increasingly adopting practices such as recycling scrap metal and utilizing renewable energy sources in their operations. This focus on sustainability not only enhances corporate responsibility but also opens new avenues for growth within the Metalworking Equipment Market, as companies strive to align with global sustainability goals.

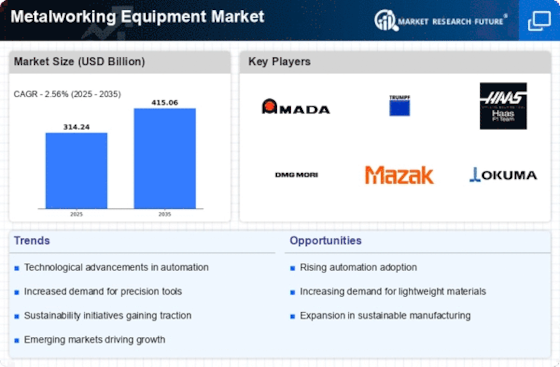

Technological Advancements

The Metalworking Equipment Market is experiencing a surge in technological advancements, which are reshaping production processes. Innovations such as computer numerical control (CNC) machines and robotics are enhancing precision and efficiency. In 2025, the market for CNC machines is projected to reach approximately 100 billion USD, indicating a robust growth trajectory. These advancements not only improve productivity but also reduce operational costs, making them attractive to manufacturers. Furthermore, the integration of artificial intelligence in metalworking equipment is expected to optimize maintenance schedules and reduce downtime. As companies increasingly adopt these technologies, the Metalworking Equipment Market is likely to witness a significant transformation, driving demand for advanced machinery.

Increased Focus on Customization

Customization has become a key trend within the Metalworking Equipment Market, as manufacturers strive to meet specific client needs. The demand for tailored solutions is rising, particularly in industries such as aerospace and medical devices, where precision is paramount. In 2025, the market for customized metalworking equipment is expected to grow by approximately 15%, reflecting the industry's shift towards bespoke manufacturing. This trend is driven by advancements in additive manufacturing and CNC technology, which allow for greater flexibility in production. As companies increasingly prioritize customization, the Metalworking Equipment Market is likely to adapt, leading to the development of innovative equipment designed to cater to diverse customer requirements.

Rising Demand from Automotive Sector

The automotive sector plays a pivotal role in the Metalworking Equipment Market, as it requires high-precision components and parts. With the ongoing shift towards electric vehicles, the demand for metalworking equipment is anticipated to increase. In 2025, the automotive industry is projected to invest over 50 billion USD in metalworking technologies to enhance production capabilities. This investment is driven by the need for lightweight materials and complex geometries that modern vehicles demand. Consequently, manufacturers are likely to seek advanced metalworking solutions to meet these evolving requirements. The growth in the automotive sector is expected to significantly bolster the Metalworking Equipment Market, creating new opportunities for equipment suppliers.

Expansion of Manufacturing Capabilities

The expansion of manufacturing capabilities is a significant driver in the Metalworking Equipment Market, as companies seek to enhance their production capacity. With the rise of Industry 4.0, manufacturers are investing in smart factories equipped with advanced metalworking technologies. In 2025, the market for smart manufacturing solutions is expected to exceed 40 billion USD, reflecting the industry's transition towards automation and connectivity. This expansion allows for greater efficiency, reduced lead times, and improved product quality. As manufacturers embrace these capabilities, the Metalworking Equipment Market is likely to experience robust growth, driven by the need for more sophisticated and efficient production processes.

.png)