Japan Metalworking Fluids Market Summary

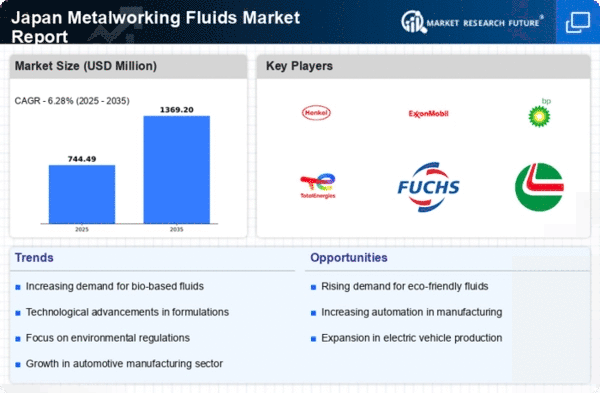

As per Market Research Future analysis, the Japan Metalworking Fluids Market Size was estimated at 700.5 USD Million in 2024. The Japan metalworking fluids market is projected to grow from 744.49 USD Million in 2025 to 1369.2 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Japan metalworking fluids market is experiencing a transformative shift towards sustainability and technological integration.

- The market is witnessing a notable shift towards eco-friendly formulations, driven by rising environmental regulations.

- Integration of smart manufacturing technologies is becoming increasingly prevalent, enhancing operational efficiency.

- The aerospace sector emerges as the largest segment, while the automotive sector is recognized as the fastest-growing segment in the market.

- Technological advancements in metalworking processes and an increased focus on product quality and performance are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 700.5 (USD Million) |

| 2035 Market Size | 1369.2 (USD Million) |

| CAGR (2025 - 2035) | 6.28% |

Major Players

Henkel (DE), ExxonMobil (US), BP (GB), TotalEnergies (FR), Fuchs Petrolub (DE), Castrol (GB), Quaker Chemical (US), Houghton International (US), Milacron (US)