Top Industry Leaders in the Metalworking Fluids Market

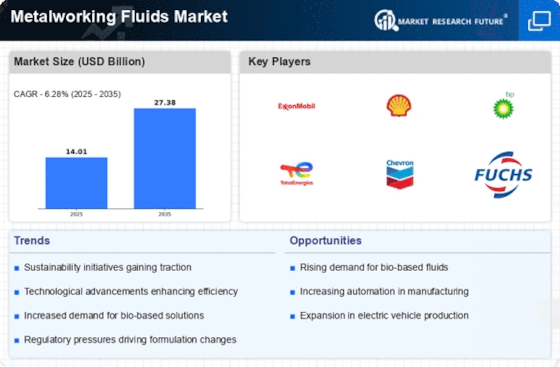

The metalworking fluids market, valued at over $13.16 billion in 2023, is a complex and dynamic arena where players vie for market share through diverse strategies and cater to a wide range of customer needs. This comprehensive report delves into the competitive landscape, exploring key strategies, market share determinants, industry news, and recent developments.

The metalworking fluids market, valued at over $13.16 billion in 2023, is a complex and dynamic arena where players vie for market share through diverse strategies and cater to a wide range of customer needs. This comprehensive report delves into the competitive landscape, exploring key strategies, market share determinants, industry news, and recent developments.

Market Share Determinants: A Balancing Act

Several factors contribute to a metalworking fluids company's market share:

-

Product Portfolio and Innovation: Offering a diverse range of fluids for various applications, along with continuous innovation in areas like biodegradability and performance, attracts customers and establishes brand leadership. -

Geographical Presence and Distribution Network: Strong global presence with efficient distribution channels ensures timely product delivery and customer satisfaction, especially in geographically dispersed industries. -

Pricing and Customer Service: Competitive pricing models and excellent customer service, including technical support and fluid management expertise, build trust and loyalty. -

Sustainability Initiatives: Embracing sustainable practices like eco-friendly fluids, recycling programs, and responsible waste disposal resonates with environmentally conscious customers and investors. -

Brand Reputation and Marketing: A strong brand reputation built through quality, reliability, and effective marketing campaigns attracts new customers and fosters brand loyalty.

Strategies Adopted by Market Players:

-

Mergers and Acquisitions: Companies like ExxonMobil and Castrol have employed mergers and acquisitions to expand their product portfolios and geographical reach. -

Partnerships and Collaborations: Collaborations with academia and research institutes foster innovation and development of next-generation fluids. -

Focus on Specific Applications and Industries: Catering to niche applications like aerospace or heavy machining with specialized fluids can create a competitive edge. -

Digitalization and Automation: Implementing AI-powered fluid management systems and online platforms for customer support improves efficiency and customer experience. -

Sustainability-Focused Initiatives: Investing in developing biodegradable fluids and implementing recycling programs attracts eco-conscious customers and aligns with environmental regulations.

Key Companies in the Metalworking Fluids market include

- Total

- Indian Oil Corporation Ltd

- Chevron Corporation

- Henkel AG & Co.

- Exxon Mobil Corporation

- HPCL

- Houghton International Inc

- BP

- Shell

- Croda International

Recent Developments:

-

July 2023: FUCHS Lubricants unveils a new generation of high-performance metalworking fluids with improved biodegradability and extended tool life. -

August 2023: ExxonMobil announces a partnership with a leading research institute to develop next-generation metalworking fluids using advanced nanotechnology. -

September 2023: Castrol launches its online fluid management platform, providing real-time data and insights to optimize fluid usage and reduce costs. -

October 2023: The European Union proposes stricter regulations on the use of mineral oils in metalworking fluids, pushing companies towards synthetic and biodegradable alternatives. -

November 2023: Chevron partners with a major recycling company to establish a nationwide program for collecting and reprocessing used metalworking fluids. -

December 2023: The International Metalworking Fluids Institute releases a new industry standard for the classification and labeling of biodegradable fluids.