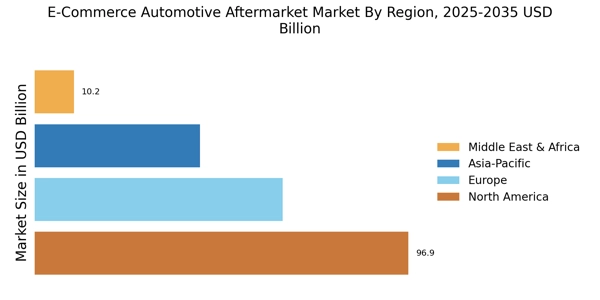

Based on Region, the global E-Commerce Automotive Aftermarket is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia-Pacific dominated the global market in 2024, while the Asia-Pacific is projected to be the fastest–growing segment during the forecast period.

The demand for the e-commerce automotive aftermarket market in North America is increasing due to several factors, including the growing adoption of online shopping across various sectors, where consumers are preferring the convenience of purchasing automotive parts and accessories from the comfort of their homes. Additionally, the increasing prevalence of DIY culture in vehicle maintenance and repair is driving demand.

In Europe, the demand for the e-commerce automotive aftermarket market is increasing due to the rapid digital transformation across various industries, including automotive, which has made online shopping the preferred method for purchasing aftermarket parts and accessories. Also, the growth of the vehicle industry and the increasing average age of vehicles in the region is further positively impacting the market of e-commerce automotive aftermarket.

The rapid growth in vehicle ownership across emerging economies such as China and India are a significant driver propelling the market growth of e-commerce automotive aftermarket in the region. Also, the rise in disposable income and the expanding middle class in the region has led to greater spending power, with consumers significantly using online platforms to purchase automotive components for cost-effectiveness and convenience.

With the rapidly growing automotive market in the region, there is a rising need for after-sale parts and accessories. Various nations in the region are witnessing a surge in car sales, driving the demand for replacement parts and vehicle servicing products. With the digital transformation and increasing trust in online shopping, more consumers are preferring purchasing automotive aftermarket parts through online platforms.

The demand for e-commerce automotive aftermarket market in South America is increasing due to a combination of economic and technological factors. The growing vehicle fleet in the region is driving the need for automotive replacement parts, accessories, and maintenance products.

FIGURE 3: GLOBAL E-COMMERCE AUTOMOTIVE AFTERMARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Further, the countries considered in the scope of the E-Commerce Automotive Aftermarket Market are the US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others.