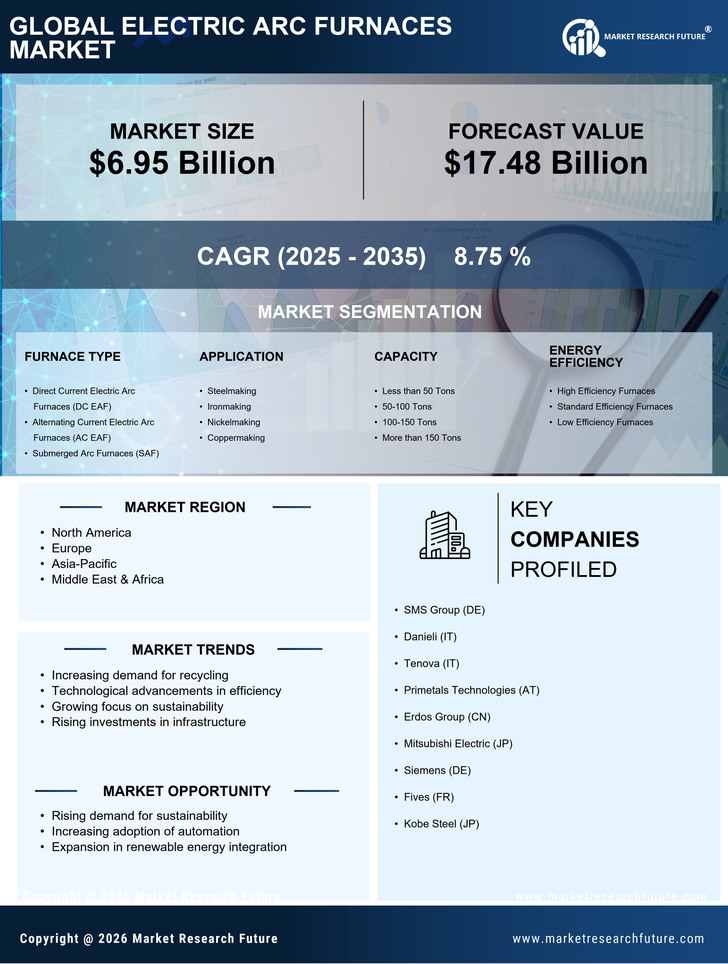

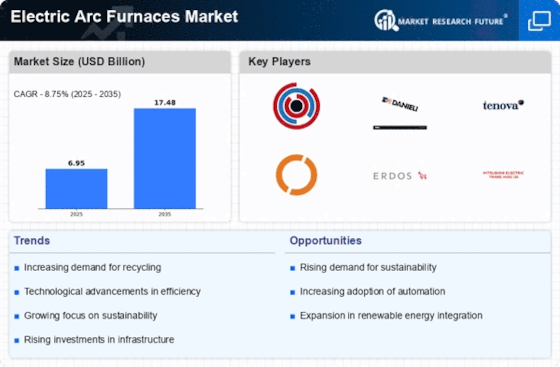

Rising Steel Demand

The Electric Arc Furnaces Market is experiencing a surge in demand for steel, driven by various sectors such as construction, automotive, and infrastructure. As urbanization accelerates, the need for steel products is projected to increase significantly. In 2025, the demand for steel is expected to reach approximately 1.8 billion tons, which could lead to a corresponding rise in the utilization of electric arc furnaces. These furnaces are favored for their efficiency and lower carbon emissions compared to traditional methods, making them a preferred choice for steel manufacturers aiming to meet the growing demand while adhering to environmental regulations. This trend suggests that the Electric Arc Furnaces Market will continue to expand as steel production ramps up.

Technological Innovations

Technological innovations play a crucial role in shaping the Electric Arc Furnaces Market. Recent advancements in automation, artificial intelligence, and data analytics are enhancing the operational efficiency of electric arc furnaces. These technologies enable real-time monitoring and optimization of the melting process, leading to improved product quality and reduced operational costs. As manufacturers increasingly adopt these innovations, the Electric Arc Furnaces Market is likely to witness a transformation in production capabilities. The integration of smart technologies not only streamlines operations but also aligns with the industry's shift towards more sustainable practices, thereby fostering growth in the market.

Energy Efficiency Improvements

Energy efficiency remains a pivotal driver in the Electric Arc Furnaces Market. Electric arc furnaces are known for their ability to recycle scrap steel, which not only conserves raw materials but also reduces energy consumption. Recent advancements indicate that these furnaces can achieve energy savings of up to 50% compared to traditional blast furnaces. As energy costs rise and sustainability becomes a priority, manufacturers are increasingly investing in electric arc furnace technology. This shift is likely to enhance the overall efficiency of steel production, thereby propelling the Electric Arc Furnaces Market forward. The emphasis on energy-efficient solutions aligns with global efforts to reduce carbon footprints and promote sustainable industrial practices.

Increased Scrap Steel Availability

The availability of scrap steel is a valve driver for the Electric Arc Furnaces Market. With the rising emphasis on recycling and circular economy principles, the supply of scrap steel is expected to increase. In 2025, The Electric Arc Furnaces Market is projected to reach approximately 500 million tons, providing a substantial feedstock for electric arc furnaces. This trend is advantageous for manufacturers, as electric arc furnaces primarily utilize scrap steel, making them more cost-effective and environmentally friendly. The anticipated growth in scrap steel availability is likely to bolster the Electric Arc Furnaces Market, as it aligns with the industry's focus on sustainability and resource efficiency.

Government Regulations and Incentives

The Electric Arc Furnaces Market is significantly influenced by government regulations aimed at reducing carbon emissions and promoting sustainable practices. Many countries are implementing stricter environmental policies that encourage the adoption of cleaner technologies in steel production. For instance, incentives for using electric arc furnaces, which emit fewer greenhouse gases compared to traditional methods, are becoming more common. This regulatory landscape is likely to drive investments in electric arc furnace technology, as manufacturers seek to comply with these regulations while maintaining competitiveness. The anticipated growth in the Electric Arc Furnaces Market is thus closely tied to the evolving regulatory framework that favors environmentally friendly production methods.