Market Share

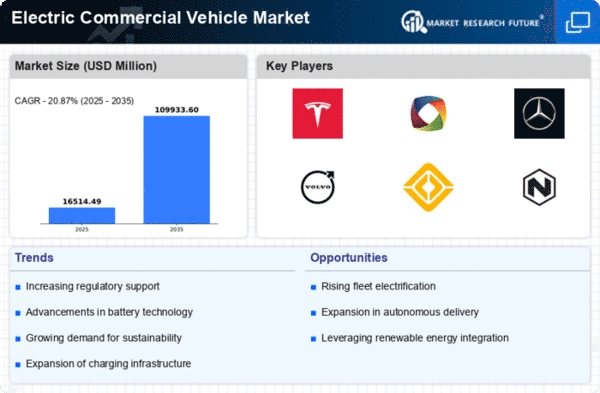

Electric Commercial Vehicle Market Share Analysis

During the lively market share positioning strategies play an important role in success for companies while competing to a victory struggle. A common strategy is referred to as differentiation, where firms aim at offering unique characteristics and capabilities of their products so that they may stand out from competition. With the use of advanced technologies e.g., state-of-the art battery systems, autonomously drive technology and progressive design etc companies try to establish themselves in a market niche. This also not only attracts environmentally aware customers but demonstrates the brand as a trendsetter in technological innovation. One of the most effective strategies that can be pursued is cost leadership in which firms desire to provide low-cost products compared with all other competitors. Economies of scale achieved through efficient manufacturing processes, strategic partnerships and supply chain management allows for competitive prices without sacrificing quality. The cost leadership strategies, however not only draw in price sensitive customer but also establish barriers for new entrants intending to compete by matching the efficiency costs. The practice of collaboration and partnership is fast emerging as the trend in this market, acting like a strategic pathway to grow one’s share. Those complementary strength and resources can be taken for granted when making alliances among companies in the same industry. Joint ventures, strategic partnerships and research collaborations contribute to acceleration innovation processes; they reduce costs of production while increasing general competitiveness. This collaborative arrangement enables the companies to have majority market share since their base is bigger due widening of expertise and customer base. In addition, market share positioning can be improved by customer segmentation. Recognition of the unique needs and wants of various customer segments enables companies to make their products as well as their marketing efforts more specific. For instance, some clients can focus on the long-range abilities while others may value load carrying capacity or charging systems. Firms address unique customer needs of distinct market groups by offering products or services tailored to segmented markets which enable companies gain some significant amount from the target group. Environmental consciousness is one of the leading factors in electric commercial vehicle market; firms that lead on ecological initiatives become preferred among green customers. The green aspect of electric vehicles and its positive impact on the reduction of carbon emissions, a strong brand image can be created. This not only brings environmentally friendly customers but also helps establish a favourable market position regarding sustainability, which becomes increasingly important on the global scale.

Leave a Comment