Government Incentives and Policies

Government initiatives aimed at promoting electric vehicle adoption are significantly influencing the Electric Vehicle Battery Anode Market. Various countries have introduced subsidies, tax breaks, and incentives to encourage consumers to purchase electric vehicles. For instance, in 2025, several nations are expected to enhance their support for EV infrastructure, which includes charging stations and battery production facilities. Such policies not only stimulate demand for electric vehicles but also create a favorable environment for the growth of the Electric Vehicle Battery Anode Market. The alignment of governmental policies with industry goals fosters collaboration between stakeholders, thereby accelerating advancements in battery technology and anode materials.

Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency in transportation is driving the Electric Vehicle Battery Anode Market. As consumers become more environmentally conscious, the demand for energy-efficient vehicles is on the rise. This trend is reflected in the automotive sector's shift towards electric vehicles, which are perceived as a more sustainable alternative to traditional combustion engines. In 2025, the energy efficiency of electric vehicles is expected to improve, leading to a corresponding increase in the demand for advanced battery technologies, including high-performance anodes. The Electric Vehicle Battery Anode Market stands to benefit from this focus on energy efficiency, as manufacturers seek to develop anodes that enhance overall battery performance and longevity.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the Electric Vehicle Battery Anode Market. As governments and organizations worldwide implement stringent regulations to reduce carbon emissions, the adoption of EVs is expected to surge. In 2025, the market for electric vehicles is projected to reach approximately 30 million units, significantly boosting the demand for high-performance battery components, including anodes. This trend indicates a robust growth trajectory for the Electric Vehicle Battery Anode Market, as manufacturers strive to meet the evolving needs of EV technology. The shift towards electric mobility not only enhances energy efficiency but also necessitates advancements in battery technology, thereby creating opportunities for innovation within the anode segment.

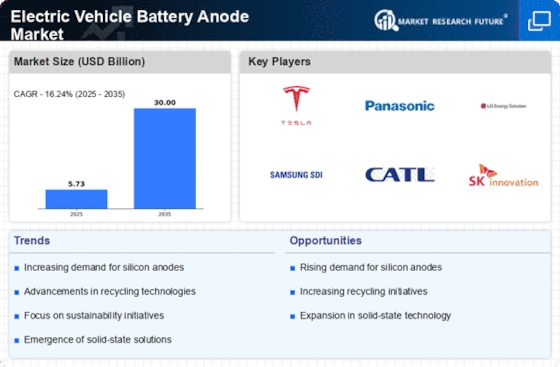

Emergence of Competitive Market Players

The Electric Vehicle Battery Anode Market is witnessing the emergence of numerous competitive players, which is driving innovation and reducing costs. As the market expands, new entrants are focusing on developing advanced anode materials and technologies, thereby intensifying competition. This influx of players is likely to lead to a diversification of product offerings, catering to various segments of the electric vehicle market. In 2025, the presence of both established companies and startups in the Electric Vehicle Battery Anode Market is expected to foster a dynamic environment that encourages research and development. This competitive landscape not only enhances the quality of anode materials but also contributes to the overall growth of the electric vehicle sector.

Technological Advancements in Battery Chemistry

Innovations in battery chemistry are propelling the Electric Vehicle Battery Anode Market forward. The development of new materials, such as silicon-based anodes, offers the potential for higher energy densities and improved performance compared to traditional graphite anodes. Research indicates that silicon anodes can increase battery capacity by up to 300%, which is a substantial enhancement for electric vehicles. As manufacturers invest in R&D to optimize these technologies, the Electric Vehicle Battery Anode Market is likely to witness a shift towards more efficient and durable anode materials. This technological evolution not only addresses the limitations of current battery systems but also aligns with the growing demand for longer-range electric vehicles, thereby fostering market expansion.

Leave a Comment