Market Growth Projections

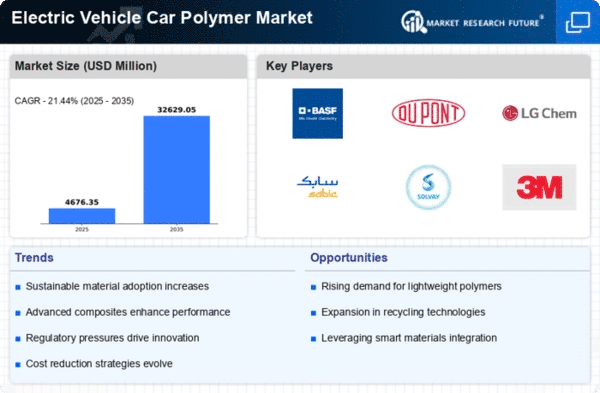

The Global Electric Vehicle Car Polymer Market Industry is projected to experience remarkable growth, with estimates indicating a rise from 3.85 USD Billion in 2024 to 32.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 21.44% from 2025 to 2035, reflecting the increasing integration of polymers in electric vehicle manufacturing. The market dynamics are influenced by various factors, including technological advancements, consumer preferences, and regulatory frameworks, all contributing to a favorable environment for polymer adoption in the electric vehicle sector.

Government Initiatives and Incentives

Government initiatives aimed at promoting electric vehicle adoption are pivotal in shaping the Global Electric Vehicle Car Polymer Market Industry. Various countries are implementing policies that encourage the use of electric vehicles, including subsidies, tax incentives, and infrastructure development. These measures are likely to stimulate demand for electric vehicles, consequently increasing the need for high-performance polymers. As governments worldwide commit to reducing carbon emissions, the market for electric vehicle polymers is expected to flourish, aligning with global sustainability goals.

Rising Demand for Lightweight Materials

The Global Electric Vehicle Car Polymer Market Industry experiences a surge in demand for lightweight materials, primarily driven by the need for enhanced energy efficiency in electric vehicles. Polymers, such as polycarbonate and polypropylene, offer significant weight reductions compared to traditional metals, thereby improving vehicle range and performance. As manufacturers strive to meet stringent emission regulations, the adoption of these materials is likely to increase. In 2024, the market is projected to reach 3.85 USD Billion, reflecting a growing recognition of the benefits of lightweight polymers in electric vehicle design.

Growing Consumer Awareness of Sustainability

The increasing consumer awareness regarding sustainability and environmental impact is significantly influencing the Global Electric Vehicle Car Polymer Market Industry. As consumers become more conscious of their carbon footprints, the demand for electric vehicles, which utilize eco-friendly polymers, is likely to rise. This shift in consumer behavior encourages manufacturers to prioritize sustainable materials in their production processes. Consequently, the market is poised for substantial growth, with a projected compound annual growth rate of 21.44% from 2025 to 2035, reflecting the alignment of consumer preferences with sustainable practices.

Technological Advancements in Polymer Production

Technological innovations in polymer production processes are transforming the Global Electric Vehicle Car Polymer Market Industry. Advanced manufacturing techniques, such as 3D printing and injection molding, enable the creation of complex polymer components with greater precision and efficiency. These advancements not only reduce production costs but also enhance the customization of electric vehicle parts. As a result, manufacturers are increasingly investing in these technologies to improve product offerings. The market is expected to grow significantly, with projections indicating a rise to 32.6 USD Billion by 2035, driven by these technological enhancements.

Expansion of Electric Vehicle Charging Infrastructure

The expansion of electric vehicle charging infrastructure is a critical driver for the Global Electric Vehicle Car Polymer Market Industry. As charging stations become more prevalent, the convenience of owning electric vehicles increases, thereby boosting their adoption. This growth in infrastructure necessitates the use of durable and weather-resistant polymers in the construction of charging stations and related components. The synergy between infrastructure development and electric vehicle adoption is expected to propel the market forward, creating a robust ecosystem that supports the growth of electric vehicle polymers.

Leave a Comment