Corporate Sustainability Initiatives

Many corporations are increasingly adopting sustainability initiatives, which are positively influencing the Electric Vehicle Charging Systems and Equipment Market. Companies are recognizing the importance of reducing their carbon footprint and are investing in electric vehicle fleets and charging infrastructure as part of their corporate social responsibility strategies. This trend is evident in various sectors, including logistics, public transportation, and corporate fleets, where businesses are transitioning to electric vehicles. The commitment to sustainability not only enhances corporate image but also aligns with consumer expectations for environmentally friendly practices. As more companies invest in electric vehicle charging systems, the market is likely to see accelerated growth, further solidifying the Electric Vehicle Charging Systems and Equipment Market's role in the transition to a low-carbon economy.

Government Incentives and Regulations

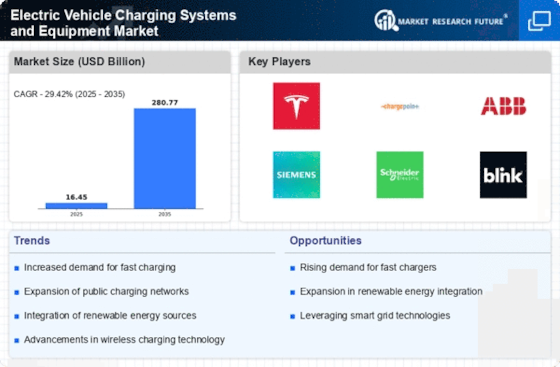

The Electric Vehicle Charging Systems and Equipment Market is experiencing a surge in demand due to various government incentives and regulations aimed at promoting electric vehicle adoption. Many countries have implemented tax credits, rebates, and grants for both consumers and businesses investing in electric vehicle charging infrastructure. For instance, the implementation of stricter emissions regulations has compelled automakers to increase their electric vehicle offerings, thereby necessitating a corresponding expansion in charging systems. As of 2025, it is estimated that government initiatives could account for a substantial portion of the market growth, potentially reaching a value of several billion dollars. This regulatory environment not only encourages investment in charging infrastructure but also fosters innovation within the Electric Vehicle Charging Systems and Equipment Market.

Rising Consumer Demand for Electric Vehicles

Consumer preferences are shifting towards electric vehicles, significantly impacting the Electric Vehicle Charging Systems and Equipment Market. As awareness of environmental issues grows, more consumers are opting for electric vehicles over traditional combustion engines. This trend is reflected in the increasing sales figures of electric vehicles, which have seen a compound annual growth rate of over 20% in recent years. The rising demand for electric vehicles necessitates a robust charging infrastructure, leading to an increase in the deployment of charging stations and related equipment. Consequently, the Electric Vehicle Charging Systems and Equipment Market is poised for substantial growth, as manufacturers and service providers strive to meet the evolving needs of consumers.

Increased Investment in Charging Infrastructure

Investment in charging infrastructure is a critical driver for the Electric Vehicle Charging Systems and Equipment Market. As electric vehicle adoption continues to rise, the need for a comprehensive and accessible charging network becomes increasingly apparent. Public and private sectors are recognizing this necessity, leading to significant investments in charging stations and related technologies. Reports indicate that investments in charging infrastructure could exceed several billion dollars in the coming years, as stakeholders aim to create a seamless charging experience for electric vehicle users. This influx of capital not only facilitates the expansion of charging networks but also encourages innovation within the Electric Vehicle Charging Systems and Equipment Market, ultimately supporting the broader transition to electric mobility.

Technological Advancements in Charging Solutions

The Electric Vehicle Charging Systems and Equipment Market is being propelled forward by rapid technological advancements in charging solutions. Innovations such as ultra-fast charging technology and wireless charging systems are enhancing the efficiency and convenience of electric vehicle charging. For example, ultra-fast chargers can deliver up to 350 kW of power, allowing electric vehicles to charge significantly faster than traditional chargers. This technological evolution not only improves user experience but also addresses range anxiety, a common concern among potential electric vehicle buyers. As these technologies become more prevalent, they are likely to attract more consumers to electric vehicles, thereby driving growth in the Electric Vehicle Charging Systems and Equipment Market.