Rising Demand for Electric Vehicles

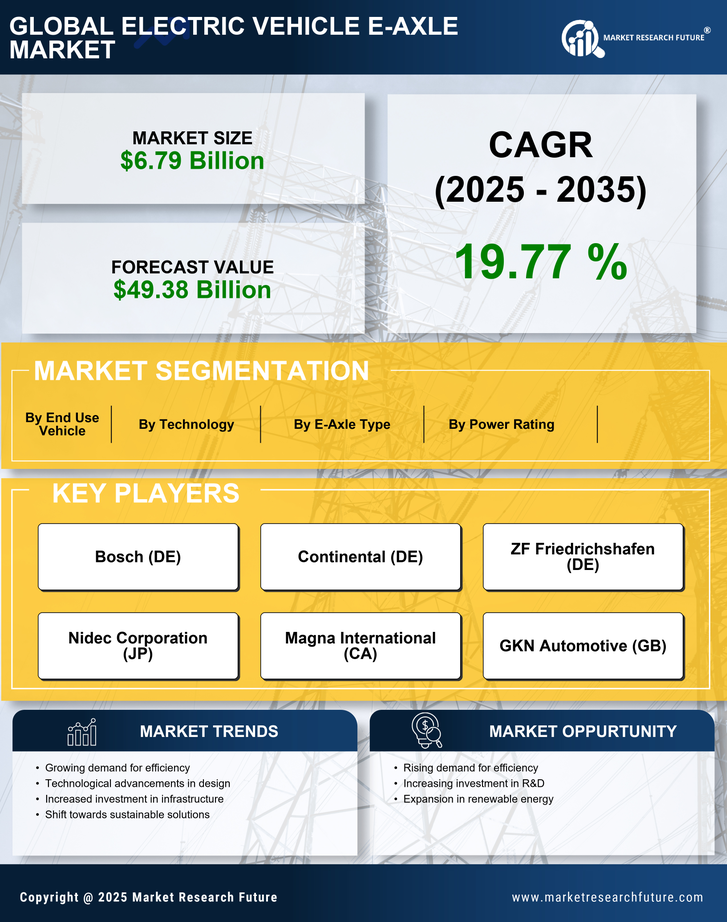

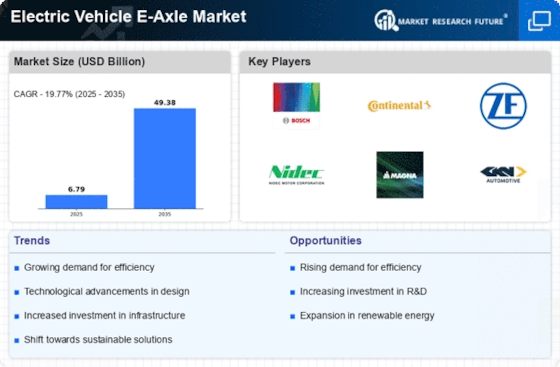

The increasing demand for electric vehicles (EVs) is a primary driver for the Electric Vehicle E-Axle Market. As consumers become more environmentally conscious, the shift towards sustainable transportation solutions accelerates. In 2025, it is estimated that the sales of electric vehicles will surpass 10 million units, indicating a robust growth trajectory. This surge in demand necessitates the development of efficient e-axles, which are crucial for enhancing vehicle performance and range. Consequently, manufacturers are investing heavily in innovative e-axle technologies to meet consumer expectations. The Electric Vehicle E-Axle Market is thus poised for significant expansion as automakers strive to align their offerings with the evolving preferences of eco-conscious consumers.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a crucial factor influencing the Electric Vehicle E-Axle Market. As more charging stations become available, consumer confidence in electric vehicles increases, leading to higher adoption rates. In 2025, it is anticipated that the number of public charging stations will double, facilitating easier access to charging for EV owners. This growth in infrastructure not only supports the existing electric vehicle market but also encourages manufacturers to invest in e-axle technologies that enhance charging efficiency. Consequently, the Electric Vehicle E-Axle Market is likely to thrive as the availability of charging solutions alleviates range anxiety among consumers, thereby promoting the widespread acceptance of electric vehicles.

Government Incentives and Regulations

Government incentives and stringent regulations aimed at reducing carbon emissions are pivotal in shaping the Electric Vehicle E-Axle Market. Many countries have implemented policies that promote the adoption of electric vehicles, including tax rebates, subsidies, and grants for EV manufacturers. For instance, in 2025, several regions are expected to enforce stricter emissions standards, compelling automakers to transition to electric drivetrains. This regulatory landscape not only fosters innovation in e-axle technologies but also enhances the overall market appeal of electric vehicles. As a result, the Electric Vehicle E-Axle Market is likely to experience accelerated growth, driven by supportive governmental frameworks that encourage sustainable transportation solutions.

Increased Investment in Electric Mobility

Increased investment in electric mobility is driving the growth of the Electric Vehicle E-Axle Market. Major automotive manufacturers and technology companies are channeling substantial resources into the development of electric drivetrains and associated technologies. In 2025, it is projected that investments in electric mobility will reach unprecedented levels, with billions allocated to research and development. This influx of capital not only accelerates innovation in e-axle design but also fosters collaborations between automakers and tech firms. As a result, the Electric Vehicle E-Axle Market is expected to benefit from enhanced product offerings and improved performance metrics, positioning it favorably in the competitive landscape of the automotive sector.

Technological Innovations in E-Axle Design

Technological innovations in e-axle design are transforming the Electric Vehicle E-Axle Market. Advances in materials science and engineering have led to the development of lighter, more efficient e-axles that improve vehicle performance. For example, the integration of advanced power electronics and software algorithms enhances energy management, thereby extending the range of electric vehicles. In 2025, it is projected that the market for high-performance e-axles will grow significantly, driven by the demand for improved efficiency and reduced weight. These innovations not only contribute to better vehicle dynamics but also align with the industry's goal of achieving higher energy efficiency. Thus, the Electric Vehicle E-Axle Market stands to benefit from ongoing research and development efforts aimed at optimizing e-axle performance.