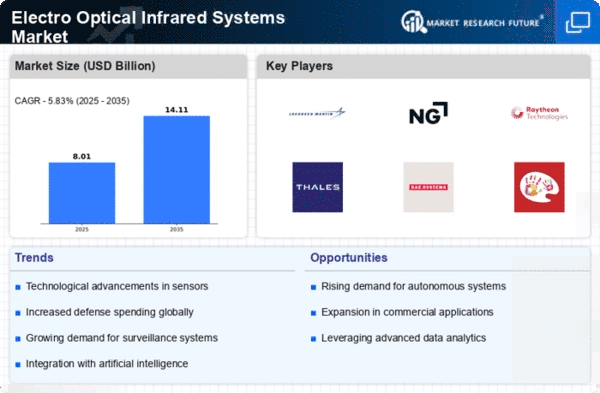

The Electro Optical Infrared Systems Market is characterized by a dynamic competitive landscape, driven by advancements in technology and increasing defense budgets across various nations. Key players such as Lockheed Martin (US), Northrop Grumman (US), and Raytheon Technologies (US) are at the forefront, focusing on innovation and strategic partnerships to enhance their market positions. These companies are not only investing heavily in research and development but are also pursuing mergers and acquisitions to consolidate their capabilities and expand their product offerings. This collective emphasis on technological advancement and strategic alignment shapes a competitive environment that is both robust and rapidly evolving.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a variety of competitive strategies, as companies seek to differentiate themselves through unique technological offerings and tailored solutions for specific customer needs.

In November 2025, Lockheed Martin (US) announced a partnership with a leading AI firm to integrate advanced machine learning algorithms into their electro-optical systems. This strategic move is likely to enhance the capabilities of their products, enabling real-time data analysis and improved decision-making for military applications. Such integration of AI is expected to set a new standard in operational efficiency and effectiveness in the field.

Similarly, in October 2025, Northrop Grumman (US) unveiled a new line of infrared sensors designed for unmanned aerial vehicles (UAVs). This launch is significant as it aligns with the growing demand for UAV technology in surveillance and reconnaissance missions. By focusing on this niche, Northrop Grumman is positioning itself to capture a larger share of the market, particularly in defense sectors that prioritize advanced aerial capabilities.

In September 2025, Raytheon Technologies (US) completed the acquisition of a smaller tech firm specializing in thermal imaging technology. This acquisition is indicative of a broader trend where larger companies are seeking to bolster their technological portfolios through strategic buyouts. By integrating this new technology, Raytheon aims to enhance its existing product lines and offer more comprehensive solutions to its clients.

As of December 2025, the competitive trends in the Electro Optical Infrared Systems Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate effectively. Looking ahead, it is anticipated that competitive differentiation will increasingly pivot from price-based strategies to those centered on innovation, technological advancement, and the reliability of supply chains. This shift underscores the importance of agility and responsiveness in a market that is continuously evolving.