Growing Defense Budgets

The US Military Electro Optical Infrared Systems Market is experiencing a notable surge due to increasing defense budgets. The US government has consistently allocated substantial funds to enhance military capabilities, with the fiscal year 2026 budget proposing over 700 billion dollars for defense spending. This financial commitment is likely to bolster investments in advanced electro-optical and infrared systems, which are critical for surveillance, reconnaissance, and targeting operations. As military operations become more complex, the demand for sophisticated imaging systems that can operate in diverse environments is expected to rise. This trend indicates a robust growth trajectory for the market, as defense contractors and technology providers align their offerings with the evolving needs of the armed forces.

Technological Advancements

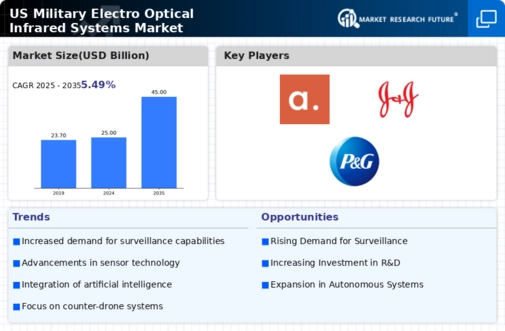

Technological advancements play a pivotal role in shaping the US Military Electro Optical Infrared Systems Market. Innovations in sensor technology, data processing, and miniaturization are driving the development of next-generation systems. For instance, the integration of artificial intelligence and machine learning into electro-optical systems enhances target recognition and situational awareness. The market is projected to grow at a compound annual growth rate of approximately 5% over the next five years, reflecting the increasing reliance on advanced technologies. As the military seeks to maintain a competitive edge, the demand for cutting-edge electro-optical and infrared solutions is likely to escalate, further propelling market growth.

Rising Geopolitical Tensions

Rising geopolitical tensions globally are significantly influencing the US Military Electro Optical Infrared Systems Market. The need for enhanced surveillance and reconnaissance capabilities has become paramount as the US faces evolving threats from state and non-state actors. This environment has prompted the military to prioritize investments in advanced electro-optical systems that provide real-time intelligence and situational awareness. The US Department of Defense has identified the modernization of its surveillance capabilities as a critical objective, leading to increased procurement of electro-optical and infrared systems. Consequently, this heightened focus on national security is expected to drive market growth as defense agencies seek to enhance their operational readiness.

Focus on Modernization Programs

The US Military Electro Optical Infrared Systems Market is significantly influenced by ongoing modernization programs within the armed forces. The Department of Defense has initiated several initiatives aimed at upgrading existing systems and acquiring new technologies to enhance operational capabilities. Programs such as the Integrated Visual Augmentation System (IVAS) and the Next Generation Combat Vehicle (NGCV) emphasize the need for advanced electro-optical and infrared systems. These modernization efforts are expected to result in substantial investments, with estimates suggesting that the market could witness growth exceeding 4 billion dollars by 2028. This focus on modernization not only enhances military effectiveness but also stimulates innovation within the industry.

Integration of Unmanned Systems

The integration of unmanned systems into military operations is a key driver for the US Military Electro Optical Infrared Systems Market. Unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) increasingly rely on advanced electro-optical and infrared systems for surveillance and reconnaissance missions. The US military has been actively investing in these technologies to enhance operational efficiency and reduce risks to personnel. Reports indicate that the market for UAVs equipped with electro-optical systems is projected to reach several billion dollars by 2027. This trend underscores the growing importance of integrating advanced imaging systems into unmanned platforms, thereby driving demand within the market.