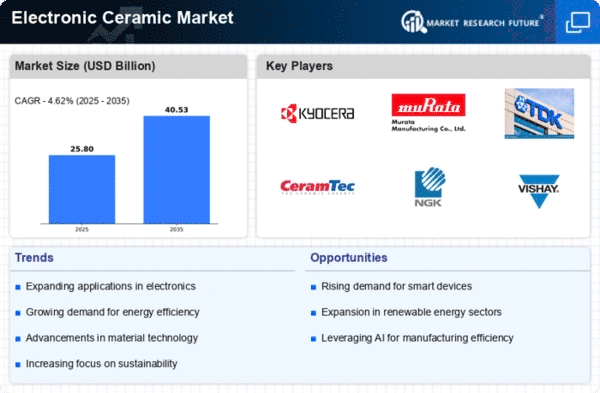

Market Growth Projections

The Global Electronic Ceramic Market Industry is projected to witness substantial growth over the next decade. With a market value of 235.94 USD Billion in 2024, it is expected to reach 541.32 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 7.84% from 2025 to 2035. Such projections reflect the increasing integration of electronic ceramics in various industries, including consumer electronics, automotive, and telecommunications. The anticipated growth underscores the importance of electronic ceramics in advancing technology and meeting the demands of a rapidly evolving market.

Advancements in Material Science

Advancements in material science are propelling innovations within the Global Electronic Ceramic Market Industry. The development of new ceramic materials with enhanced properties, such as improved dielectric strength and thermal stability, is enabling manufacturers to create more efficient electronic components. For instance, the introduction of high-k dielectric ceramics has led to smaller and more powerful capacitors, which are essential for modern electronic devices. These advancements not only enhance performance but also contribute to the overall growth of the market, as manufacturers seek to meet the evolving demands of various applications, including telecommunications and automotive sectors.

Growing Demand for Consumer Electronics

The increasing demand for consumer electronics is a primary driver of the Global Electronic Ceramic Market Industry. As technology advances, the need for high-performance electronic components, such as capacitors and insulators, is rising. In 2024, the market is valued at approximately 235.94 USD Billion, reflecting the robust growth in sectors like smartphones and laptops. This trend is expected to continue, with projections indicating a market value of 541.32 USD Billion by 2035. The compound annual growth rate (CAGR) of 7.84% from 2025 to 2035 suggests that consumer electronics will significantly influence the market dynamics in the coming years.

Increasing Applications in Automotive Sector

The automotive sector's increasing reliance on electronic components is a significant driver for the Global Electronic Ceramic Market Industry. With the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), the demand for high-performance ceramics is surging. Ceramics are used in various applications, including sensors, capacitors, and insulators, which are crucial for vehicle safety and efficiency. As the automotive industry transitions towards electrification, the market is expected to expand, contributing to the overall growth trajectory. This shift indicates a broader trend where automotive applications will play a pivotal role in shaping the future of electronic ceramics.

Rising Demand for Energy-Efficient Solutions

The Global Electronic Ceramic Market Industry is experiencing growth driven by the rising demand for energy-efficient solutions. As global energy consumption continues to rise, industries are increasingly seeking materials that enhance energy efficiency in electronic devices. Electronic ceramics, known for their excellent insulating properties and thermal stability, are being utilized in applications that require minimal energy loss. This trend is particularly evident in the development of energy-efficient power electronics, which are essential for renewable energy systems. The push for sustainability and energy conservation is likely to further propel the market, as manufacturers prioritize eco-friendly solutions.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure is a crucial driver for the Global Electronic Ceramic Market Industry. As countries invest in upgrading their communication networks, the demand for reliable electronic components is increasing. Ceramics play a vital role in telecommunications, particularly in the production of capacitors and insulators that ensure signal integrity and reliability. With the ongoing rollout of 5G networks and the increasing need for high-speed internet, the market is poised for growth. This expansion not only enhances connectivity but also drives innovation in electronic ceramics, as manufacturers strive to meet the demands of next-generation communication technologies.