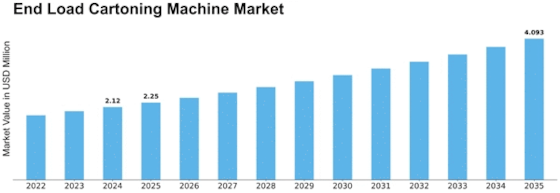

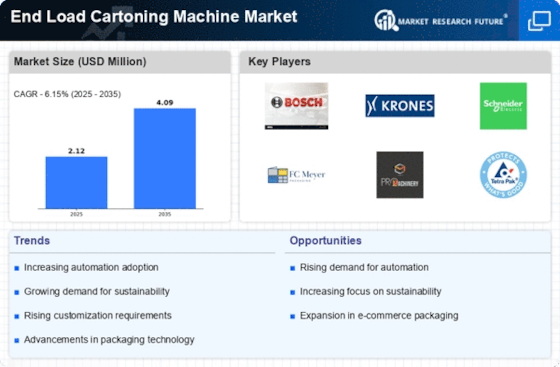

End Load Cartoning Machine Size

End Load Cartoning Machine Market Growth Projections and Opportunities

As a subset of the packing equipment, the end load cartoning machine market is always changing and adapting. This has led to an increase in demand for flexible and adaptable cartoning solutions due to changes in consumer tastes and market requirements. Technological advancements, regulatory mandates as well as dynamism of end-user industries are among some of the issues that affect dynamics within the End Load Cartoning Machines marketplace.

Technological breakthroughs heavily influence dynamics of the End Load Cartoning Machines market. For instance, the machines in this market change with time to meet user requirements such as speed, accuracy and adaptability. The incorporation of robots and automation that employs smart technologies has been a growing trend; thereby enhancing productivity while minimizing downtime. Accordingly, cutting-edge End Load Cartoning Machines have become popular in packaging sector firms seeking process optimization to maintain competitiveness.

End-load cartoning machine market dynamics are also influenced by trends and needs from end-user industries. In this regard, one industry demanding more versatile packaging solutions is pharmaceuticals where there is a shift towards smaller batch sizes and personalized medication treatments. Similarly, there has been development of End Load Cartoning Machine which enables eco-friendly packaging activities within food and beverage industry hence promoting sustainability. Market players need to stay alert concerning needs emanating from their targeted sectors if they want remain relevant.

The performance of End Load Cartoning Machines market is subject to both domestic and global economic trends. The ability of businesses to invest in packaging equipment may be influenced by changes in purchasing power due to fluctuations in the economy, trade policies or political issues. Therefore, a flexible approach is required from manufacturers who have to think on their feet when operating under varied economic situations and exploit opportunities that come their way. Technological developments, regulatory mandates, end user industries’ trends, economic conditions and intense rivals define how end load cartoning machines work. To keep abreast with ever changing packaging industry and meet varied expectations of its customers’, makers of End Load Cartoning Machines have to be agile, responsive as well as forward-thinking.

Leave a Comment