Market Share

End Load Cartoning Machine Market Share Analysis

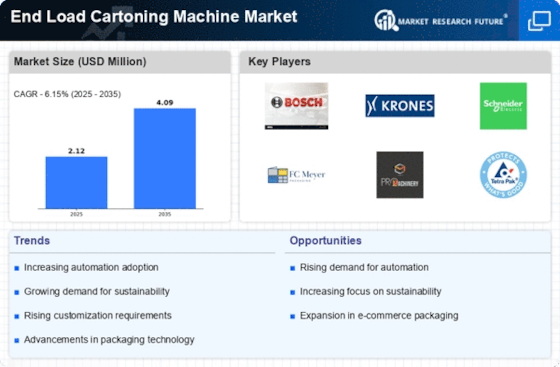

Like the rest of the packaging industry, the market for end load cartoning machines has experienced some rather interesting changes lately. The increasing need for efficiency and automation is affecting this sector in a significant way. Many industries that depend on production processes to be more efficient employ these equipment as they simplify their packing operations. These products do not require much human intervention as they are highly automated hence output per worker is high.

Apart from the rising importance of sustainability, there are other major trends in this industry. In response to globally increasing environmentally sensitive practices, end load cartoning machines are being modified to handle sustainable packaging materials. Manufacturers have adjusted their products so that they can meet the growing demand for eco-friendly options in different industries to help achieve their sustainability goals.

Consumer tastes continue to change as technology improves over time. With smart technology and Industry 4.0 concepts integrated into them, end load cartoning machines have been improved upon by incorporating features like efficiency, real-time monitoring and predictive maintenance abilities among others. This also aligns these devices with a global trend of digital transformation in manufacturing besides making them better performers.

One of the reasons behind the growth of most players in the food and pharmaceutical sectors is their reliance on end load cartoning machine market segment. Pharmaceutical industry has specific packaging standards that should be adhered to for its products to be safe and compliant as well. Consequently, manufacturers of end-load cartoners create secure packing solutions that are both accurate and up-to-date according to relevant codes. Multifunctionality is yet another aspect which makes food producers happy about these tools since using different styles allows effective packaging of various goods.

The End Load Cartoning Machine Market thus shows how companies adjust themselves towards emerging packaging demands”. To facilitate innovation in design by producers therefore these necessitate automation, move toward sustainable practices, progressions in digital technologies, and need for flexibility are doing just so “prompting leading companies worldwide.” In addition, since end load cartoning machines are already playing a major role in several industries, their future will be determined by technology changes, shifts in consumer preferences, and the global push for sustainable practices.

Leave a Comment